Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Empirical Evaluation of Hybrid Defaultable Bond Pricing ... - risklab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

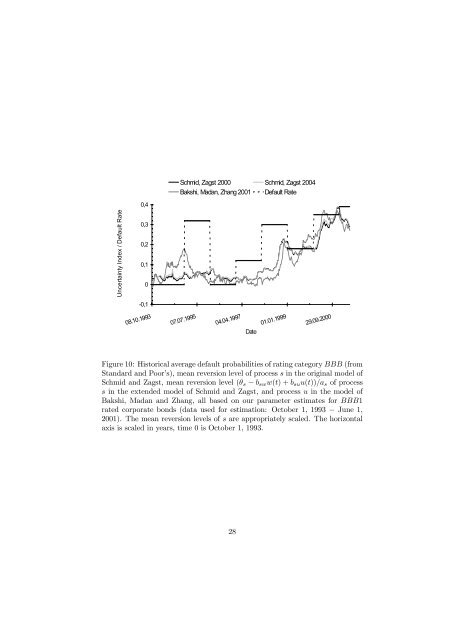

Schmid, Zagst 2000 Schmid, Zagst 2004<br />

Bakshi, Madan, Zhang 2001 Default Rate<br />

0,4<br />

Uncertainty Index / Default Rate<br />

0,3<br />

0,2<br />

0,1<br />

0<br />

-0,1<br />

08.10.1993<br />

07.07.1995<br />

04.04.1997<br />

Date<br />

01.01.1999<br />

29.09.2000<br />

Figure 10: Historical average default probabilities <strong>of</strong> rating category BBB (from<br />

Standard and Poor’s), mean reversion level <strong>of</strong> process s in the original model <strong>of</strong><br />

Schmid and Zagst, mean reversion level (θ s − b sw w(t)+b su u(t))/a s <strong>of</strong> process<br />

s in the extended model <strong>of</strong> Schmid and Zagst, and process u in the model <strong>of</strong><br />

Bakshi, Madan and Zhang, all based on our parameter estimates for BBB1<br />

rated corporate bonds (data used for estimation: October 1, 1993 − June 1,<br />

2001). The mean reversion levels <strong>of</strong> s are appropriately scaled. The horizontal<br />

axis is scaled in years, time 0 is October 1, 1993.<br />

28