force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

force_download.php?fp=/client_assets/cp/publication/676/A_Child_Rights_Impact_Assessment_of_Budget_Decisions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

change in income (£/week)<br />

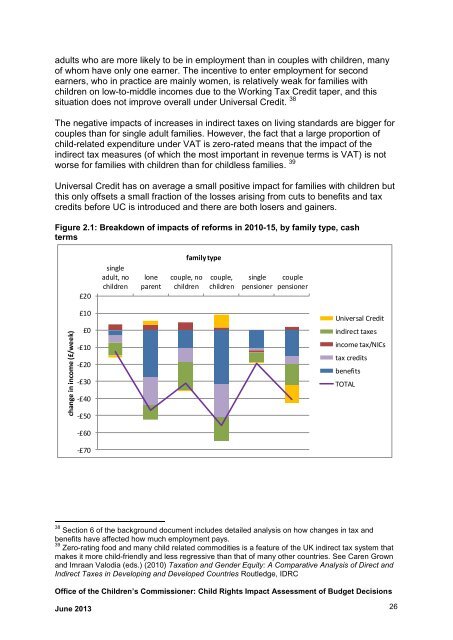

adults who are more likely to be in employment than in couples with children, many<br />

<strong>of</strong> whom have only one earner. The incentive to enter employment for second<br />

earners, who in practice are mainly women, is relatively weak for families with<br />

children on low-to-middle incomes due to the Working Tax Credit taper, and this<br />

situation does not improve overall under Universal Credit. 38<br />

The negative impacts <strong>of</strong> increases in indirect taxes on living standards are bigger for<br />

couples than for single adult families. However, the fact that a large proportion <strong>of</strong><br />

child-related expenditure under VAT is zero-rated means that the impact <strong>of</strong> the<br />

indirect tax measures (<strong>of</strong> which the most important in revenue terms is VAT) is not<br />

worse for families with children than for childless families. 39<br />

Universal Credit has on average a small positive impact for families with children but<br />

this only <strong>of</strong>fsets a small fraction <strong>of</strong> the losses arising from cuts to benefits and tax<br />

credits before UC is introduced and there are both losers and gainers.<br />

Figure 2.1: Breakdown <strong>of</strong> impacts <strong>of</strong> reforms in 2010-15, by family type, cash<br />

terms<br />

£20<br />

single<br />

adult, no<br />

children<br />

lone<br />

parent<br />

family type<br />

couple, no<br />

children<br />

couple,<br />

children<br />

single<br />

pensioner<br />

couple<br />

pensioner<br />

£10<br />

£0<br />

-£10<br />

-£20<br />

-£30<br />

-£40<br />

Universal Credit<br />

indirect taxes<br />

income tax/NICs<br />

tax credits<br />

benefits<br />

TOTAL<br />

-£50<br />

-£60<br />

-£70<br />

38 Section 6 <strong>of</strong> the background document includes detailed analysis on how changes in tax and<br />

benefits have affected how much employment pays.<br />

39 Zero-rating food and many child related commodities is a feature <strong>of</strong> the UK indirect tax system that<br />

makes it more child-friendly and less regressive than that <strong>of</strong> many other countries. See Caren Grown<br />

and Imraan Valodia (eds.) (2010) Taxation and Gender Equity: A Comparative Analysis <strong>of</strong> Direct and<br />

Indirect Taxes in Developing and Developed Countries Routledge, IDRC<br />

Office <strong>of</strong> the <strong>Child</strong>ren’s Commissioner: <strong>Child</strong> <strong>Rights</strong> <strong>Impact</strong> <strong>Assessment</strong> <strong>of</strong> <strong>Budget</strong> <strong>Decisions</strong><br />

June 2013 26