Strength and Stability - SNL Financial

Strength and Stability - SNL Financial

Strength and Stability - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FIRST COMMONWEALTH FINANCIAL CORPORATION AND SUBSIDIARIES<br />

ITEM 7. Management’s Discussion <strong>and</strong> Analysis of <strong>Financial</strong> Condition <strong>and</strong> Results of Operations<br />

(Continued)<br />

Results of Operations—2008 Compared to 2007 (Continued)<br />

Non-Interest Income<br />

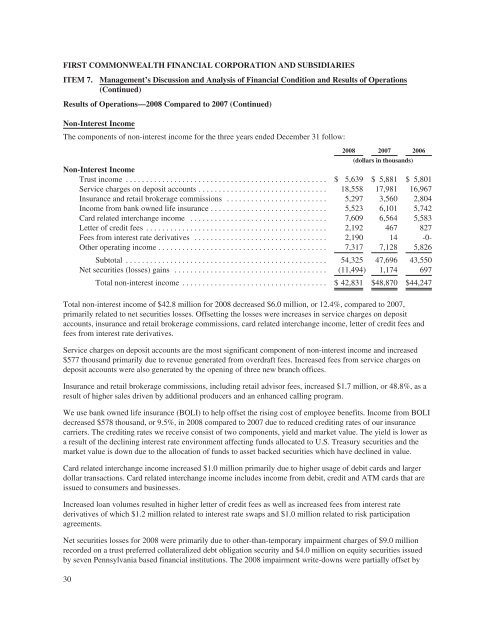

The components of non-interest income for the three years ended December 31 follow:<br />

2008 2007 2006<br />

(dollars in thous<strong>and</strong>s)<br />

Non-Interest Income<br />

Trust income .................................................. $ 5,639 $ 5,881 $ 5,801<br />

Service charges on deposit accounts ................................ 18,558 17,981 16,967<br />

Insurance <strong>and</strong> retail brokerage commissions ......................... 5,297 3,560 2,804<br />

Income from bank owned life insurance ............................. 5,523 6,101 5,742<br />

Card related interchange income .................................. 7,609 6,564 5,583<br />

Letter of credit fees ............................................. 2,192 467 827<br />

Fees from interest rate derivatives ................................. 2,190 14 -0-<br />

Other operating income .......................................... 7,317 7,128 5,826<br />

Subtotal .................................................. 54,325 47,696 43,550<br />

Net securities (losses) gains ...................................... (11,494) 1,174 697<br />

Total non-interest income .................................... $42,831 $48,870 $44,247<br />

Total non-interest income of $42.8 million for 2008 decreased $6.0 million, or 12.4%, compared to 2007,<br />

primarily related to net securities losses. Offsetting the losses were increases in service charges on deposit<br />

accounts, insurance <strong>and</strong> retail brokerage commissions, card related interchange income, letter of credit fees <strong>and</strong><br />

fees from interest rate derivatives.<br />

Service charges on deposit accounts are the most significant component of non-interest income <strong>and</strong> increased<br />

$577 thous<strong>and</strong> primarily due to revenue generated from overdraft fees. Increased fees from service charges on<br />

deposit accounts were also generated by the opening of three new branch offices.<br />

Insurance <strong>and</strong> retail brokerage commissions, including retail advisor fees, increased $1.7 million, or 48.8%, as a<br />

result of higher sales driven by additional producers <strong>and</strong> an enhanced calling program.<br />

We use bank owned life insurance (BOLI) to help offset the rising cost of employee benefits. Income from BOLI<br />

decreased $578 thous<strong>and</strong>, or 9.5%, in 2008 compared to 2007 due to reduced crediting rates of our insurance<br />

carriers. The crediting rates we receive consist of two components, yield <strong>and</strong> market value. The yield is lower as<br />

a result of the declining interest rate environment affecting funds allocated to U.S. Treasury securities <strong>and</strong> the<br />

market value is down due to the allocation of funds to asset backed securities which have declined in value.<br />

Card related interchange income increased $1.0 million primarily due to higher usage of debit cards <strong>and</strong> larger<br />

dollar transactions. Card related interchange income includes income from debit, credit <strong>and</strong> ATM cards that are<br />

issued to consumers <strong>and</strong> businesses.<br />

Increased loan volumes resulted in higher letter of credit fees as well as increased fees from interest rate<br />

derivatives of which $1.2 million related to interest rate swaps <strong>and</strong> $1.0 million related to risk participation<br />

agreements.<br />

Net securities losses for 2008 were primarily due to other-than-temporary impairment charges of $9.0 million<br />

recorded on a trust preferred collateralized debt obligation security <strong>and</strong> $4.0 million on equity securities issued<br />

by seven Pennsylvania based financial institutions. The 2008 impairment write-downs were partially offset by<br />

30