Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Centre for Business Studies<br />

and Information<br />

<strong>Technology</strong><br />

Further Studies<br />

Students completing the Associate Diploma <strong>of</strong><br />

Business (Accounting) may be eligible to apply<br />

for admission to Bachelor <strong>of</strong> Business courses<br />

conducted by a number <strong>of</strong> Colleges <strong>of</strong> Advanced<br />

Education and Universities (for example, Deakin<br />

<strong>University</strong>, Monash <strong>University</strong>, <strong>Swinburne</strong><br />

<strong>University</strong> <strong>of</strong> <strong>Technology</strong>).<br />

Employment Prospects<br />

Initial employment may be gained in a wide<br />

variety <strong>of</strong> accounting related functions for<br />

example, costing, payroll, accounts payable,<br />

accounts receivable, taxation or budgeting.<br />

Associate Diploma <strong>of</strong> Business (Accounting)<br />

holders may also advance to management<br />

positions in industry, commerce and<br />

Government.<br />

Industry Recognition<br />

1. National lnstitute <strong>of</strong> Accountants<br />

Students who complete the Associate<br />

Diploma <strong>of</strong> Business (Accounting) including<br />

advanced accounting will be academically<br />

qualified to join the National Institute <strong>of</strong><br />

Accountants. Direct enquiries to The<br />

National Institute <strong>of</strong> Accountants, 5th Floor,<br />

Gateway Plaza, 449 Swanston Street,<br />

Melbourne, 3000. Telephone 663 3457.<br />

2. Tax Agent's Registration Board<br />

Students who complete the Associate<br />

Diploma <strong>of</strong> Business (Accounting),<br />

including the three taxation units, and who<br />

are eligible for membership <strong>of</strong> the NIA are<br />

academically qualified to apply for a Tax<br />

Agent's Licence. Applications must be made<br />

within three years <strong>of</strong> completing the tax<br />

units. Direct enquiries to The Tax Agents<br />

Registration Board <strong>of</strong> Victoria, 350 Little<br />

Collins Street, Melbourne, 3000. Telephone<br />

608 2882.<br />

Application Procedure<br />

New students are enrolled twice a year subject to<br />

funding. Enrolments are in February for semester<br />

one and July for semester two. Prospective<br />

students must complete an application form<br />

which is available from:-<br />

Centre for Business Studies and Information<br />

<strong>Technology</strong><br />

<strong>Swinburne</strong> <strong>University</strong> <strong>of</strong> <strong>Technology</strong> -<br />

TAFE Division<br />

Prahran Campus, 144 High Street, Prahran, 3181.<br />

Telephone: (03) 522 6828, Fax (03) 529 5294<br />

Applications best meeting the entrance criteria<br />

are <strong>of</strong>fered places in order <strong>of</strong> receipt. Written<br />

notification <strong>of</strong> a place is made no later than<br />

February, lor semester one, and July, for<br />

semester two. Notification <strong>of</strong> failure to gain a<br />

place is made alter these clates and when all<br />

places are filled. Applications close on 30<br />

November for semester one enrolment and on<br />

31 May for semester 2 enrolment. Late<br />

applications may be accepted depending on<br />

availability <strong>of</strong> places.<br />

Off Campus<br />

Students may be able to undertake all or part <strong>of</strong><br />

this course through the college Off-Campus<br />

Centre. Enquiries should be directed to the Off-<br />

Campus Centre, telephone 522 6798.<br />

Assessment Procedures<br />

To gain the award stutlents must:-<br />

* pass all required units by demonstrating<br />

achievement <strong>of</strong> the performance objectives<br />

as outlined in current syllabus<br />

documentation;<br />

attend 80% <strong>of</strong> class contact time.<br />

Exemption Applications<br />

Exemption from units may be granted to those<br />

who have passed equivalent subjects at other<br />

institutions. No exemption will be granted for<br />

MSC or VCE subjects where these are part <strong>of</strong> the<br />

entrance requirement. Application forms are<br />

available at enrolment time.<br />

English Language<br />

Units are conducted in English. Students with<br />

English as a Second Language require advanced<br />

level English. Generally students must have<br />

sufficient English language skills to understand<br />

instructions, read technical books and<br />

magazines, make oral presentations, and prepare<br />

written reports. Full-time students will be given<br />

opportunity for extra English tuition <strong>of</strong> up to 3<br />

hours per week.<br />

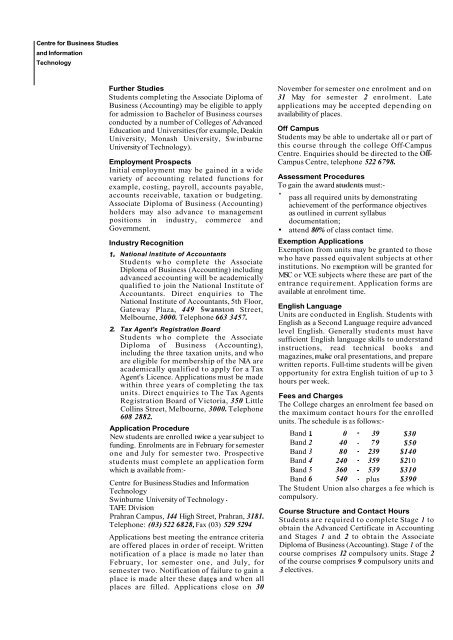

Fees and Charges<br />

The College charges an enrolment fee based on<br />

the maximum contact hours for the enrolled<br />

units. The schedule is as follows:-<br />

Band 1 0 - 39 $30<br />

Band 2 40 - 79 $50<br />

Band 3 80 - 239 $140<br />

Band 4 240 - 359 $2 10<br />

Band 5 360 - 539 $310<br />

Band 6 540 - plus $390<br />

The Student Union also charges a fee which is<br />

compulsory.<br />

Course Structure and Contact Hours<br />

Students are required to complete Stage 1 to<br />

obtain the Advanced Certificate in Accounting<br />

and Stages 1 and 2 to obtain the Associate<br />

Diploma <strong>of</strong> Business (Accounting). Stage 1 <strong>of</strong> the<br />

course comprises 12 compulsory units. Stage 2<br />

<strong>of</strong> the course comprises 9 compulsory units and<br />

3 electives.