Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

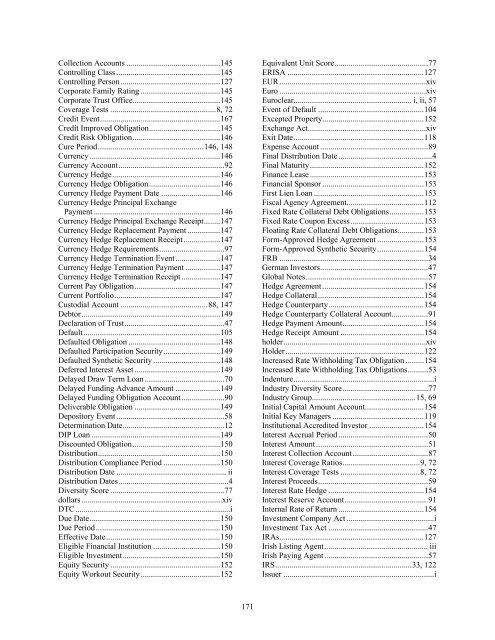

Collection Accounts ..............................................145<br />

Controlling Class ...................................................145<br />

Controlling Person.................................................127<br />

Corporate Family Rating .......................................145<br />

Corporate Trust Office...........................................145<br />

Coverage Tests ....................................................8, 72<br />

Credit Event...........................................................167<br />

Credit Improved Obligation...................................145<br />

Credit Risk Obligation...........................................146<br />

Cure Period....................................................146, 148<br />

Currency ................................................................146<br />

Currency Account....................................................92<br />

Currency Hedge.....................................................146<br />

Currency Hedge Obligation...................................146<br />

Currency Hedge Payment Date .............................146<br />

Currency Hedge Principal <strong>Exchange</strong><br />

Payment ..............................................................146<br />

Currency Hedge Principal <strong>Exchange</strong> Receipt........147<br />

Currency Hedge Replacement Payment ................147<br />

Currency Hedge Replacement Receipt..................147<br />

Currency Hedge Requirements................................97<br />

Currency Hedge Termination Event......................147<br />

Currency Hedge Termination Payment .................147<br />

Currency Hedge Termination Receipt ...................147<br />

Current Pay Obligation..........................................147<br />

Current Portfolio....................................................147<br />

Custodial Account ...........................................88, 147<br />

Debtor....................................................................149<br />

Declaration of Trust.................................................47<br />

Default ...................................................................105<br />

Defaulted Obligation .............................................148<br />

Defaulted Participation Security............................149<br />

Defaulted Synthetic Security .................................148<br />

Deferred Interest Asset ..........................................149<br />

Delayed Draw Term Loan .......................................70<br />

Delayed Funding Advance Amount ......................149<br />

Delayed Funding Obligation Account .....................90<br />

Deliverable Obligation ..........................................149<br />

Depository Event .....................................................58<br />

Determination Date..................................................12<br />

DIP Loan ...............................................................149<br />

Discounted Obligation...........................................150<br />

Distribution............................................................150<br />

Distribution Compliance Period ............................150<br />

Distribution Date ...................................................... ii<br />

Distribution Dates......................................................4<br />

Diversity Score ........................................................77<br />

dollars .....................................................................xiv<br />

DTC............................................................................i<br />

Due Date................................................................150<br />

Due Period.............................................................150<br />

Effective Date........................................................150<br />

Eligible Financial Institution .................................150<br />

Eligible <strong>Investment</strong>................................................150<br />

Equity Security ......................................................152<br />

Equity Workout Security .......................................152<br />

Equivalent Unit Score..............................................77<br />

ERISA ...................................................................127<br />

EUR........................................................................xiv<br />

Euro ........................................................................xiv<br />

Euroclear.......................................................... i, ii, 57<br />

Event of Default ....................................................104<br />

Excepted Property..................................................152<br />

<strong>Exchange</strong> Act..........................................................xiv<br />

Exit Date................................................................118<br />

Expense Account .....................................................89<br />

Final Distribution Date ..............................................4<br />

Final Maturity........................................................152<br />

Finance Lease ........................................................153<br />

Financial Sponsor ..................................................153<br />

First Lien Loan ......................................................153<br />

Fiscal Agency Agreement......................................112<br />

Fixed Rate Collateral Debt Obligations.................153<br />

Fixed Rate Coupon Excess ....................................153<br />

Floating Rate Collateral Debt Obligations.............153<br />

Form-Approved Hedge Agreement .......................153<br />

Form-Approved Synthetic Security.......................154<br />

FRB .........................................................................34<br />

German Investors.....................................................47<br />

Global Notes............................................................57<br />

Hedge Agreement..................................................154<br />

Hedge Collateral....................................................154<br />

Hedge Counterparty...............................................154<br />

Hedge Counterparty Collateral Account..................91<br />

Hedge Payment Amount........................................154<br />

Hedge Receipt Amount .........................................154<br />

holder......................................................................xiv<br />

Holder....................................................................122<br />

Increased Rate Withholding Tax Obligation .........154<br />

Increased Rate Withholding Tax Obligations..........53<br />

Indenture.....................................................................i<br />

Industry Diversity Score..........................................77<br />

Industry Group...................................................15, 69<br />

Initial Capital Amount Account.............................154<br />

Initial Key Managers .............................................119<br />

Institutional Accredited Investor ...........................154<br />

Interest Accrual Period ............................................50<br />

Interest Amount .......................................................51<br />

Interest Collection Account .....................................87<br />

Interest Coverage Ratios......................................9, 72<br />

Interest Coverage Tests .......................................8, 72<br />

Interest Proceeds......................................................59<br />

Interest Rate Hedge ...............................................154<br />

Interest Reserve Account.........................................91<br />

Internal Rate of Return ..........................................154<br />

<strong>Investment</strong> Company Act ...........................................i<br />

<strong>Investment</strong> Tax Act .................................................47<br />

IRAs.......................................................................127<br />

<strong>Irish</strong> Listing Agent................................................... iii<br />

<strong>Irish</strong> Paying Agent...................................................57<br />

IRS...................................................................33, 122<br />

Issuer ..........................................................................i<br />

171