We make our customers successful. - Oerlikon Barmag

We make our customers successful. - Oerlikon Barmag

We make our customers successful. - Oerlikon Barmag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

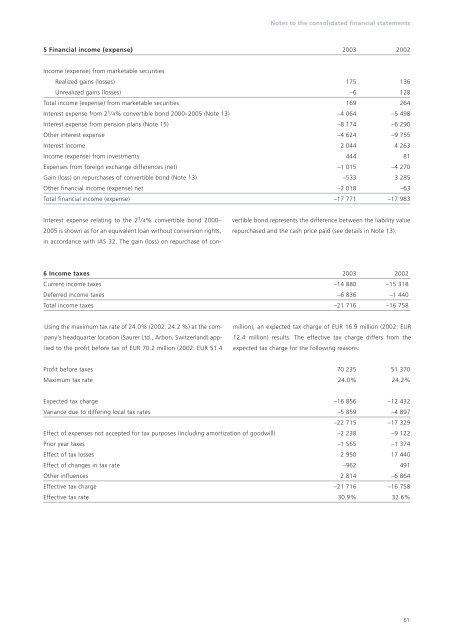

Notes to the consolidated financial statements<br />

5 Financial income (expense) 2003 2002<br />

Income (expense) from marketable securities<br />

Realized gains (losses) 175 136<br />

Unrealized gains (losses) –6 128<br />

Total income (expense) from marketable securities 169 264<br />

Interest expense from 21 ⁄ 4% convertible bond 2000–2005 (Note 13) –4 064 –5 498<br />

Interest expense from pension plans (Note 15) –8 174 –6 290<br />

Other interest expense –4 624 –9 755<br />

Interest income 2 044 4 263<br />

Income (expense) from investments 444 81<br />

Expenses from foreign exchange differences (net) –1 015 –4 270<br />

Gain (loss) on repurchases of convertible bond (Note 13) –533 3 285<br />

Other financial income (expense) net –2 018 –63<br />

Total financial income (expense) –17 771 –17 983<br />

Interest expense relating to the 21 ⁄ 4% convertible bond 2000–<br />

2005 is shown as for an equivalent loan without conversion rights,<br />

in accordance with IAS 32. The gain (loss) on repurchase of con-<br />

6 Income taxes 2003 2002<br />

Current income taxes –14 880 –15 318<br />

Deferred income taxes –6 836 –1 440<br />

Total income taxes –21 716 –16 758<br />

Using the maximum tax rate of 24.0% (2002: 24.2 %) at the company's<br />

headquarter location (Saurer Ltd., Arbon, Switzerland) applied<br />

to the profit before tax of EUR 70.2 million (2002: EUR 51.4<br />

vertible bond represents the difference between the liability value<br />

repurchased and the cash price paid (see details in Note 13).<br />

million), an expected tax charge of EUR 16.9 million (2002: EUR<br />

12.4 million) results. The effective tax charge differs from the<br />

expected tax charge for the following reasons:<br />

Profit before taxes 70 235 51 370<br />

Maximum tax rate 24.0% 24.2%<br />

Expected tax charge –16 856 –12 432<br />

Variance due to differing local tax rates –5 859 –4 897<br />

–22 715 –17 329<br />

Effect of expenses not accepted for tax purposes (including amortization of goodwill) –2 238 –9 122<br />

Prior year taxes –1 565 –1 374<br />

Effect of tax losses 2 950 17 440<br />

Effect of changes in tax rate –962 491<br />

Other influences 2 814 –6 864<br />

Effective tax charge –21 716 –16 758<br />

Effective tax rate 30.9% 32.6%<br />

61