- Page 1 and 2:

Public Economics Lectures Part 1: I

- Page 3 and 4:

Motivation 1: Practical Relevance I

- Page 5 and 6:

Motivation 2: Academic Interest Pub

- Page 7 and 8:

Methodological Themes 1 Micro-based

- Page 9 and 10:

Federal Government Revenue and Expe

- Page 11 and 12:

Federal Revenues (% of total revenu

- Page 13 and 14:

Federal Spending (% of total spendi

- Page 15 and 16:

Government Intervention in the Econ

- Page 17 and 18:

First Role for Government: Improve

- Page 19 and 20: First Welfare Theorem Private marke

- Page 21 and 22: Failure 2: Asymmetric Information a

- Page 23 and 24: Individual Failures Recent addition

- Page 25 and 26: Why Limit Government Intervention?

- Page 27 and 28: Three Types of Questions in Public

- Page 29 and 30: Public Economics Lectures Part 2: I

- Page 31 and 32: References on Tax Incidence Kotliko

- Page 33 and 34: Economic vs. Statutory Incidence Eq

- Page 35 and 36: Overview of Literature Ideally, we

- Page 37 and 38: Partial Equilibrium Model: Setup Tw

- Page 39 and 40: Partial Equilibrium Model: Supply P

- Page 41 and 42: Tax Levied on Producers Price S+t $

- Page 43 and 44: Perfectly Inelastic Demand Price D

- Page 45 and 46: Formula for Tax Incidence Implicitl

- Page 47 and 48: Tax Incidence with Salience Effects

- Page 49 and 50: Chetty et al.: Empirical Framework

- Page 51 and 52: Chetty et al.: Strategy 1 Experimen

- Page 53 and 54: TABLE 1 Evaluation of Tags: Classro

- Page 55 and 56: Period Effect of Posting TaxInclu

- Page 57 and 58: Period Effect of Posting TaxInclu

- Page 59 and 60: Chetty et al.: Strategy 2 Compare e

- Page 61 and 62: Per Capita Beer Consumption and Sta

- Page 63 and 64: Tax Incidence with Salience Effects

- Page 65 and 66: Tax Incidence with Salience Effects

- Page 67 and 68: Evaluating Empirical Studies Consid

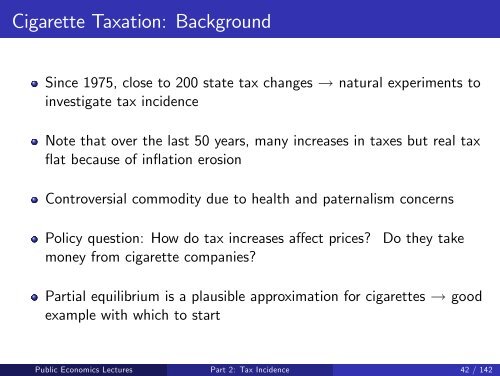

- Page 69: Cigarette Taxation: Background Ciga

- Page 73 and 74: Public Economics Lectures () Part 2

- Page 75 and 76: Triple Difference Some studies use

- Page 77 and 78: Fixed Effects Include time and stat

- Page 79 and 80: Evans, Ringel, and Stech (1999) Imp

- Page 81 and 82: Evans, Ringel, and Stech: Incidence

- Page 83 and 84: Evans, Ringel, and Stech: Demand El

- Page 85 and 86: Evans, Ringel, and Stech: Long Run

- Page 87 and 88: Public Economics Lectures () Part 2

- Page 89 and 90: Hastings and Washington 2008 Questi

- Page 91 and 92: Public Economics Lectures () Part 2

- Page 93 and 94: Public Economics Lectures () Part 2

- Page 95 and 96: Rothstein 2008 How does EITC affect

- Page 97 and 98: Public Economics Lectures () Part 2

- Page 99 and 100: Rothstein: Empirical Strategy Two m

- Page 101 and 102: DFL Reweighting Widely used method

- Page 103 and 104: Public Economics Lectures () Part 2

- Page 105 and 106: Public Economics Lectures () Part 2

- Page 107 and 108: Rothstein: Results Basic DFL compar

- Page 109 and 110: Rothstein: Results Ultimately uses

- Page 111 and 112: Extensions of Basic Partial Equilib

- Page 113 and 114: Extensions of Basic Partial Equilib

- Page 115 and 116: Harberger 1962 Two Sector Model 1 F

- Page 117 and 118: Harberger Model: Effect of Tax Incr

- Page 119 and 120: Harberger Model: Main Effects 2. Ou

- Page 121 and 122:

