Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

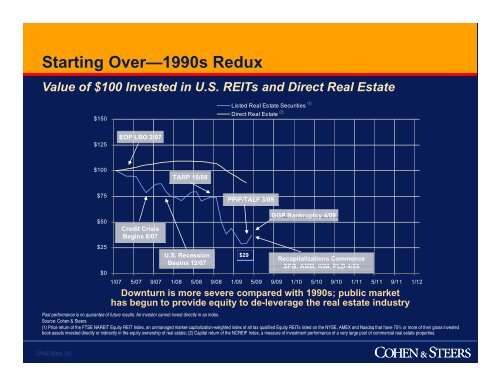

Starting Over—1990s Redux<br />

Value of $100 Invested in U.S. REITs and Direct <strong>Real</strong> <strong>Estate</strong><br />

$150<br />

Listed <strong>Real</strong> <strong>Estate</strong> Securities<br />

Direct <strong>Real</strong> <strong>Estate</strong><br />

(2)<br />

(1)<br />

$125<br />

EOP LBO 2/07<br />

$100<br />

TARP 10/08<br />

$75<br />

PPIP/TALF 3/09<br />

$50<br />

$25<br />

$0<br />

Credit Crisis<br />

Begins 8/07<br />

U.S. Recession<br />

Begins 12/07<br />

$29<br />

GGP Bankruptcy 4/09<br />

Recapitalizations Commence<br />

SPG, AMB, KIM, PLD 4/09<br />

1/07 5/07 9/07 1/08 5/08 9/08 1/09 5/09 9/09 1/10 5/10 9/10 1/11 5/11 9/11 1/12<br />

Downturn is more severe compared with 1990s; public market<br />

has begun to provide equity to de-leverage the real estate industry<br />

Past performance is no guarantee of future results. An investor cannot invest directly in an index.<br />

Source: Cohen & Steers<br />

(1) Price return of the FTSE NAREIT Equity REIT Index, an unmanaged market-capitalization-weighted index of all tax qualified Equity REITs listed on the NYSE, AMEX and Nasdaq that have 75% or more of their gross invested<br />

book assets invested directly or indirectly in the equity ownership of real estate; (2) Capital return of the NCREIF Index, a measure of investment performance of a very large pool of commercial real estate properties.<br />

CPRET8309_OS