force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

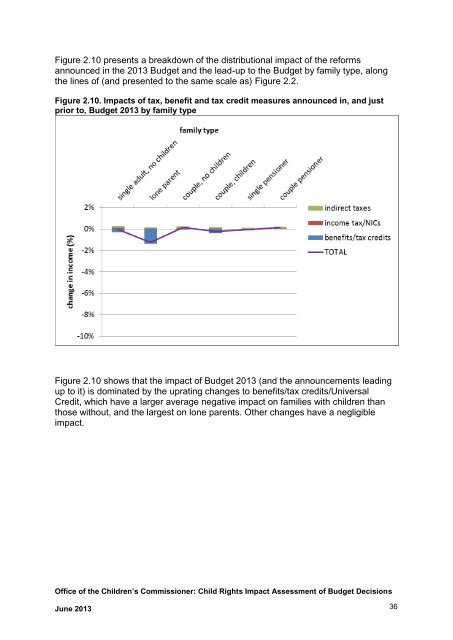

Figure 2.10 presents a breakdown <strong>of</strong> the distributional impact <strong>of</strong> the reforms<br />

announced in the 2013 <strong>Budget</strong> and the lead-up to the <strong>Budget</strong> by family type, along<br />

the lines <strong>of</strong> (and presented to the same scale as) Figure 2.2.<br />

Figure 2.10. <strong>Impact</strong>s <strong>of</strong> tax, benefit and tax credit measures announced in, and just<br />

prior to, <strong>Budget</strong> 2013 by family type<br />

Figure 2.10 shows that the impact <strong>of</strong> <strong>Budget</strong> 2013 (and the announcements leading<br />

up to it) is dominated by the uprating changes to benefits/tax credits/Universal<br />

Credit, which have a larger average negative impact on families with children than<br />

those without, and the largest on lone parents. Other changes have a negligible<br />

impact.<br />

Office <strong>of</strong> the <strong>Child</strong>ren’s Commissioner: <strong>Child</strong> <strong>Rights</strong> <strong>Impact</strong> <strong>Assessment</strong> <strong>of</strong> <strong>Budget</strong> <strong>Decisions</strong><br />

June 2013 36