Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

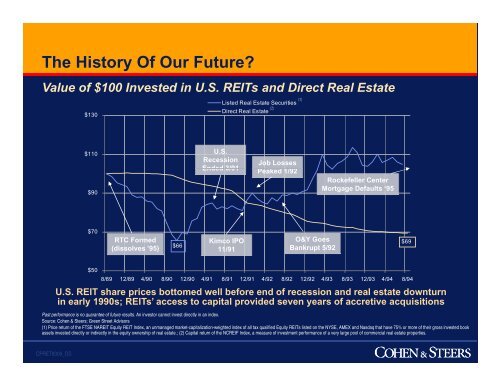

The History Of Our Future?<br />

Value of $100 Invested in U.S. REITs and Direct <strong>Real</strong> <strong>Estate</strong><br />

$130<br />

Listed <strong>Real</strong> <strong>Estate</strong> Securities<br />

Direct <strong>Real</strong> <strong>Estate</strong><br />

(2)<br />

(1)<br />

$110 U.S.<br />

$90<br />

Recession<br />

Ended 3/91<br />

Job Losses<br />

Peaked 1/92<br />

Rockefeller Center<br />

Mortgage Defaults ‘95<br />

$70<br />

RTC Formed<br />

(dissolves ’95)<br />

$66<br />

Kimco IPO<br />

11/91<br />

O&Y Goes<br />

Bankrupt 5/92<br />

$69<br />

$50<br />

8/89 12/89 4/90 8/90 12/90 4/91 8/91 12/91 4/92 8/92 12/92 4/93 8/93 12/93 4/94 8/94<br />

U.S. REIT share prices bottomed well before end of recession and real estate downturn<br />

in early 1990s; REITs’ access to capital provided seven years of accretive acquisitions<br />

Past performance is no guarantee of future results. An investor cannot invest directly in an index.<br />

Source: Cohen & Steers; Green Street Advisors<br />

(1) Price return of the FTSE NAREIT Equity REIT Index, an unmanaged market-capitalization-weighted index of all tax qualified Equity REITs listed on the NYSE, AMEX and Nasdaq that have 75% or more of their gross invested book<br />

assets invested directly or indirectly in the equity ownership of real estate.; (2) Capital return of the NCREIF Index, a measure of investment performance of a very large pool of commercial real estate properties.<br />

CPRET8309_OS