Harberger Model: Main Effects 3. Su

- Page 123 and 124:

Computable General Equilibrium Mode

- Page 125 and 126:

Criticism of CGE Models Findings ve

- Page 127 and 128:

Open Economy Application: Framework

- Page 129 and 130:

Open Economy Application: Empirics

- Page 131 and 132:

Feldstein and Horioka 1980 Second s

- Page 133 and 134:

Open Economy Applications: Empirics

- Page 135 and 136:

Capitalization and the Asset Price

- Page 137 and 138:

Empirical Applications 1 [Cutler 19

- Page 139 and 140:

Cutler 1988 First, compute excess r

- Page 141 and 142:

Cutler: Results Cutler finds ˆb =

- Page 143 and 144:

Public Economics Lectures () Part 2

- Page 145 and 146:

Public Economics Lectures () Part 2

- Page 147 and 148:

Linden and Rockoff: Results Find ho

- Page 149 and 150:

Excess Returns Around Drug Approval

- Page 151 and 152:

Distribution of Excess Returns arou

- Page 153 and 154:

Mandated Benefits We have focused u

- Page 155 and 156:

Mandated Benefits: Simple Model Lab

- Page 157 and 158:

Mandated Benefit Wage Rate S w 1 B

- Page 159 and 160:

Mandated Benefits: Incidence Formul

- Page 161 and 162:

Gruber 1994 Studies state mandates

- Page 163 and 164:

Public Economics Lectures () Part 2

- Page 165 and 166:

Acemoglu and Angrist 2001 Look at e

- Page 167 and 168:

Acemoglu and Angrist 2001 Acemoglu

- Page 169 and 170:

Public Economics Lectures () Part 2

- Page 171 and 172:

Public Economics Lectures Part 3: E

- Page 173 and 174:

Definition Incidence analysis: effe

- Page 175 and 176:

Effi ciency Cost: Introduction Gove

- Page 177 and 178:

Partial Equilibrium Model: Setup Tw

- Page 179 and 180:

Price Excess Burden of Taxation S $

- Page 181 and 182:

Effi ciency Cost: Marshallian Surpl

- Page 183 and 184:

Effi ciency Cost: Marshallian Surpl

- Page 185 and 186:

Effi ciency Cost: Marshallian Surpl

- Page 187 and 188:

EB Increases with Square of Tax Rat

- Page 189 and 190:

P P 3 P 2 P 1 S+t 1 +t 2 S+t 1 E B

- Page 191 and 192:

Tax Policy Implications With many g

- Page 193 and 194:

General Model: Demand and Indirect

- Page 195 and 196:

Path Dependence Problem Initial pri

- Page 197 and 198:

Consumer Surplus: Conceptual Proble

- Page 199 and 200:

Compensating and Equivalent Variati

- Page 201 and 202:

Equivalent Variation Measures utili

- Page 203 and 204:

Effi ciency Cost Formulas with Inco

- Page 205 and 206:

Compensating vs. Equivalent Variati

- Page 207 and 208:

Marshallian Surplus p h(V(p 1 ,Z))

- Page 209 and 210:

Excess Burden Deadweight burden: ch

- Page 211 and 212:

p h(V(p 1 ,Z)) ~ h(V(p 0 ,Z)) p 1 M

- Page 213 and 214:

Implementable Excess Burden Formula

- Page 215 and 216:

Harberger Formula Without pre-exist

- Page 217 and 218:

Goulder and Williams 2003 Show that

- Page 219 and 220:

Goulder and Williams Formula Obtain

- Page 221 and 222:

Goulder and Williams Results Calibr

- Page 223 and 224:

Harberger vs. Hausman Approach Unde

- Page 225 and 226:

Primitives Sufficient Stats. Welfar

- Page 227 and 228:

Heterogeneity Benefit of suff stat

- Page 229 and 230:

Discrete Choice Model Recast as pla

- Page 231 and 232:

Effi ciency Cost: Applications 1 [I

- Page 233 and 234:

