Vision 2020 - Transportation Research Group of India

Vision 2020 - Transportation Research Group of India

Vision 2020 - Transportation Research Group of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Government <strong>of</strong> <strong>India</strong><br />

Ministry <strong>of</strong> Railways<br />

(Railway Board)<br />

by 15.2% in 2007-08 over 2006-07, the total container business grew by 23.4% during the same period. The<br />

difference is explained by the additional traffic brought in by the private players. These growth rates, however,<br />

mask the true potential <strong>of</strong> the market which is limited at present by constraints at ports, inland container depots<br />

and to some extent, carrying capacity <strong>of</strong> the Railways. These constraints are now being addressed by the<br />

respective agencies. Container Train Operators are bringing in their own rolling stock and also adding to terminal<br />

capacity. Increased competition among the container operators will not only expand the market served by the<br />

Railways, but also improve service levels.<br />

In addition to maritime container traffic, containerized movement <strong>of</strong> domestic traffic is also emerging as a traffic<br />

stream <strong>of</strong> considerable promise. It is expected that the level <strong>of</strong> containerization would rise from 45% to about 70%<br />

in <strong>2020</strong>. Containerization <strong>of</strong> various products presently moving piecemeal and mostly by road could facilitate<br />

aggregation and thus make it amenable to rail movement. Container Train Operating companies are already<br />

engaged in tapping this market. It is expected that the market will grow as adequate terminal capacities are built,<br />

bottlenecks on congested routes are removed and transit times improved. An annual growth <strong>of</strong> 20% in container<br />

tonnage appears to be a reasonable assumption.<br />

Container traffic, therefore, is expected to touch 210 million tonnes by <strong>2020</strong>.<br />

4.1.9 Others<br />

Apart from the traditional segments where Railway already have a dominant presence, several other<br />

opportunities will unfold in respect <strong>of</strong> commodities such as fast moving consumer goods (FMCG), fly-ash and<br />

automobiles. However, in order to tap these opportunities and build them into new growth platforms, Railways<br />

would have to forge partnerships with logistics providers and develop industry- friendly special-purpose rolling<br />

stock and transportation services. A total <strong>of</strong> 100 MT <strong>of</strong> other traffic is anticipated by <strong>2020</strong>.<br />

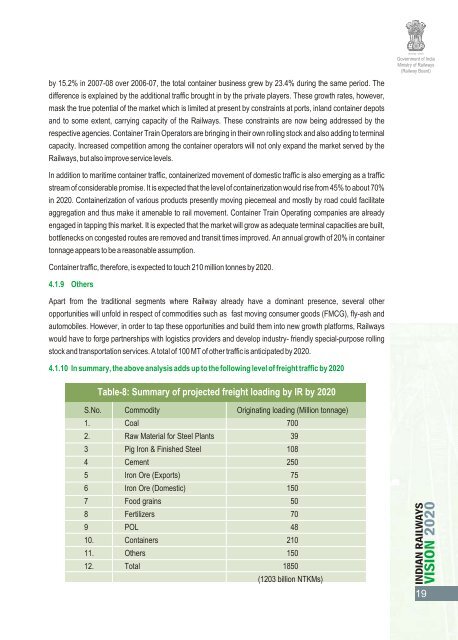

4.1.10 In summary, the above analysis adds up to the following level <strong>of</strong> freight traffic by <strong>2020</strong><br />

Table-8: Summary <strong>of</strong> projected freight loading by IR by <strong>2020</strong><br />

S.No. Commodity Originating loading (Million tonnage)<br />

1. Coal 700<br />

2. Raw Material for Steel Plants 39<br />

3 Pig Iron & Finished Steel 108<br />

4 Cement 250<br />

5 Iron Ore (Exports) 75<br />

6 Iron Ore (Domestic) 150<br />

7 Food grains 50<br />

8 Fertilizers 70<br />

9 POL 48<br />

10. Containers 210<br />

11. Others 150<br />

12. Total 1850<br />

(1203 billion NTKMs)<br />

19