We make our customers successful. - Oerlikon Barmag

We make our customers successful. - Oerlikon Barmag

We make our customers successful. - Oerlikon Barmag

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

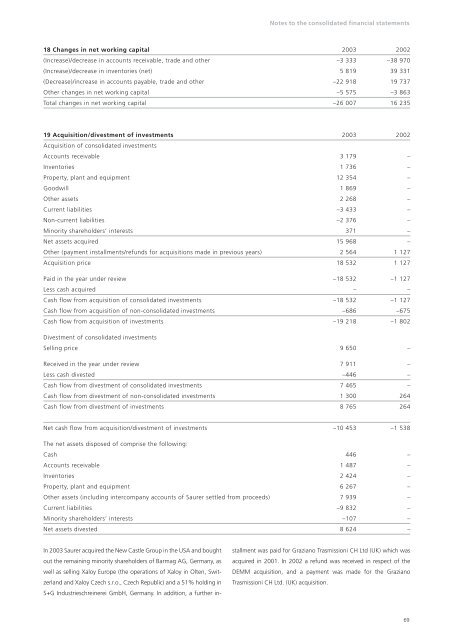

Notes to the consolidated financial statements<br />

18 Changes in net working capital 2003 2002<br />

(Increase)/decrease in accounts receivable, trade and other –3 333 –38 970<br />

(Increase)/decrease in inventories (net) 5 819 39 331<br />

(Decrease)/increase in accounts payable, trade and other –22 918 19 737<br />

Other changes in net working capital –5 575 –3 863<br />

Total changes in net working capital –26 007 16 235<br />

19 Acquisition/divestment of investments<br />

Acquisition of consolidated investments<br />

2003 2002<br />

Accounts receivable 3 179 –<br />

Inventories 1 736 –<br />

Property, plant and equipment 12 354 –<br />

Goodwill 1 869 –<br />

Other assets 2 268 –<br />

Current liabilities –3 433 –<br />

Non-current liabilities –2 376 –<br />

Minority shareholders’ interests 371 –<br />

Net assets acquired 15 968 –<br />

Other (payment installments/refunds for acquisitions made in previous years) 2 564 1 127<br />

Acquisition price 18 532 1 127<br />

Paid in the year under review –18 532 –1 127<br />

Less cash acquired – –<br />

Cash flow from acquisition of consolidated investments –18 532 –1 127<br />

Cash flow from acquisition of non-consolidated investments –686 –675<br />

Cash flow from acquisition of investments –19 218 –1 802<br />

Divestment of consolidated investments<br />

Selling price 9 650 –<br />

Received in the year under review 7 911 –<br />

Less cash divested –446 –<br />

Cash flow from divestment of consolidated investments 7 465 –<br />

Cash flow from divestment of non-consolidated investments 1 300 264<br />

Cash flow from divestment of investments 8 765 264<br />

Net cash flow from acquisition/divestment of investments –10 453 –1 538<br />

The net assets disposed of comprise the following:<br />

Cash 446 –<br />

Accounts receivable 1 487 –<br />

Inventories 2 424 –<br />

Property, plant and equipment 6 267 –<br />

Other assets (including intercompany accounts of Saurer settled from proceeds) 7 939 –<br />

Current liabilities –9 832 –<br />

Minority shareholders’ interests –107 –<br />

Net assets divested 8 624 –<br />

In 2003 Saurer acquired the New Castle Group in the USA and bought<br />

out the remaining minority shareholders of <strong>Barmag</strong> AG, Germany, as<br />

well as selling Xaloy Europe (the operations of Xaloy in Olten, Switzerland<br />

and Xaloy Czech s.r.o., Czech Republic) and a 51% holding in<br />

S+G Industrieschreinerei GmbH, Germany. In addition, a further in-<br />

stallment was paid for Graziano Trasmissioni CH Ltd (UK) which was<br />

acquired in 2001. In 2002 a refund was received in respect of the<br />

DEMM acquisition, and a payment was made for the Graziano<br />

Trasmissioni CH Ltd. (UK) acquisition.<br />

69