Feldstein Model: Setup Government l

- Page 235 and 236:

Taxable Income Formula Simplicity o

- Page 237 and 238:

Excess Burden with Transfer Costs L

- Page 239 and 240:

Gorodnichenko, Martinez-Vazquez, an

- Page 241 and 242:

Public Economics Lectures () Part 3

- Page 243 and 244:

Poterba 1992 Estimates effi ciency

- Page 245 and 246:

Public Economics Lectures () Part 3

- Page 247 and 248:

Porterba: Results Tax reforms in 19

- Page 249 and 250:

Public Economics Lectures () Part 3

- Page 251 and 252:

Price and Tax Elasticities By Year

- Page 253 and 254:

Welfare Analysis in Behavioral Mode

- Page 255 and 256:

Behavioral Welfare Economics: Two A

- Page 257 and 258:

Behavioral Welfare Economics: Two A

- Page 259 and 260:

Bernheim and Rangel 2009: Choice Se

- Page 261 and 262:

Bernheim and Rangel 2009: Compensat

- Page 263 and 264:

Bernheim and Rangel 2009: Refinemen

- Page 265 and 266:

Welfare Analysis with Salience Effe

- Page 267 and 268:

Welfare Analysis with Salience Effe

- Page 269 and 270:

Preference Recovery Assumptions A1

- Page 271 and 272:

Excess Burden with No Income Effect

- Page 273 and 274:

Effi ciency Cost with Income Effect

- Page 275 and 276:

Directions for Further Work on Beha

- Page 277 and 278:

Outline 1 Commodity Taxation I: Ram

- Page 279 and 280:

Second Welfare Theorem Starting poi

- Page 281 and 282:

Four Central Results in Optimal Tax

- Page 283 and 284:

Ramsey Model: Key Assumptions 1 Lum

- Page 285 and 286:

Ramsey Model: Consumer Behavior Lag

- Page 287 and 288:

Ramsey Model: Government’s Proble

- Page 289 and 290:

Ramsey Formula: Perturbation Argume

- Page 291 and 292:

Ramsey Formula: Compensated Elastic

- Page 293 and 294:

Special Case 1: Inverse Elasticity

- Page 295 and 296:

Special Case 2: Uniform Taxation Th

- Page 297 and 298:

Diamond 1975: Many-Person Model H i

- Page 299 and 300:

Diamond: Many-Person Optimal Tax Fo

- Page 301 and 302:

Diamond: Optimal Transfer In this m

- Page 303 and 304:

Lipsey and Lancaster (1956): Theory

- Page 305 and 306:

Diamond and Mirrlees Model Two good

- Page 307 and 308:

Consumer’s Offer Curve Public Eco

- Page 309 and 310:

Production Set with Revenue Require

- Page 311 and 312:

Second Best: Optimal Distortionary

- Page 313 and 314:

Diamond and Mirrlees: General Model

- Page 315 and 316:

Proof of Production Effi ciency Res

- Page 317 and 318:

Policy Consequences: Public Sector

- Page 319 and 320:

Policy Consequences: No Taxation of

- Page 321 and 322:

Policy Consequences: No Taxation of

- Page 323 and 324:

Diamond and Mirrlees: Optimal Tax R

- Page 325 and 326:

Diamond and Mirrlees Result: Limita

- Page 327 and 328:

Key Concepts for Taxes/Transfers Le

- Page 329 and 330:

Optimal Income Tax with No Behavior

- Page 331 and 332:

Mirrlees 1971: Incorporating Behavi

- Page 333 and 334:

Mirrlees: Subsequent Work Mirrlees

- Page 335 and 336:

Revenue-Maximizing Tax Rate: Laffer

- Page 337 and 338:

Public Economics Lectures () Part 4

- Page 339 and 340:

Optimal Top Income Tax Rate { } dM

- Page 341 and 342:

Optimal Top Income Tax Rate In US t

- Page 343 and 344:

Connection to Revenue Maximizing Ta

- Page 345 and 346:

Public Economics Lectures () Part 4

- Page 347 and 348:

General Non-Linear Income Tax Optim

- Page 349 and 350:

Numerical Simulations of Optimal Ta

- Page 351 and 352:

Numerical Simulations Use formula e

- Page 353 and 354:

