2010 Buyers Guide - Broadband Properties

2010 Buyers Guide - Broadband Properties

2010 Buyers Guide - Broadband Properties

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

would most likely be dwarfed by other<br />

factors, especially market structure and<br />

competition, or the lack of it.<br />

A key market structure factor is<br />

the extent and nature of competition<br />

between wholesale and retail levels in<br />

the supply chain. Alternative market<br />

structures include vertical integration;<br />

the opposite, where there is separation<br />

between wholesale (network) and retail<br />

ends of the market; and some hybrids in<br />

between. These different market structures<br />

also imply differing approaches to<br />

regulation.<br />

In general, competition makes a difference.<br />

Although the introduction and<br />

maintenance of competition through<br />

regulatory arrangements, including<br />

third-party access to infrastructure,<br />

particularly network infrastructure, in<br />

industries such as electricity, water and<br />

gas, aviation and others has not been<br />

perfect, there is compelling evidence<br />

that it has brought significant economic<br />

gains to Australia. This is reflected in<br />

lower prices for services, sustained investment<br />

in provision of services and<br />

sustained growth and employment.<br />

Without competition in the access network,<br />

the monopoly telecom provider would charge<br />

higher prices, increasing the cost of the nextgeneration<br />

network. In effect, the community<br />

would pay for the network many times over.<br />

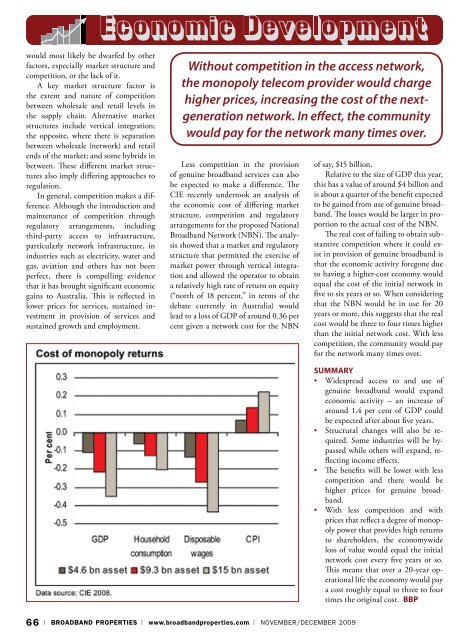

Less competition in the provision<br />

of genuine broadband services can also<br />

be expected to make a difference. The<br />

CIE recently undertook an analysis of<br />

the economic cost of differing market<br />

structure, competition and regulatory<br />

arrangements for the proposed National<br />

<strong>Broadband</strong> Network (NBN). The analysis<br />

showed that a market and regulatory<br />

structure that permitted the exercise of<br />

market power through vertical integration<br />

and allowed the operator to obtain<br />

a relatively high rate of return on equity<br />

(“north of 18 percent,” in terms of the<br />

debate currently in Australia) would<br />

lead to a loss of GDP of around 0.36 per<br />

cent given a network cost for the NBN<br />

of say, $15 billion.<br />

Relative to the size of GDP this year,<br />

this has a value of around $4 billion and<br />

is about a quarter of the benefit expected<br />

to be gained from use of genuine broadband.<br />

The losses would be larger in proportion<br />

to the actual cost of the NBN.<br />

The real cost of failing to obtain substantive<br />

competition where it could exist<br />

in provision of genuine broadband is<br />

that the economic activity foregone due<br />

to having a higher-cost economy would<br />

equal the cost of the initial network in<br />

five to six years or so. When considering<br />

that the NBN would be in use for 20<br />

years or more, this suggests that the real<br />

cost would be three to four times higher<br />

than the initial network cost. With less<br />

competition, the community would pay<br />

for the network many times over.<br />

Summary<br />

• Widespread access to and use of<br />

genuine broadband would expand<br />

economic activity – an increase of<br />

around 1.4 per cent of GDP could<br />

be expected after about five years.<br />

• Structural changes will also be required.<br />

Some industries will be bypassed<br />

while others will expand, reflecting<br />

income effects.<br />

• The benefits will be lower with less<br />

competition and there would be<br />

higher prices for genuine broadband.<br />

• With less competition and with<br />

prices that reflect a degree of monopoly<br />

power that provides high returns<br />

to shareholders, the economywide<br />

loss of value would equal the initial<br />

network cost every five years or so.<br />

This means that over a 20-year operational<br />

life the economy would pay<br />

a cost roughly equal to three to four<br />

times the original cost. BBP<br />

66 | BROADBAND PROPERTIES | www.broadbandproperties.com | November/December 2009