Annual Report 2012 (PDF) - Hamburg

Annual Report 2012 (PDF) - Hamburg

Annual Report 2012 (PDF) - Hamburg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4 Receivables and other assets<br />

Receivables from affiliated companies are listed in Table 4.<br />

Receivables from affiliated companies include € 4,342,000<br />

(previous year: € 11,073,000) receivable from shareholders.<br />

Receivables from companies in which a participatory interest<br />

is held, along with receivables from the Free and Hanseatic<br />

City of <strong>Hamburg</strong>, relate in the year under review and in<br />

the previous year both to products delivered and to services<br />

provided.<br />

Receivables have, as in the previous year, a residual<br />

term of up to one year.<br />

Other assets to the value of € 1,725,000 (previous year:<br />

€ 2,328,000) have a residual term of more than one year.<br />

5 Equity<br />

Subscribed capital remains unchanged at € 56,026,500.00.<br />

As of 31 December, <strong>2012</strong> a total of € 0 is available to be<br />

paid as shareholder dividends (previous year: € 0). A total of<br />

€0 (previous year: € 0) is subject to the dividend payout restriction<br />

imposed by law and by the articles of association.<br />

6 Provisions<br />

Pension provisions are calculated with reference to the option<br />

specified in Art. 67 Para. 1 of EGHGB. The allocation of<br />

the difference is taking place in equal annual rates over a<br />

period of 15 years up until the year 2024. The outstanding<br />

sum not listed in the balance sheet was € 7,883,000 (previous<br />

year: € 8,540,000) at 31 December, <strong>2012</strong>.<br />

The provisions for anniversary bonuses have not been<br />

changed, as provided for by the option retained according<br />

to Art. 67 Para. 1 Subpara. 2 of EGHGB. The value will appreciate<br />

by the year 2024. Surplus provision at 31 December,<br />

<strong>2012</strong> was € 8,000 (previous year: € 22,000).<br />

Tax provisions relate to energy and electricity taxes. No<br />

tax provisions were established in the previous year.<br />

Significant individual items reported under other provisions<br />

at the accounting date include: provisions for noise<br />

protection measures amounting to € 10,152,000; provisions<br />

for outstanding supplier invoicing amounting to<br />

€ 7,229,000; provisions for partial retirement amounting<br />

to € 3,741,000; and provisions for former employees who<br />

transferred to subsidiary and other companies in previous<br />

years amounting to € 2,837,000.<br />

7 Liabilities<br />

The residual terms of liabilities as of the accounting date<br />

are shown in Table 7.<br />

Liabilities to Group companies include € 6,058,000<br />

arising from supplies and services (previous year:<br />

€ 5,689,000), € 47,686,000 in other liabilities (previous<br />

year: € 61,030,000) and € 2,545,000 for loans (previous<br />

year: € 2,545,000). They are balanced with receivables<br />

arising from supplies and services of € 364,000 (previous<br />

year: € 356,000) and miscellaneous receivables of<br />

€ 545,000 (previous year: € 915,000).<br />

Liabilities include € 39,006,000 payable to shareholders<br />

(previous year: € 49,213,000); this amount consists entirely<br />

of the profit transfer owed to the parent company, FHK<br />

(previous year: € 49,213,000).<br />

Liabilities to companies in which a participatory interest<br />

is held relate in the year under review, as in the previous<br />

year, to supplies and services. Liabilities to the Free and<br />

Hanseatic City of <strong>Hamburg</strong> relate, as in the previous year,<br />

primarily to miscellaneous liabilities.<br />

Miscellaneous liabilities include € 433,000 (previous year:<br />

€ 421,000) in taxes. Liabilities relating to social security<br />

amount to €83,000 (previous year: € 172,000).<br />

Liabilities are not secured by the company.<br />

8 Sales revenue<br />

Sales revenue is broken down in Table 8.<br />

9 Expenditure and income falling outside the year under<br />

review<br />

The profit and loss statement contains income falling outside<br />

the year under review amounting to € 2,461,000, in<br />

particular income from the liquidation of provisions, along<br />

with expenditure falling outside the year under review<br />

amounting to € 430,000, primarily losses arising from the<br />

disposal and/or sale of fixed assets.<br />

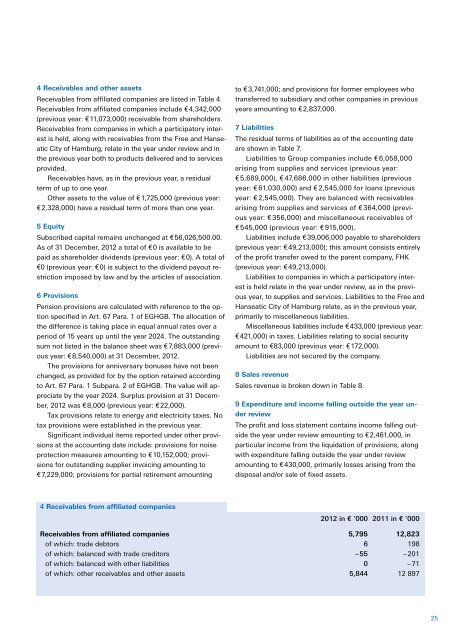

4 Receivables from affiliated companies<br />

<strong>2012</strong> in € ’000 2011 in € ’000<br />

Receivables from affiliated companies 5,795 12,823<br />

of which: trade debtors 6 198<br />

of which: balanced with trade creditors – 55 – 201<br />

of which: balanced with other liabilities 0 – 71<br />

of which: other receivables and other assets 5,844 12 897<br />

25