Commodity vs. Income Taxation Now c

- Page 355 and 356:

Atkinson and Stiglitz: Commodity Ta

- Page 357 and 358:

Atkinson-Stiglitz: Proof Revenue un

- Page 359 and 360:

Atkinson-Stiglitz: Intuition With s

- Page 361 and 362:

Atkinson-Stiglitz: Implications for

- Page 363 and 364:

Chamley-Judd: Capital Taxation Judd

- Page 365 and 366:

Taxation and Savings: Evidence Key

- Page 367 and 368:

Public Economics Lectures () Part 4

- Page 369 and 370:

Optimal Transfer Programs Several t

- Page 371 and 372:

Optimal Transfers: Mirrless Model M

- Page 373 and 374:

Saez 2002: Participation Model Mode

- Page 375 and 376:

Public Economics Lectures () Part 4

- Page 377 and 378:

Public Economics Lectures () Part 4

- Page 379 and 380:

Saez 2002: Optimal Tax Formula Smal

- Page 381 and 382:

Public Economics Lectures () Part 4

- Page 383 and 384:

Public Economics Lectures () Part 4

- Page 385 and 386:

Public Economics Lectures () Part 4

- Page 387 and 388:

Mankiw and Weinzierl 2009 Tagging w

- Page 389 and 390:

Nichols and Zeckhauser 1982: In-Kin

- Page 391 and 392:

Soup Kitchen without Wait: Cash Tra

- Page 393 and 394:

Income Taxation as Insurance (Varia

- Page 395 and 396:

Varian Model: Private Insurance Var

- Page 397 and 398:

Public Economics Lectures Part 5: I

- Page 399 and 400:

References Surveys in labor economi

- Page 401 and 402:

Baseline Labor-Leisure Choice Model

- Page 403 and 404:

Labor Supply Behavior First order c

- Page 405 and 406:

Econometric Problem 1: Unobserved H

- Page 407 and 408:

Measurement Error and Division Bias

- Page 409 and 410:

Extensive vs. Intensive Margin Rela

- Page 411 and 412:

Progressive Taxes and Labor Supply

- Page 413 and 414:

Example 1: Progressive Income Tax P

- Page 415 and 416:

Example 3: Social Security Payroll

- Page 417 and 418:

Progressive Taxes and Labor Supply

- Page 419 and 420:

Non-Linear Budget Set Estimation: V

- Page 421 and 422:

Likelihood Function: Located at the

- Page 423 and 424:

Hausman (1981) Application Hausman

- Page 425 and 426:

Saez 2009: Bunching at Kinks Saez o

- Page 427 and 428:

Public Economics Lectures ()Part 5:

- Page 429 and 430:

Earnings Density and the EITC: Wage

- Page 431 and 432:

Taxable Income Density, 1960-1969:

- Page 433 and 434:

Friedberg 2000: Social Security Ear

- Page 435 and 436:

Friedberg: Estimates Estimates elas

- Page 437 and 438:

Public Economics Lectures ()Part 5:

- Page 439 and 440:

Why not more bunching at kinks? 1 T

- Page 441 and 442:

Public Economics Lectures ()Part 5:

- Page 443 and 444:

Chetty et al. 2009: Model Firms pos

- Page 445 and 446:

Cost of Bunching at Bracket Cutoff

- Page 447 and 448:

Marginal Tax Rates in Denmark in 19

- Page 449 and 450:

All Wage Earners: Top Tax Bracket C

- Page 451 and 452:

Married Women Frequency 0 10000 200

- Page 453 and 454:

Married Female Professionals with A

- Page 455 and 456:

Married Women, 1994 Frequency 0 100

- Page 457 and 458:

Married Women, 1996 Frequency 0 100

- Page 459 and 460:

Married Women, 1998 Frequency 0 100

- Page 461 and 462:

Married Women, 2000 Frequency 0 100

- Page 463 and 464:

Married Women at the Middle Tax: 10

- Page 465 and 466:

Married Women at the Middle Tax: 8%

- Page 467 and 468:

Distribution of Individuals’Deduc

- Page 469 and 470:

Teachers Wage Income: 1998 Frequenc

- Page 471 and 472:

Wage Earnings: Teachers with Deduct

- Page 473 and 474:

Distribution of Modes in Occupation

- Page 475 and 476:

