'n Skool wil vir hul 'n nuwe bus koop op 1 Januarie 2012 ... - AdMaths

'n Skool wil vir hul 'n nuwe bus koop op 1 Januarie 2012 ... - AdMaths

'n Skool wil vir hul 'n nuwe bus koop op 1 Januarie 2012 ... - AdMaths

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

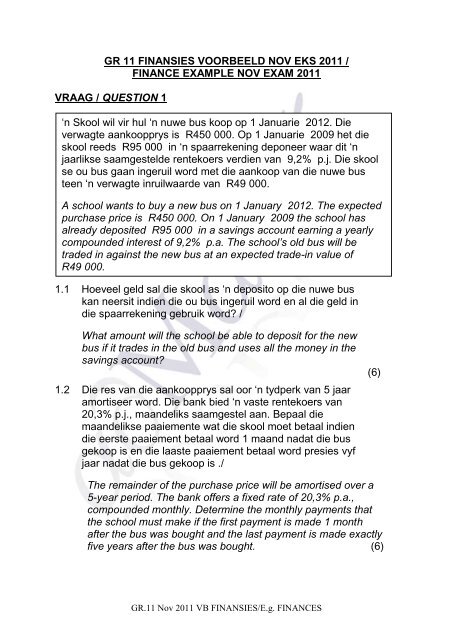

GR 11 FINANSIES VOORBEELD NOV EKS 2011 /<br />

FINANCE EXAMPLE NOV EXAM 2011<br />

VRAAG / QUESTION 1<br />

‘n <strong>Skool</strong> <strong>wil</strong> <strong>vir</strong> <strong>hul</strong> ‘n <strong>nuwe</strong> <strong>bus</strong> <strong>ko<strong>op</strong></strong> <strong>op</strong> 1 <strong>Januarie</strong> <strong>2012</strong>. Die<br />

verwagte aan<strong>ko<strong>op</strong></strong>prys is R450 000. Op 1 <strong>Januarie</strong> 2009 het die<br />

skool reeds R95 000 in ‘n spaarrekening deponeer waar dit ‘n<br />

jaarlikse saamgestelde rentekoers verdien van 9,2% p.j. Die skool<br />

se ou <strong>bus</strong> gaan ingeruil word met die aan<strong>ko<strong>op</strong></strong> van die <strong>nuwe</strong> <strong>bus</strong><br />

teen ‘n verwagte inruilwaarde van R49 000.<br />

A school wants to buy a new <strong>bus</strong> on 1 January <strong>2012</strong>. The expected<br />

purchase price is R450 000. On 1 January 2009 the school has<br />

already deposited R95 000 in a savings account earning a yearly<br />

compounded interest of 9,2% p.a. The school’s old <strong>bus</strong> <strong>wil</strong>l be<br />

traded in against the new <strong>bus</strong> at an expected trade-in value of<br />

R49 000.<br />

1.1 Hoeveel geld sal die skool as ‘n deposito <strong>op</strong> die <strong>nuwe</strong> <strong>bus</strong><br />

kan neersit indien die ou <strong>bus</strong> ingeruil word en al die geld in<br />

die spaarrekening gebruik word? /<br />

What amount <strong>wil</strong>l the school be able to deposit for the new<br />

<strong>bus</strong> if it trades in the old <strong>bus</strong> and uses all the money in the<br />

savings account?<br />

1.2 Die res van die aan<strong>ko<strong>op</strong></strong>prys sal oor ‘n tydperk van 5 jaar<br />

amortiseer word. Die bank bied ‘n vaste rentekoers van<br />

20,3% p.j., maandeliks saamgestel aan. Bepaal die<br />

maandelikse paaiemente wat die skool moet betaal indien<br />

die eerste paaiement betaal word 1 maand nadat die <strong>bus</strong><br />

ge<strong>ko<strong>op</strong></strong> is en die laaste paaiement betaal word presies vyf<br />

jaar nadat die <strong>bus</strong> ge<strong>ko<strong>op</strong></strong> is ./<br />

The remainder of the purchase price <strong>wil</strong>l be amortised over a<br />

5-year period. The bank offers a fixed rate of 20,3% p.a.,<br />

compounded monthly. Determine the monthly payments that<br />

the school must make if the first payment is made 1 month<br />

after the <strong>bus</strong> was bought and the last payment is made exactly<br />

five years after the <strong>bus</strong> was bought. (6)<br />

GR.11 Nov 2011 VB FINANSIES/E.g. FINANCES<br />

(6)

Die <strong>nuwe</strong> <strong>bus</strong> het ‘n verwagte lewensduur van 8 jaar. Die<br />

verwagte slo<strong>op</strong>waarde na 8 jaar is R40 000. Die verwagte<br />

inflasiekoers <strong>vir</strong> die hele 8 jaar is 6% p.j. /<br />

The new <strong>bus</strong> has an expected lifespan of 8 years. The<br />

estimated scrap value after this time is R40 000. Inflation<br />

is expected to run at 6% p.a. for the whole 8 years.<br />

1.3 Bereken die jaarlikse depresiasiekoers <strong>vir</strong> die <strong>nuwe</strong> <strong>bus</strong><br />

deur van ‘n verminderende balans-metode gebruik te maak.<br />

/<br />

Calculate the annual depreciation rate for the new <strong>bus</strong>,<br />

using a reducing balance method.<br />

1.4 Bereken die verwagte vervangingswaarde van die <strong>bus</strong> na 8<br />

jaar. /<br />

Calculate the expected replacement value of the <strong>bus</strong> after 8<br />

years.<br />

(5)<br />

GR.11 Nov 2011 VB FINANSIES/E.g. FINANCES<br />

(8)

Nadat die <strong>nuwe</strong> <strong>bus</strong> klaar betaal is, <strong>wil</strong> die skool ‘n<br />

delgingsfonds instel met ‘n <strong>nuwe</strong> vaste halfjaarlikse<br />

betaling <strong>vir</strong> die res van die 3 jaar voordat die <strong>nuwe</strong> <strong>bus</strong><br />

vervang moet word (6 paaiemente - die finale<br />

paaiement moet onmiddellik voor vervanging van die<br />

<strong>nuwe</strong> <strong>bus</strong> betaal word.) Die skool <strong>wil</strong> R500 000 in die<br />

delgingsfonds hê na die 3 - jaar periode. /<br />

Once the school has finished paying off the new <strong>bus</strong> it<br />

<strong>wil</strong>l set up a sinking fund with fixed half-yearly payments<br />

for the remaining 3 year period before the new <strong>bus</strong> has<br />

to be replaced (6 payments - the final being made<br />

immediately prior to replacing the new <strong>bus</strong>). The school<br />

wishes to have R500 000 in the sinking fund after the 3<br />

year period.<br />

1.5 As die rente <strong>op</strong> die geld teen 11,3% p.j. maandeliks<br />

saamgestel, bereken word... /<br />

If interest on the money is calculated at 11,3% p.a.,<br />

compounded monthly... /<br />

1.5.1 bepaal die halfjaarlikse paaiement in die delgingsfonds. /<br />

determine the semi-annual payment into the sinking fund.<br />

1.5.2 bereken die effek <strong>op</strong> die waarde van die delgingsfonds na<br />

die 3-jaar periode, indien <strong>hul</strong> die tweede en vyfde<br />

paaiement nie kon betaal nie. /<br />

determine the effect on the value of the sinking fund after<br />

the 3 year period if they could not pay the second and fifth<br />

payments.<br />

GR.11 Nov 2011 VB FINANSIES/E.g. FINANCES<br />

(9)<br />

(6)<br />

[40]