the neighborhoods of tustin town center: a new ... - City of Tustin

the neighborhoods of tustin town center: a new ... - City of Tustin

the neighborhoods of tustin town center: a new ... - City of Tustin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financing costs consist <strong>of</strong> such items as loan fees, interest during construction and<br />

leasing. Total financing costs are estimated at $677,000, or 10% <strong>of</strong> direct costs.<br />

Net Operating Income<br />

As shown on Table A-3, KMA has estimated that <strong>the</strong> proposed development scenario will<br />

generate net operating income (NOI) totaling $946,000 annually. The following assumptions<br />

were used in determining this figure:<br />

<br />

Gross scheduled income (GSI) <strong>of</strong> $1.2 million, or an average lease rate <strong>of</strong> $1.79 per SF<br />

per month.<br />

Overall vacancy factor <strong>of</strong> 5%.<br />

<br />

<br />

Unreimbursed retail operating expenses at 5% <strong>of</strong> retail GSI.<br />

Office expenses <strong>of</strong> $4 per SF per year.<br />

Residual Land Value<br />

As shown on Table A-4, after assuming <strong>the</strong> capitalized value <strong>of</strong> <strong>the</strong> NOI from <strong>the</strong> retail, and<br />

<strong>of</strong>fice space, this scenario generates a total project value <strong>of</strong> $12.6 million. After deducting a<br />

cost <strong>of</strong> sale (3% <strong>of</strong> value), developer pr<strong>of</strong>it (12% <strong>of</strong> value), and total development costs, KMA<br />

finds <strong>the</strong> proposed project generates a residual land value <strong>of</strong> $1.4 million, or $10 per SF <strong>of</strong><br />

site area.<br />

It should be noted that while Site 3 generates a positive residual land value, this does not<br />

assume <strong>the</strong> proposed project is feasible. The residual land value is generally <strong>the</strong> amount a<br />

developer can feasibly afford to pay for a site after considering <strong>the</strong> project’s value against<br />

development costs and developer pr<strong>of</strong>it. KMA’s analysis has not estimated costs associated<br />

with acquisition, demolition <strong>of</strong> existing improvements, and/or relocation <strong>of</strong> existing occupants.<br />

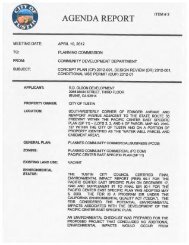

C. Sou<strong>the</strong>rn Gateway, Site 9 (Alternative B)<br />

Project Description<br />

As shown on Table B-1, Site 9 is comprised <strong>of</strong> three parcels totaling 3.9 acres. The<br />

development scenario assumes construction <strong>of</strong> a three-story <strong>of</strong>fice building at Newport and<br />

Walnut containing 34,000 SF <strong>of</strong> <strong>of</strong>fice and 12,000 SF <strong>of</strong> retail space on <strong>the</strong> ground floor.<br />

The scenario also includes a one-story 22,000-SF freestanding retail building, which allows<br />

potential for a grocery story, drug store, or medium-sized tenant. Retail and <strong>of</strong>fice parking is<br />

accommodated in a surface lot with a total <strong>of</strong> at least 266 parking spaces.<br />

A-32 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010