SAPPI LTD (SAP) 6-K

SAPPI LTD (SAP) 6-K

SAPPI LTD (SAP) 6-K

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

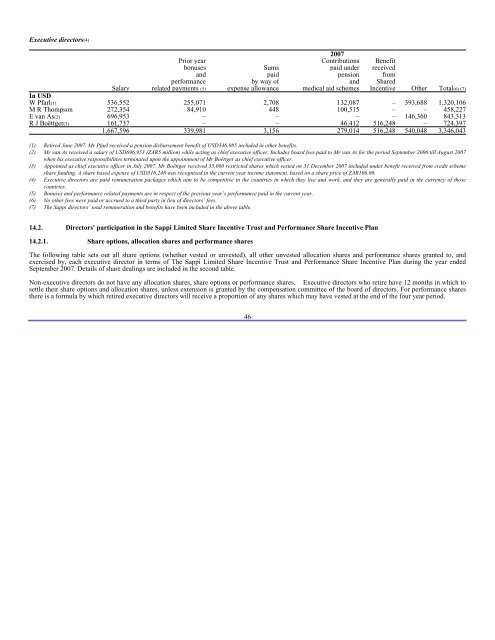

Executive directors(4)<br />

2007<br />

Prior year Contributions Benefit<br />

bonuses Sums paid under received<br />

and paid pension from<br />

performance by way of and Shared<br />

Salary related payments (5) expense allowance medical aid schemes Incentive Other Total(6) (7)<br />

In USD<br />

W Pfarl(1) 536,552 255,071 2,708 132,087 – 393,688 1,320,106<br />

M R Thompson 272,354 84,910 448 100,515 – – 458,227<br />

E van As(2) 696,953 – – – – 146,360 843,313<br />

R J Boëttger(3) 161,737 – – 46,412 516,248 – 724,397<br />

1,667,596 339,981 3,156 279,014 516,248 540,048 3,346,043<br />

(1) Retired June 2007. Mr Pfarl received a pension disbursement benefit of USD346,085 included in other benefits.<br />

(2) Mr van As received a salary of USD696,953 (ZAR5 million) while acting as chief executive officer. Includes board fees paid to Mr van As for the period September 2006 till August 2007<br />

when his executive responsibilities terminated upon the appointment of Mr Boëttger as chief executive officer.<br />

(3) Appointed as chief executive officer in July 2007. Mr Boëttger received 35,000 restricted shares which vested on 31 December 2007 included under benefit received from credit scheme<br />

share funding. A share based expense of USD516,248 was recognised in the current year income statement, based on a share price of ZAR106.00.<br />

(4) Executive directors are paid remuneration packages which aim to be competitive in the countries in which they live and work, and they are generally paid in the currency of those<br />

countries.<br />

(5) Bonuses and performance related payments are in respect of the previous year’s performance paid in the current year.<br />

(6) No other fees were paid or accrued to a third party in lieu of directors’ fees.<br />

(7) The Sappi directors’ total remuneration and benefits have been included in the above table.<br />

14.2. Directors' participation in the Sappi Limited Share Incentive Trust and Performance Share Incentive Plan<br />

14.2.1. Share options, allocation shares and performance shares<br />

The following table sets out all share options (whether vested or unvested), all other unvested allocation shares and performance shares granted to, and<br />

exercised by, each executive director in terms of The Sappi Limited Share Incentive Trust and Performance Share Incentive Plan during the year ended<br />

September 2007. Details of share dealings are included in the second table.<br />

Non-executive directors do not have any allocation shares, share options or performance shares. Executive directors who retire have 12 months in which to<br />

settle their share options and allocation shares, unless extension is granted by the compensation committee of the board of directors. For performance shares<br />

there is a formula by which retired executive directors will receive a proportion of any shares which may have vested at the end of the four year period.<br />

46