Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

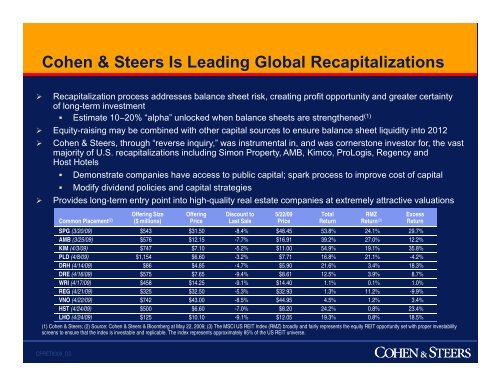

Cohen & Steers Is Leading Global Recapitalizations<br />

‣ Recapitalization process addresses balance sheet risk, creating profit opportunity and greater certainty<br />

of long-term investment<br />

• Estimate 10–20% “alpha” unlocked when balance sheets are strengthened<br />

(1)<br />

‣ Equity-raising may be combined with other capital sources to ensure balance sheet liquidity into 2012<br />

‣ Cohen & Steers, through “reverse inquiry,” was instrumental in, and was cornerstone investor for, the vast<br />

majority of U.S. recapitalizations including Simon Property, AMB, Kimco, ProLogis, Regency and<br />

Host Hotels<br />

• Demonstrate companies have access to public capital; spark process to improve cost of capital<br />

• Modify dividend policies and capital strategies<br />

‣ Provides long-term entry point into high-quality real estate companies at extremely attractive valuations<br />

Offering Size Offering Discount to 5/22/09 Total RMZ Excess<br />

Common Placement (2) ($ millions) Price Last Sale Price Return Return (3) Return<br />

SPG (3/20/09) $543 $31.50 -8.4% $48.45 53.8% 24.1% 29.7%<br />

AMB (3/25/09) $576 $12.15 -7.7% $16.91 39.2% 27.0% 12.2%<br />

KIM (4/3/09) $747 $7.10 -5.2% $11.00 54.9% 19.1% 35.8%<br />

PLD (4/8/09) $1,154 $6.60 -3.2% $7.71 16.8% 21.1% -4.2%<br />

DRH (4/14/09) $86 $4.85 -47% -4.7% $5.90 21.6% 34% 3.4% 18.3%<br />

DRE (4/16/09) $575 $7.65 -9.4% $8.61 12.5% 3.9% 8.7%<br />

WRI (4/17/09) $458 $14.25 -9.1% $14.40 1.1% 0.1% 1.0%<br />

REG (4/21/09) $325 $32.50 -5.3% $32.93 1.3% 11.2% -9.9%<br />

VNO (4/22/09) $742 $43.00 -8.5% $44.95 4.5% 1.2% 3.4%<br />

HST (4/24/09) $500 $6.60 -7.0% $8.20 24.2% 0.8% 23.4%<br />

LHO (4/24/09) $125 $10.10 -9.1% $12.05 19.3% 0.8% 18.5%<br />

(1) Cohen & Steers; (2) Source: Cohen & Steers & Bloomberg at May 22, 2009; (3) The MSCI US REIT Index (RMZ) broadly and fairly represents the equity REIT opportunity set with proper investability<br />

screens to ensure that the index is investable and replicable. The index represents approximately 85% of the US REIT universe.<br />

CPRET8309_OS