Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

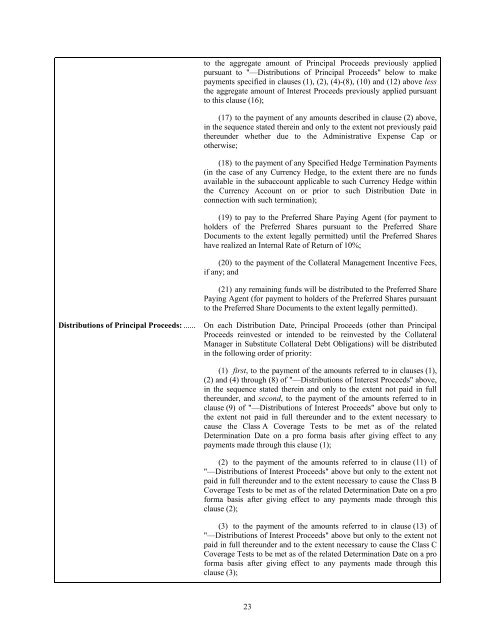

to the aggregate amount of Principal Proceeds previously applied<br />

pursuant to "—Distributions of Principal Proceeds" below to make<br />

payments specified in clauses (1), (2), (4)-(8), (10) and (12) above less<br />

the aggregate amount of Interest Proceeds previously applied pursuant<br />

to this clause (16);<br />

(17) to the payment of any amounts described in clause (2) above,<br />

in the sequence stated therein and only to the extent not previously paid<br />

thereunder whether due to the Administrative Expense Cap or<br />

otherwise;<br />

(18) to the payment of any Specified Hedge Termination Payments<br />

(in the case of any Currency Hedge, to the extent there are no funds<br />

available in the subaccount applicable to such Currency Hedge within<br />

the Currency Account on or prior to such Distribution Date in<br />

connection with such termination);<br />

(19) to pay to the Preferred Share Paying Agent (for payment to<br />

holders of the Preferred Shares pursuant to the Preferred Share<br />

Documents to the extent legally permitted) until the Preferred Shares<br />

have realized an Internal Rate of Return of 10%;<br />

(20) to the payment of the Collateral Management Incentive Fees,<br />

if any; and<br />

(21) any remaining funds will be distributed to the Preferred Share<br />

Paying Agent (for payment to holders of the Preferred Shares pursuant<br />

to the Preferred Share Documents to the extent legally permitted).<br />

Distributions of Principal Proceeds: ...... On each Distribution Date, Principal Proceeds (other than Principal<br />

Proceeds reinvested or intended to be reinvested by the Collateral<br />

Manager in Substitute Collateral Debt Obligations) will be distributed<br />

in the following order of priority:<br />

(1) first, to the payment of the amounts referred to in clauses (1),<br />

(2) and (4) through (8) of "—Distributions of Interest Proceeds" above,<br />

in the sequence stated therein and only to the extent not paid in full<br />

thereunder, and second, to the payment of the amounts referred to in<br />

clause (9) of "—Distributions of Interest Proceeds" above but only to<br />

the extent not paid in full thereunder and to the extent necessary to<br />

cause the Class A Coverage Tests to be met as of the related<br />

Determination Date on a pro forma basis after giving effect to any<br />

payments made through this clause (1);<br />

(2) to the payment of the amounts referred to in clause (11) of<br />

"—Distributions of Interest Proceeds" above but only to the extent not<br />

paid in full thereunder and to the extent necessary to cause the Class B<br />

Coverage Tests to be met as of the related Determination Date on a pro<br />

forma basis after giving effect to any payments made through this<br />

clause (2);<br />

(3) to the payment of the amounts referred to in clause (13) of<br />

"—Distributions of Interest Proceeds" above but only to the extent not<br />

paid in full thereunder and to the extent necessary to cause the Class C<br />

Coverage Tests to be met as of the related Determination Date on a pro<br />

forma basis after giving effect to any payments made through this<br />

clause (3);<br />

23