Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

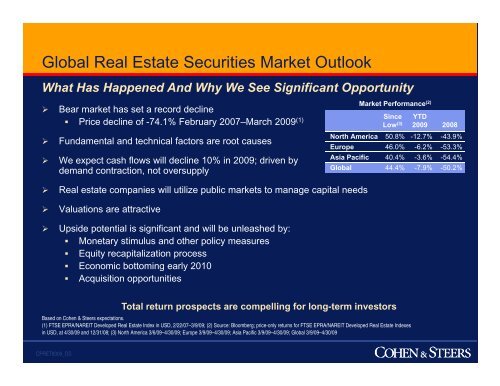

Global <strong>Real</strong> <strong>Estate</strong> Securities Market Outlook<br />

What Has Happened And Why We See Significant Opportunity<br />

‣ Bear market has set a record decline<br />

• Price decline of -74.1% February 2007–March 2009 (1)<br />

‣ Fundamental and technical factors are root causes<br />

‣ We expect cash flows will decline 10% in 2009; driven by<br />

demand d contraction, ti not oversupply<br />

Market Performance (2)<br />

Since YTD<br />

Low (3) 2009 2008<br />

North America 50.8% -12.7% -43.9%<br />

Europe 46.0% -6.2% -53.3%<br />

Asia Pacific 40.4% -3.6% -54.4%<br />

Global 44.4% 4% -7.9% -50.2%<br />

‣ <strong>Real</strong> estate companies will utilize public markets to manage capital needs<br />

‣ Valuations are attractive<br />

‣ Upside potential is significant and will be unleashed by:<br />

• Monetary stimulus and other policy measures<br />

• Equity recapitalization process<br />

• Economic bottoming early 2010<br />

• Acquisition opportunities<br />

Total return prospects are compelling for long-term investors<br />

Based on Cohen & Steers expectations.<br />

(1) FTSE EPRA/NAREIT Developed <strong>Real</strong> <strong>Estate</strong> Index in USD, 2/22/07–3/9/09; (2) Source: Bloomberg; price-only returns for FTSE EPRA/NAREIT Developed <strong>Real</strong> <strong>Estate</strong> Indexes<br />

in USD, at 4/30/09 and 12/31/08; (3) North America 3/6/09–4/30/09; Europe 3/9/09–4/30/09; Asia Pacific 3/9/09–4/30/09; Global 3/9/09–4/30/09<br />

CPRET8309_OS