force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

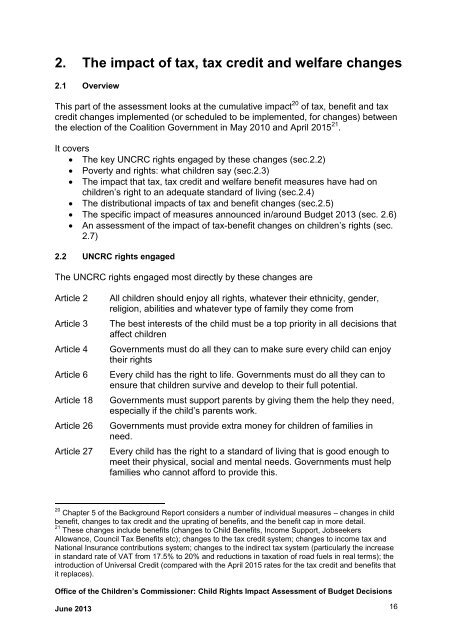

2. The impact <strong>of</strong> tax, tax credit and welfare changes<br />

2.1 Overview<br />

This part <strong>of</strong> the assessment looks at the cumulative impact 20 <strong>of</strong> tax, benefit and tax<br />

credit changes implemented (or scheduled to be implemented, for changes) between<br />

the election <strong>of</strong> the Coalition Government in May 2010 and April 2015 21 .<br />

It covers<br />

The key UNCRC rights engaged by these changes (sec.2.2)<br />

Poverty and rights: what children say (sec.2.3)<br />

The impact that tax, tax credit and welfare benefit measures have had on<br />

children’s right to an adequate standard <strong>of</strong> living (sec.2.4)<br />

The distributional impacts <strong>of</strong> tax and benefit changes (sec.2.5)<br />

The specific impact <strong>of</strong> measures announced in/around <strong>Budget</strong> 2013 (sec. 2.6)<br />

An assessment <strong>of</strong> the impact <strong>of</strong> tax-benefit changes on children’s rights (sec.<br />

2.7)<br />

2.2 UNCRC rights engaged<br />

The UNCRC rights engaged most directly by these changes are<br />

Article 2<br />

Article 3<br />

Article 4<br />

Article 6<br />

Article 18<br />

Article 26<br />

Article 27<br />

All children should enjoy all rights, whatever their ethnicity, gender,<br />

religion, abilities and whatever type <strong>of</strong> family they come from<br />

The best interests <strong>of</strong> the child must be a top priority in all decisions that<br />

affect children<br />

Governments must do all they can to make sure every child can enjoy<br />

their rights<br />

Every child has the right to life. Governments must do all they can to<br />

ensure that children survive and develop to their full potential.<br />

Governments must support parents by giving them the help they need,<br />

especially if the child’s parents work.<br />

Governments must provide extra money for children <strong>of</strong> families in<br />

need.<br />

Every child has the right to a standard <strong>of</strong> living that is good enough to<br />

meet their physical, social and mental needs. Governments must help<br />

families who cannot afford to provide this.<br />

20 Chapter 5 <strong>of</strong> the Background Report considers a number <strong>of</strong> individual measures – changes in child<br />

benefit, changes to tax credit and the uprating <strong>of</strong> benefits, and the benefit cap in more detail.<br />

21 These changes include benefits (changes to <strong>Child</strong> Benefits, Income Support, Jobseekers<br />

Allowance, Council Tax Benefits etc); changes to the tax credit system; changes to income tax and<br />

National Insurance contributions system; changes to the indirect tax system (particularly the increase<br />

in standard rate <strong>of</strong> VAT from 17.5% to 20% and reductions in taxation <strong>of</strong> road fuels in real terms); the<br />

introduction <strong>of</strong> Universal Credit (compared with the April 2015 rates for the tax credit and benefits that<br />

it replaces).<br />

Office <strong>of</strong> the <strong>Child</strong>ren’s Commissioner: <strong>Child</strong> <strong>Rights</strong> <strong>Impact</strong> <strong>Assessment</strong> <strong>of</strong> <strong>Budget</strong> <strong>Decisions</strong><br />

June 2013 16