SelfEmployed: Distribution around

- Page 477 and 478:

Estimates of Hours and Participatio

- Page 479 and 480:

Public Economics Lectures ()Part 5:

- Page 481 and 482:

Public Economics Lectures ()Part 5:

- Page 483 and 484:

Problems with Experimental Design E

- Page 485 and 486:

Instrumental Variable Methods Anoth

- Page 487 and 488:

Mroz 1987: Setup and Results Uses b

- Page 489 and 490:

Public Economics Lectures ()Part 5:

- Page 491 and 492:

Public Economics Lectures ()Part 5:

- Page 493 and 494:

Eissa 1995: Caveats Does the common

- Page 495 and 496:

Bianchi, Gudmundsson, and Zoega 200

- Page 497 and 498:

Public Economics Lectures ()Part 5:

- Page 499 and 500:

Bianchi, Gudmundsson, and Zoega 200

- Page 501 and 502:

Overall Costs of Anti Poverty Progr

- Page 503 and 504:

Monthly Welfare Case Loads: 1963-20

- Page 505 and 506:

Behavioral Responses to the EITC 1

- Page 507 and 508:

Eissa and Liebman 1996 Study labor

- Page 509 and 510:

Eissa and Liebman: Results Find a s

- Page 511 and 512:

Public Economics Lectures ()Part 5:

- Page 513 and 514:

Meyer and Rosenbaum 2001 Analyze th

- Page 515 and 516:

Eissa and Hoynes 2004 EITC based on

- Page 517 and 518:

Meyer and Sullivan 2004 Examine the

- Page 519 and 520:

Relative Consumption: single women

- Page 521 and 522:

Meyer and Sullivan: Results Materia

- Page 523 and 524:

Changing Elasticities: Blau and Kah

- Page 525 and 526:

Intertemporal Models and the MaCurd

- Page 527 and 528:

Life Cycle Model: Time Separability

- Page 529 and 530:

Dynamic Life Cycle Model: Frisch El

- Page 531 and 532:

Public Economics Lectures ()Part 5:

- Page 533 and 534:

Frisch vs. Compensated vs. Uncompen

- Page 535 and 536:

Card Critique of ITLS models Critiq

- Page 537 and 538:

Blundell, Duncan, and Meghir 1998 C

- Page 539 and 540:

Blundell, Duncan, and Meghir: Resul

- Page 541 and 542:

Public Economics Lectures ()Part 5:

- Page 543 and 544:

Farber 2005: Division Bias Argues t

- Page 545 and 546:

Manoli and Weber 2009 Use variation

- Page 547 and 548:

Distribution of Tenure at Retiremen

- Page 549 and 550:

US Income Taxation: Trends The bigg

- Page 551 and 552:

Bottom 99% Tax Units 40% $40,000 35

- Page 553 and 554:

Feldstein 1995 First study of taxab

- Page 555 and 556:

Feldstein: Results Feldstein obtain

- Page 557 and 558:

Feldstein: Econometric Criticisms S

- Page 559 and 560:

18% 16% Wages SCorp. Partner. Sol

- Page 561 and 562:

Public Economics Lectures ()Part 5:

- Page 563 and 564:

Gruber and Saez 2002 First study to

- Page 565 and 566:

Gruber and Saez: Results Find an el

- Page 567 and 568:

Imbens et al. 2001: Income Effects

- Page 569 and 570:

Taxable Income Literature: Summary

- Page 571 and 572:

Prescott 2004 Uses data on hours wo

- Page 573 and 574:

Davis and Henrekson 2005 Run regres

- Page 575 and 576:

Public Economics Lectures ()Part 5:

- Page 577 and 578:

Optimization Frictions Many frictio

- Page 579 and 580:

Public Economics Lectures ()Part 5:

- Page 581 and 582:

Setup Consider a static demand mode

- Page 583 and 584:

Optimization Frictions Define agent

- Page 585 and 586:

Construction of Choice Set 151 150

- Page 587 and 588:

Identification with Optimization Fr

- Page 589 and 590:

Identification with Optimization Fr

- Page 591 and 592:

Calculation of Bounds on Structural

- Page 593 and 594:

) Lower Bound on Structural Elastic

- Page 595 and 596:

