You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SourCE MarKEtS PLC<br />

The US energy landscape is undergoing a profound structural<br />

shift as technological advances allow the extraction of oil<br />

and gas from previously inaccessible reserves. Master Limited<br />

Partnerships (MLPs) are central to this transformation. MLPs<br />

own and operate many of the US’s core infrastructure assets,<br />

including pipelines, storage, processing facilities and gathering<br />

iSSuEr source Markets plc<br />

nuMbEr of ProduCtS<br />

MlPs sW (dividend reinvesting)<br />

MlPd sW (dividend distributing)<br />

trading CurrEnCy usd<br />

fEES Mgt. fee: 0.50% / swap fee: 0.75%<br />

bEnChMarK Morningstar ® MlP composite Index sM (Tr)<br />

LaunCh datE 15 May <strong>2013</strong><br />

auM $120Mn (as of 09/08/<strong>2013</strong>)<br />

hEdging no<br />

wEbSitE www.source.info<br />

PhonE nuMbEr +44 (0)20 3370 1100<br />

Chf daiLy CurrEnCy-hEdgEd CoMModity SECuritiES<br />

ETF Securities has developed a range of 28 Swiss Franc Daily<br />

Currency-Hedged Commodity Securities on SIX Swiss <strong>Exchange</strong>.<br />

The impact of currency movements on investment<br />

returns can be significant. These products offer an opportunity<br />

for investors to achieve a total return exposure to commodities<br />

in Swiss Francs whilst mitigating the effects of fluctuations in<br />

iSSuEr swiss commodity securities limited<br />

nuMbEr of ProduCtS 28<br />

trading CurrEnCy chF<br />

fEES 0.49%<br />

bEnChMarK<br />

LaunCh datE 28.01.<strong>2013</strong><br />

hEdging daily hedging<br />

swiss Franc hedged daily versions of<br />

the dow Jones-uBs commodity Indices<br />

wEbSitE www.etfsecurities.com<br />

PhonE nuMbEr +44 (0)20 7448 4330<br />

69 ExchangE TradEd ProducTs & IndExIng guIdE <strong>Switzerland</strong> <strong>2013</strong><br />

systems. The Source Morningstar US Energy Infrastructure<br />

MLP UCITS ETF is the first European ETF to offer exposure<br />

to this high dividend and rapidly growing space. Source is<br />

a leading European ETP provider with US$14BN in assets in<br />

equity, fixed income and commodity products, it had the second<br />

highest net new assets in Europe in 2012.<br />

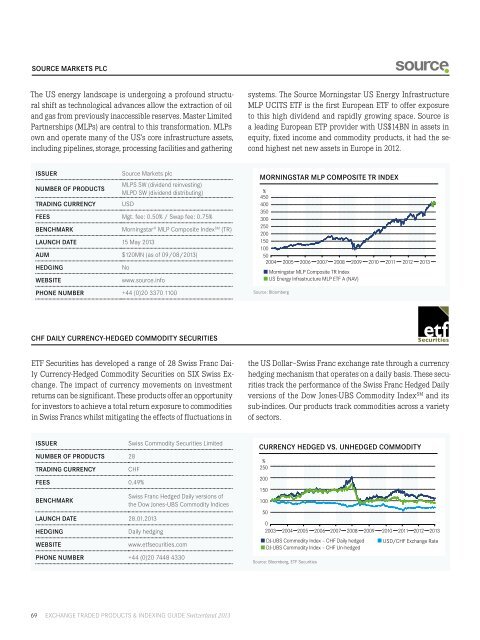

MorningStar MLP CoMPoSitE tr indEX<br />

%<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

2004 2005 2006 2007 2009 2010 2011 2012 <strong>2013</strong><br />

Morningstar MLP Composite TR Index<br />

US Energy Infrastructure MLP ETF A (NAV)<br />

source: Bloomberg<br />

2008<br />

the US Dollar–Swiss Franc exchange rate through a currency<br />

hedging mechanism that operates on a daily basis. These securities<br />

track the performance of the Swiss Franc Hedged Daily<br />

versions of the Dow Jones-UBS Commodity Index SM and its<br />

sub-indices. Our products track commodities across a variety<br />

of sectors.<br />

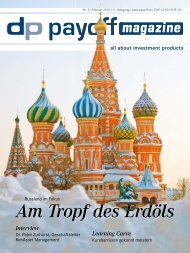

CurrEnCy hEdgEd VS. unhEdgEd CoMModity<br />

%<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2003 2004 2005 2006 2007 2009 2010 2011 2012 <strong>2013</strong><br />

DJ-UBS Commodity Index – CHF Daily hedged<br />

DJ-UBS Commodity Index – CHF Un-hedged<br />

USD/CHF <strong>Exchange</strong> Rate<br />

source: Bloomberg, ETF securities<br />

2008