You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Focus<br />

the ETPs (based on the Swiss definition, those comprise ETCs<br />

and ETNs) introduced on the SIX Swiss <strong>Exchange</strong> in 2010 have<br />

— up to now — played a very minor role. Only this year was that<br />

drought broken. The segment is significantly smaller compared<br />

with ETFs, ETCs and COSIs, and currently has slightly more<br />

than 60 products. Last but not least, the terms ETI and ETV<br />

come up again and again. They are made up of the somewhat<br />

"The most obvious difference between<br />

ETPs and COSI products lies in the way<br />

that security is provided."<br />

clumsy general terms exchange traded instruments and exchange<br />

traded vehicles. With this, our trip through the thicket<br />

of concepts has come to an end. However, new terms can<br />

always be right around the corner. The creativity of financial<br />

product developers and issuers is great, as we know. <br />

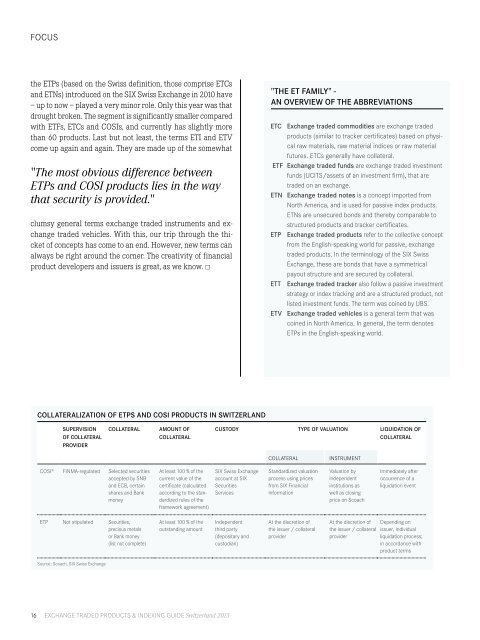

CoLLatEraLization of EtPS and CoSi ProduCtS in SwitzErLand<br />

SuPErViSion<br />

of CoLLatEraL<br />

ProVidEr<br />

CoLLatEraL aMount of<br />

CoLLatEraL<br />

cosI ® FInMa-regulated selected securities<br />

accepted by snB<br />

and EcB, certain<br />

shares and Bank<br />

money<br />

ETP not stipulated securities,<br />

precious metals<br />

or Bank money<br />

(list not complete)<br />

source: scoach, sIx swiss <strong>Exchange</strong><br />

at least 100 % of the<br />

current value of the<br />

certificate (calculated<br />

according to the standardized<br />

rules of the<br />

framework agreement)<br />

at least 100 % of the<br />

outstanding amount<br />

16 ExchangE TradEd ProducTs & IndExIng guIdE <strong>Switzerland</strong> <strong>2013</strong><br />

CuStody tyPE of VaLuation Liquidation of<br />

CoLLatEraL<br />

sIx swiss <strong>Exchange</strong><br />

account at sIx<br />

securities<br />

services<br />

Independent<br />

third party<br />

(depositary and<br />

custodian)<br />

"thE Et faMiLy" -<br />

an oVErViEw of thE abbrEViationS<br />

EtC <strong>Exchange</strong> traded commodities are exchange traded<br />

products (similar to tracker certificates) based on physical<br />

raw materials, raw material indices or raw material<br />

futures. ETcs generally have collateral.<br />

Etf <strong>Exchange</strong> traded funds are exchange traded investment<br />

funds (ucITs/assets of an investment firm), that are<br />

traded on an exchange.<br />

Etn <strong>Exchange</strong> traded notes is a concept imported from<br />

north america, and is used for passive index products.<br />

ETns are unsecured bonds and thereby comparable to<br />

structured products and tracker certificates.<br />

EtP <strong>Exchange</strong> traded products refer to the collective concept<br />

from the English-speaking world for passive, exchange<br />

traded products. In the terminology of the sIx swiss<br />

<strong>Exchange</strong>, these are bonds that have a symmetrical<br />

payout structure and are secured by collateral.<br />

Ett <strong>Exchange</strong> traded tracker also follow a passive investment<br />

strategy or index tracking and are a structured product, not<br />

listed investment funds. The term was coined by uBs.<br />

EtV <strong>Exchange</strong> traded vehicles is a general term that was<br />

coined in north america. In general, the term denotes<br />

ETPs in the English-speaking world.<br />

collaTEral InsTruMEnT<br />

standardized valuation<br />

process using prices<br />

from sIx Financial<br />

Information<br />

at the discretion of<br />

the issuer / collateral<br />

provider<br />

Valuation by<br />

independent<br />

institutions as<br />

well as closing<br />

price on scoach<br />

Immediately after<br />

occurrence of a<br />

liquidation event<br />

at the discretion of depending on<br />

the issuer / collateral issuer, individual<br />

provider<br />

liquidation process;<br />

in accordance with<br />

product terms