Application to Taxation and Labor S

- Page 597 and 598:

4.0 Bounds on IntensiveMargin Lab

- Page 599 and 600:

4.0 3.5 Bounds on IntensiveMargin

- Page 601 and 602:

Chetty and Saez 2009: Experimental

- Page 603 and 604:

Year 2 Earnings Distributions: 1 De

- Page 605 and 606:

Year 2 Wage Earnings Distributions:

- Page 607 and 608:

Labor Supply Elasticities: Implicat

- Page 609 and 610:

Chetty: Formula for Risk Aversion L

- Page 611 and 612:

u c ,u l w 0 u c (w 0 l,l) Case A:

- Page 613 and 614:

Chetty 2006: Results Labor supply e

- Page 615 and 616:

Outline 1 Motivations for Social In

- Page 617 and 618:

Growth of Social Insurance in the U

- Page 619 and 620:

Unemployment Benefit Systems in Dev

- Page 621 and 622:

Useful Background Reading 1 Institu

- Page 623 and 624:

Adverse Selection as a Motivation f

- Page 625 and 626:

Rothschild-Stiglitz: Key Assumption

- Page 627 and 628:

Rothschild-Stiglitz: Equilibrium De

- Page 629 and 630:

Public Economics Lectures () Part 6

- Page 631 and 632:

Rothschild-Stiglitz: Second Best So

- Page 633 and 634:

Rothschild-Stiglitz: Second Best So

- Page 635 and 636:

Rothschild-Stiglitz: Second Best So

- Page 637 and 638:

Rothschild-Stiglitz: Second Best So

- Page 639 and 640:

Adverse Selection: Empirical Eviden

- Page 641 and 642:

Public Economics Lectures () Part 6

- Page 643 and 644:

Aggregate Shocks as a Motivation fo

- Page 645 and 646:

Unemployment Insurance Start with U

- Page 647 and 648:

Replacement Rate Common measure of

- Page 649 and 650:

Baily-Chetty model Canonical analys

- Page 651 and 652:

Baily-Chetty model: Setup Static mo

- Page 653 and 654:

Baily-Chetty model: First Best Prob

- Page 655 and 656:

Baily-Chetty model: Second Best Pro

- Page 657 and 658:

Two Approaches to Optimal Social In

- Page 659 and 660:

Envelope Condition Why can ∂e ∂

- Page 661 and 662:

Suffi cient Statistic Approach to K

- Page 663 and 664:

Baily-Chetty model: Second Best Sol

- Page 665 and 666:

Baily-Chetty Consumption-Based Form

- Page 667 and 668:

Empirical Estimates: Duration Elast

- Page 669 and 670:

Hazard Models Define hazard rate h

- Page 671 and 672:

Meyer 1990 Meyer includes log UI be

- Page 673 and 674:

Consumption Smoothing Benefits of U

- Page 675 and 676:

Consumption Smoothing Benefits of U

- Page 677 and 678:

Calibrating the Model b ∗ Results

- Page 679 and 680:

Homeowners’Consumption around Une

- Page 681 and 682:

Commitments and Risk Aversion How d

- Page 683 and 684:

Commitments Model: Implications for

- Page 685 and 686:

Chetty 2008: Moral Hazard vs. Liqui

- Page 687 and 688:

Chetty 2008: Job Search Technology

- Page 689 and 690:

Chetty 2008: Value Functions Value

- Page 691 and 692:

Chetty 2008: Moral Hazard vs. Liqui

- Page 693 and 694:

Chetty 2008: Formula for Optimal UI

- Page 695 and 696:

Moral Hazard vs. Liquidity: Evidenc

- Page 697 and 698:

Figure 3a Effect of UI Benefits on

- Page 699 and 700:

Figure 3c Effect of UI Benefits on

- Page 701 and 702:

log UI ben 0.527 (0.267) TABLE 2

- Page 703 and 704:

Figure 5 Effect of Severance Pay on

- Page 705 and 706:

Figure 6b Effect of Severance Pay o

- Page 707 and 708:

Chetty 2008: Implications for Optim

- Page 709 and 710:

Figure 3 Frequency of Layoffs by Jo

- Page 711 and 712:

Figure 4 Selection on Observables M

- Page 713 and 714:

TABLE 3a Effects of Severance Pay a

- Page 715 and 716:

