Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

Understanding Real Estate Understanding Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

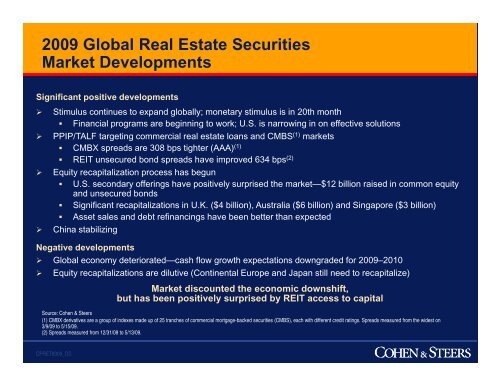

2009 Global <strong>Real</strong> <strong>Estate</strong> Securities<br />

Market Developments<br />

Significant positive developments<br />

‣ Stimulus continues to expand globally; monetary stimulus is in 20th month<br />

• Financial programs are beginning to work; U.S. is narrowing in on effective solutions<br />

‣ PPIP/TALF targeting commercial real estate loans and CMBS (1) markets<br />

• CMBX spreads are 308 bps tighter (AAA) (1)<br />

• REIT unsecured bond spreads have improved 634 bps (2)<br />

‣ Equity recapitalization process has begun<br />

• U.S. secondary offerings have positively surprised the market—$12 billion raised in common equity<br />

and unsecured bonds<br />

• Significant recapitalizations in U.K. ($4 billion), Australia ($6 billion) and Singapore ($3 billion)<br />

• Asset sales and debt refinancings have been better than expected<br />

‣ China stabilizing<br />

Negative developments<br />

‣ Global economy deteriorated—cash flow growth expectations downgraded for 2009–2010<br />

‣ Equity recapitalizations are dilutive (Continental Europe and Japan still need to recapitalize)<br />

Market discounted the economic downshift,<br />

but has been positively surprised by REIT access to capital<br />

Source: Cohen & Steers<br />

(1) CMBX derivatives are a group of indexes made up of 25 tranches of commercial mortgage-backed securities (CMBS), each with different credit ratings. Spreads measured from the widest on<br />

3/9/09 to 5/15/09.<br />

(2) Spreads measured from 12/31/08 to 5/13/09.<br />

CPRET8309_OS