You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Focus<br />

A product concept with added value<br />

When a small group of exchange brokers and exchange employees<br />

in Toronto, Canada developed a new kind of investment<br />

fund 23 years ago that went by the name of the Toronto Index<br />

Participation Fund, they had no idea what revolutionary effects<br />

their new invention would have. The world's first exchange<br />

traded fund was thus born in March 1990. For the first time,<br />

investors could participate in the performance of the Canadian<br />

Stock Index, the TSE 35 Index, without having to go to the arduous<br />

step of purchasing all of the 35 shares in it. From then on, it<br />

was possible to have the entire stock index in one's securities<br />

account by purchasing a single fund share.<br />

Solid advantages<br />

The exchange traded fund performed just like the index and<br />

tracked it like a shadow. In the specialized jargon, this is referred<br />

to as a "passive investment." With it, an investor does<br />

not miss out on a market movement in the index because he<br />

just did not include one or two shares in his share account, or<br />

because he did not otherwise have the means of tracking the<br />

index. The composition and in particular the management — in<br />

the context of the operational administration — of an ETF are<br />

"ETFs become increasingly<br />

popular as product wrapper among<br />

Swiss investors."<br />

clearly simpler and more economical compared with classical<br />

investment funds, because the exclusive goal of the ETF manager<br />

is merely to track the performance of a reference index.<br />

In that way, with ETFs, the investor pays considerably less fees<br />

than he would for classical investment funds, and is always<br />

at least as good as the reference index. These innovative characteristics<br />

continue to define ETFs, to this day.<br />

A kick-start, thanks to some Wall Street innovators<br />

This novel financial product, the ETF, did not remain undiscovered<br />

for long. In January 1993, the idea reached the United<br />

States. Financial product developers Nathan Most and Steven<br />

Bloom in New York City were inspired by the ETF out of<br />

Canada. The two worked for the American Stock <strong>Exchange</strong><br />

(AMEX) and also developed a fund listed on the exchange with<br />

which an investor could track the entire Standard & Poor's<br />

500 Index with just one fund share. The new index fund was<br />

shortened to the four letters "SPDR" - for S&P Depositary Re-<br />

08 ExchangE TradEd ProducTs & IndExIng guIdE <strong>Switzerland</strong> <strong>2013</strong><br />

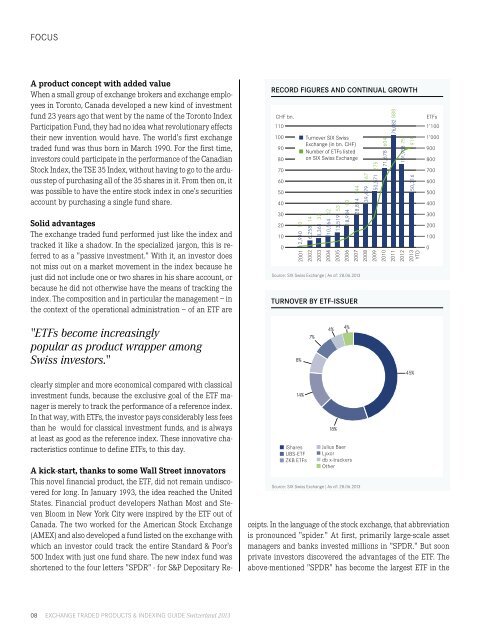

rECord figurES and ContinuaL growth<br />

CHF bn. ETFs<br />

110<br />

1'100<br />

100 Turnover SIX Swiss<br />

1'000<br />

90<br />

<strong>Exchange</strong> (in bn. CHF)<br />

Number of ETFs listed<br />

900<br />

80 on SIX Swiss <strong>Exchange</strong><br />

800<br />

70<br />

700<br />

60<br />

600<br />

50<br />

500<br />

40<br />

400<br />

30<br />

300<br />

20<br />

200<br />

10<br />

100<br />

0<br />

0<br />

2,940 10<br />

6,258 14<br />

8,361 32<br />

10,564 42<br />

13,519 53<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

18,984 80<br />

28,814 144<br />

39,479 167<br />

2007<br />

2008<br />

source: sIx swiss <strong>Exchange</strong> | as of: 28.06.<strong>2013</strong><br />

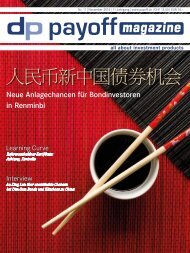

turnoVEr by Etf-iSSuEr<br />

8%<br />

14%<br />

iShares<br />

UBS-ETF<br />

ZKB ETFs<br />

7%<br />

4%<br />

18%<br />

4%<br />

Julius Baer<br />

Lyxor<br />

db x-trackers<br />

Other<br />

source: sIx swiss <strong>Exchange</strong> | as of: 28.06.<strong>2013</strong><br />

50,571 275<br />

71,678 604<br />

2009<br />

2010<br />

ceipts. In the language of the stock exchange, that abbreviation<br />

is pronounced "spider." At first, primarily large-scale asset<br />

managers and banks invested millions in "SPDR." But soon<br />

private investors discovered the advantages of the ETF. The<br />

above-mentioned "SPDR" has become the largest ETF in the<br />

76,082 888<br />

2011<br />

2012<br />

101,938 757<br />

50,316 919<br />

<strong>2013</strong><br />

YTD<br />

45%