Shimer and Werning 2007: Reservatio

- Page 717 and 718:

Figure 5a Effect of Severance Pay o

- Page 719 and 720:

Figure 10b Effect of Severance Pay

- Page 721 and 722:

Effect of Extended Benefits on Subs

- Page 723 and 724:

Spike at Benefit Exhaustion Most st

- Page 725 and 726:

Job Finding vs. Unemployment Exit H

- Page 727 and 728:

Effect of Benefit Expiration on Haz

- Page 729 and 730:

Experience Rating in Washington, 20

- Page 731 and 732:

Feldstein 1978: Empirical Results F

- Page 733 and 734:

UI Savings Accounts Alternative to

- Page 735 and 736:

Feldstein and Altman 2007 Calculati

- Page 737 and 738:

Black, Smith, Berger, and Noel 2003

- Page 739 and 740:

Public Economics Lectures () Part 6

- Page 741 and 742:

Black, Smith, Berger, and Noel 2003

- Page 743 and 744:

Dynamics: Path of UI Benefits Class

- Page 745 and 746:

Workers Compensation Insurance agai

- Page 747 and 748:

Theory of Workers’Compensation Fo

- Page 749 and 750:

Public Economics Lectures () Part 6

- Page 751 and 752:

Effects of Benefits on Injuries Pot

- Page 753 and 754:

Public Economics Lectures () Part 6

- Page 755 and 756:

Effect on Equilibrium Wage Workers

- Page 757 and 758:

Disability Insurance See Bound et.

- Page 759 and 760:

Two Views on the Rise in DI Trend h

- Page 761 and 762:

Theory of Disability Insurance Key

- Page 763 and 764:

Empirical Evidence: Bound-Parsons D

- Page 765 and 766:

Empirical Evidence: Bound-Parsons D

- Page 767 and 768:

Gruber 2000 Exploits differential l

- Page 769 and 770:

Public Economics Lectures () Part 6

- Page 771 and 772:

Autor and Duggan 2003 Focus on inte

- Page 773 and 774:

Public Economics Lectures () Part 6

- Page 775 and 776:

Employment Shocks and DI Applicatio

- Page 777 and 778:

Employment Shocks and DI Applicatio

- Page 779 and 780:

Health Insurance Arrow (1963): semi

- Page 781 and 782:

Health Care Spending in OECD Nation

- Page 783 and 784:

Americans’Source of Health Insura

- Page 785 and 786:

Growing Health Expenditures: Key Fa

- Page 787 and 788:

Market Failures and Government Inte

- Page 789 and 790:

Measuring Health Before discussing

- Page 791 and 792:

Public Economics Lectures () Part 6

- Page 793 and 794:

Optimal Govt. Intervention in Healt

- Page 795 and 796:

Feldstein 1973 x = non-medical cons

- Page 797 and 798:

Feldstein 1973: First Best Solution

- Page 799 and 800:

Price of each visit $200 A B S=MC $

- Page 801 and 802:

Public Economics Lectures () Part 6

- Page 803 and 804:

Public Economics Lectures () Part 6

- Page 805 and 806:

Finkelstein 2006 Impact of Medicare

- Page 807 and 808:

Ellis and McGuire 1986 Previous ana

- Page 809 and 810:

Ellis and McGuire: Compensation Sch

- Page 811 and 812:

Ellis and McGuire: Optimal Payment

- Page 813 and 814:

Ellis and McGuire: Optimal Payment

- Page 815 and 816:

Ellis and McGuire Model: Limitation

- Page 817 and 818:

Crowdout of Private Insurance So fa

- Page 819 and 820:

Currie and Gruber 1995: Benefits of

- Page 821 and 822:

Public Economics Lectures Part 7: P

- Page 823 and 824:

Public vs. Private Goods Private go

- Page 825 and 826:

Public Good Person 1’s Consumptio

- Page 827 and 828:

Public Goods Model: Setup Economy w

- Page 829 and 830:

First Best if G is Private To ident

- Page 831 and 832:

First Best if G is a Pure Public Go

- Page 833 and 834:

Samuelson (1954) Rule Condition for

- Page 835 and 836:

Model of Private Provision: Setup P

- Page 837 and 838:

Lindahl Equilibrium How to achieve

- Page 839 and 840:

