Strength and Stability - SNL Financial

Strength and Stability - SNL Financial

Strength and Stability - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FIRST COMMONWEALTH FINANCIAL CORPORATION AND SUBSIDIARIES<br />

ITEM 7.<br />

Management’s Discussion <strong>and</strong> Analysis of <strong>Financial</strong> Condition <strong>and</strong> Results of Operations<br />

(Continued)<br />

<strong>Financial</strong> Condition (Continued)<br />

Non-Performing Loans (Continued)<br />

the weakened financial condition of the borrower. Past due loans are those loans which are contractually past due 90<br />

days or more as to interest or principal payments but are well secured <strong>and</strong> in the process of collection.<br />

Non-performing loans are closely monitored on an ongoing basis as part of our loan review <strong>and</strong> work-out process.<br />

The potential risk of loss on these loans is evaluated by comparing the loan balance to the fair value of any<br />

underlying collateral or the present value of projected future cash flows. Losses are recognized where appropriate.<br />

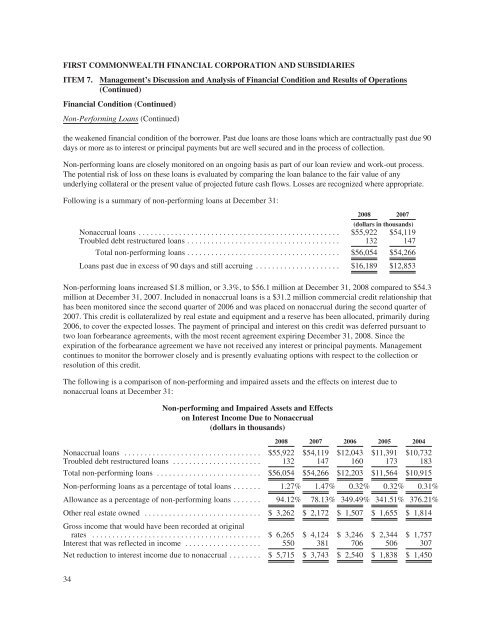

Following is a summary of non-performing loans at December 31:<br />

2008 2007<br />

(dollars in thous<strong>and</strong>s)<br />

Nonaccrual loans .................................................. $55,922 $54,119<br />

Troubled debt restructured loans ...................................... 132 147<br />

Total non-performing loans ...................................... $56,054 $54,266<br />

Loans past due in excess of 90 days <strong>and</strong> still accruing ..................... $16,189 $12,853<br />

Non-performing loans increased $1.8 million, or 3.3%, to $56.1 million at December 31, 2008 compared to $54.3<br />

million at December 31, 2007. Included in nonaccrual loans is a $31.2 million commercial credit relationship that<br />

has been monitored since the second quarter of 2006 <strong>and</strong> was placed on nonaccrual during the second quarter of<br />

2007. This credit is collateralized by real estate <strong>and</strong> equipment <strong>and</strong> a reserve has been allocated, primarily during<br />

2006, to cover the expected losses. The payment of principal <strong>and</strong> interest on this credit was deferred pursuant to<br />

two loan forbearance agreements, with the most recent agreement expiring December 31, 2008. Since the<br />

expiration of the forbearance agreement we have not received any interest or principal payments. Management<br />

continues to monitor the borrower closely <strong>and</strong> is presently evaluating options with respect to the collection or<br />

resolution of this credit.<br />

The following is a comparison of non-performing <strong>and</strong> impaired assets <strong>and</strong> the effects on interest due to<br />

nonaccrual loans at December 31:<br />

Non-performing <strong>and</strong> Impaired Assets <strong>and</strong> Effects<br />

on Interest Income Due to Nonaccrual<br />

(dollars in thous<strong>and</strong>s)<br />

2008 2007 2006 2005 2004<br />

Nonaccrual loans .................................. $55,922 $54,119 $12,043 $11,391 $10,732<br />

Troubled debt restructured loans ...................... 132 147 160 173 183<br />

Total non-performing loans .......................... $56,054 $54,266 $12,203 $11,564 $10,915<br />

Non-performing loans as a percentage of total loans ....... 1.27% 1.47% 0.32% 0.32% 0.31%<br />

Allowance as a percentage of non-performing loans ....... 94.12% 78.13% 349.49% 341.51% 376.21%<br />

Other real estate owned ............................. $ 3,262 $ 2,172 $ 1,507 $ 1,655 $ 1,814<br />

Gross income that would have been recorded at original<br />

rates .......................................... $ 6,265 $ 4,124 $ 3,246 $ 2,344 $ 1,757<br />

Interest that was reflected in income ................... 550 381 706 506 307<br />

Net reduction to interest income due to nonaccrual ........ $ 5,715 $ 3,743 $ 2,540 $ 1,838 $ 1,450<br />

34