Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Octagon Investment Partners IX, Ltd. JPMorgan - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

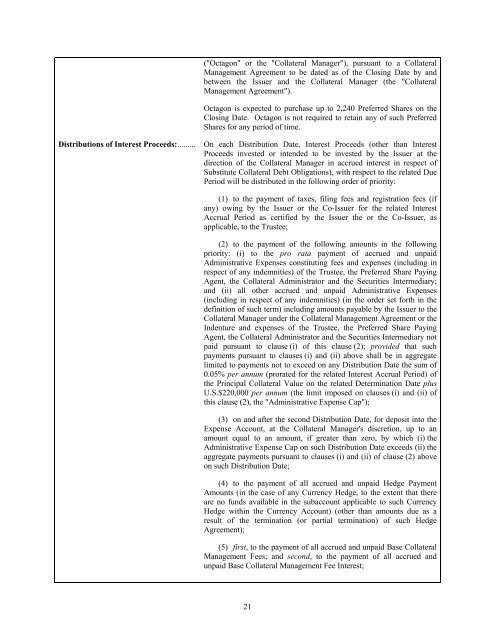

("<strong>Octagon</strong>" or the "Collateral Manager"), pursuant to a Collateral<br />

Management Agreement to be dated as of the Closing Date by and<br />

between the Issuer and the Collateral Manager (the "Collateral<br />

Management Agreement").<br />

<strong>Octagon</strong> is expected to purchase up to 2,240 Preferred Shares on the<br />

Closing Date. <strong>Octagon</strong> is not required to retain any of such Preferred<br />

Shares for any period of time.<br />

Distributions of Interest Proceeds:......... On each Distribution Date, Interest Proceeds (other than Interest<br />

Proceeds invested or intended to be invested by the Issuer at the<br />

direction of the Collateral Manager in accrued interest in respect of<br />

Substitute Collateral Debt Obligations), with respect to the related Due<br />

Period will be distributed in the following order of priority:<br />

(1) to the payment of taxes, filing fees and registration fees (if<br />

any) owing by the Issuer or the Co-Issuer for the related Interest<br />

Accrual Period as certified by the Issuer the or the Co-Issuer, as<br />

applicable, to the Trustee;<br />

(2) to the payment of the following amounts in the following<br />

priority: (i) to the pro rata payment of accrued and unpaid<br />

Administrative Expenses constituting fees and expenses (including in<br />

respect of any indemnities) of the Trustee, the Preferred Share Paying<br />

Agent, the Collateral Administrator and the Securities Intermediary;<br />

and (ii) all other accrued and unpaid Administrative Expenses<br />

(including in respect of any indemnities) (in the order set forth in the<br />

definition of such term) including amounts payable by the Issuer to the<br />

Collateral Manager under the Collateral Management Agreement or the<br />

Indenture and expenses of the Trustee, the Preferred Share Paying<br />

Agent, the Collateral Administrator and the Securities Intermediary not<br />

paid pursuant to clause (i) of this clause (2); provided that such<br />

payments pursuant to clauses (i) and (ii) above shall be in aggregate<br />

limited to payments not to exceed on any Distribution Date the sum of<br />

0.05% per annum (prorated for the related Interest Accrual Period) of<br />

the Principal Collateral Value on the related Determination Date plus<br />

U.S.$220,000 per annum (the limit imposed on clauses (i) and (ii) of<br />

this clause (2), the "Administrative Expense Cap");<br />

(3) on and after the second Distribution Date, for deposit into the<br />

Expense Account, at the Collateral Manager's discretion, up to an<br />

amount equal to an amount, if greater than zero, by which (i) the<br />

Administrative Expense Cap on such Distribution Date exceeds (ii) the<br />

aggregate payments pursuant to clauses (i) and (ii) of clause (2) above<br />

on such Distribution Date;<br />

(4) to the payment of all accrued and unpaid Hedge Payment<br />

Amounts (in the case of any Currency Hedge, to the extent that there<br />

are no funds available in the subaccount applicable to such Currency<br />

Hedge within the Currency Account) (other than amounts due as a<br />

result of the termination (or partial termination) of such Hedge<br />

Agreement);<br />

(5) first, to the payment of all accrued and unpaid Base Collateral<br />

Management Fees; and second, to the payment of all accrued and<br />

unpaid Base Collateral Management Fee Interest;<br />

21