Lindahl Equilibria: Key Properties

- Page 841 and 842:

Voting Model: Setup Suppose that pu

- Page 843 and 844:

Arrow (1951) and Single-Peaked Pref

- Page 845 and 846:

Median Voter Theorem With single-pe

- Page 847 and 848:

Median Voter Choice: Effi ciency In

- Page 849 and 850:

Public Economics Lectures () Part 7

- Page 851 and 852:

Optimal Second Best Provision of PG

- Page 853 and 854:

Bergstrom, Blume, and Varian (1986)

- Page 855 and 856:

Bergstrom-Blume-Varian Model: Crowd

- Page 857 and 858:

BBV Model: Additional Results 1 Tot

- Page 859 and 860:

Empirical Evidence on Crowd-Out Two

- Page 861 and 862:

Public Economics Lectures () Part 7

- Page 863 and 864:

Hungerman 2005 Studies crowdout of

- Page 865 and 866:

Hungerman 2005 Estimates imply that

- Page 867 and 868:

Andreoni and Payne 2003 OLS still y

- Page 869 and 870:

Andreoni and Payne 2003 $1000 incre

- Page 871 and 872:

Public Economics Lectures () Part 7

- Page 873 and 874:

Andreoni 1988 Isaac, McCue, and Plo

- Page 875 and 876:

Andreoni 1993 Uses lab experiment t

- Page 877 and 878:

Public Economics Lectures () Part 7

- Page 879 and 880:

Andreoni 1993 Public good levels ar

- Page 881 and 882:

Financing PGs with Distortionary Ta

- Page 883 and 884:

PGs with Distortionary Taxes: Setup

- Page 885 and 886:

PGs with Distortionary Taxes: 1st B

- Page 887 and 888:

PGs with Distortionary Taxes: 2nd B

- Page 889 and 890:

Kreiner and Verdelin 2009 Consider

- Page 891 and 892:

Subsidies for Charity: Setup Warm-g

- Page 893 and 894:

Optimal Subsidies for Charity Resul

- Page 895 and 896:

Optimal Subsidies for Charity (Saez

- Page 897 and 898:

Empirical Evidence Existing studies

- Page 899 and 900:

Externalities: Outline 1 Definition

- Page 901 and 902:

Externalities: Main Questions 1 The

- Page 903 and 904:

Model of Externalities: Equilibrium

- Page 905 and 906:

Model of Externalities: Deadweight

- Page 907 and 908:

Remedies for Externalities 1 Coasia

- Page 909 and 910:

Coasian Solution: Limitations 1 Cos

- Page 911 and 912:

Price Pigouvian Tax SMC=PMC+MD S=PM

- Page 913 and 914:

Permits: Cap-and-Trade Cap total am

- Page 915 and 916:

Weitzman 1974: Market for Pollution

- Page 917 and 918:

Weitzman Model: Policy without Unce

- Page 919 and 920:

MB steep, Quantity regulation Publi

- Page 921 and 922:

Quantity Regulation Price Regulatio

- Page 923 and 924:

MB Flat, Quantity Regulation Public

- Page 925 and 926:

Quantity regulation Price Regulatio

- Page 927 and 928:

Optimal Second-Best Taxation with E

- Page 929 and 930:

Sandmo 1975: Setup Individual maxim

- Page 931 and 932:

Sandmo 1975: Additivity Result Main

- Page 933 and 934:

Double Dividend Debate Claim: gas t

- Page 935 and 936:

Externalities: Empirical Measuremen

- Page 937 and 938:

Public Economics Lectures () Part 7

- Page 939 and 940:

Public Economics Lectures () Part 7

- Page 941 and 942:

Brookshire et al. 1982 Infer willin

- Page 943 and 944:

Public Economics Lectures () Part 7

- Page 945 and 946:

Chay and Greenstone 2005 Conclusion

- Page 947 and 948:

Public Economics Lectures () Part 7

- Page 949 and 950:

Public Economics Lectures () Part 7

- Page 951 and 952:

Public Economics Lectures () Part 7

- Page 953 and 954:

Diamond and Hausman 1994 Describe p

- Page 955 and 956:

Becker and Murphy 1988 Show that ad

- Page 957 and 958:

Bernheim and Rangel 2004 Model of