Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

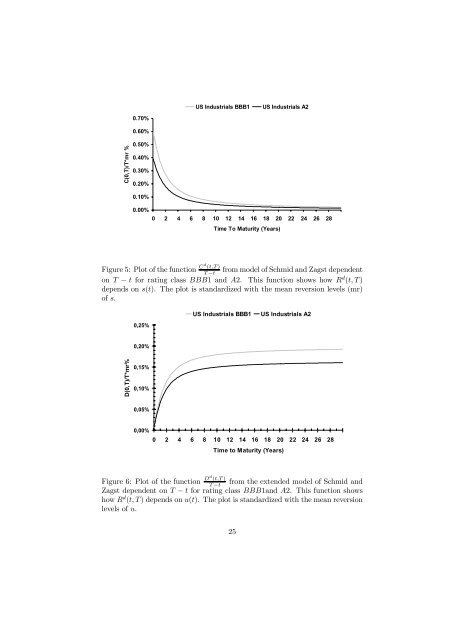

US Industrials BBB1<br />

US Industrials A2<br />

C(0,T)/T*mr %<br />

0.70%<br />

0.60%<br />

0.50%<br />

0.40%<br />

0.30%<br />

0.20%<br />

0.10%<br />

0.00%<br />

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28<br />

Time To Maturity (Years)<br />

Figure 5: Plot <strong>of</strong> the function Cd (t,T )<br />

T −t<br />

from model <strong>of</strong> Schmid and Zagst dependent<br />

on T − t for rating class BBB1 and A2. This function shows how R d (t, T )<br />

depends on s(t). The plot is standardized with the mean reversion levels (mr)<br />

<strong>of</strong> s.<br />

0,25%<br />

US Industrials BBB1<br />

US Industrials A2<br />

0,20%<br />

D(0,T)/T*mr%<br />

0,15%<br />

0,10%<br />

0,05%<br />

0,00%<br />

0 2 4 6 8 10 12 14 16 18 20 22 24 26 28<br />

Time to Maturity (Years)<br />

Figure 6: Plot <strong>of</strong> the function Dd (t,T )<br />

T −t<br />

from the extended model <strong>of</strong> Schmid and<br />

Zagst dependent on T − t for rating class BBB1and A2. This function shows<br />

how R d (t, T ) depends on u(t). The plot is standardized with the mean reversion<br />

levels <strong>of</strong> u.<br />

25