the neighborhoods of tustin town center: a new ... - City of Tustin

the neighborhoods of tustin town center: a new ... - City of Tustin

the neighborhoods of tustin town center: a new ... - City of Tustin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

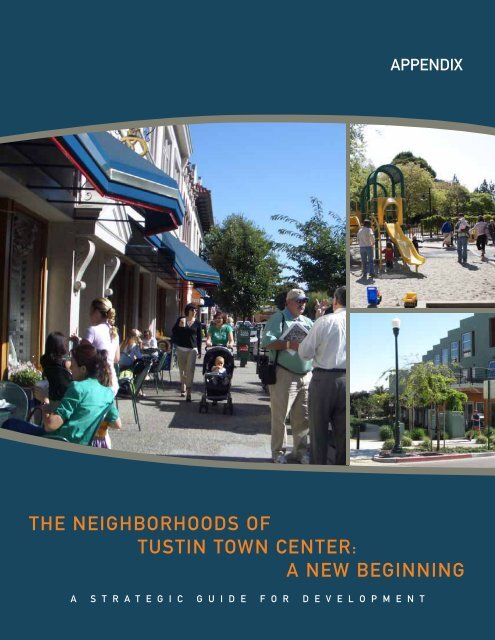

APPENDIX<br />

THE NEIGHBORHOODS OF<br />

TUSTIN TOWN CENTER:<br />

A NEW BEGINNING<br />

A S T R A T E G I C G U I D E F O R D E V E L O P M E N T

APPENDIX<br />

THE NEIGHBORHOODS OF<br />

TUSTIN TOWN CENTER:<br />

A NEW BEGINNING<br />

A S T R A T E G I C G U I D E F O R D E V E L O P M E N T<br />

PREPARED BY<br />

FIELD PAOLI<br />

WITH KEYSER MARSTON ASSOCIATES<br />

AND AUSTIN-FOUST ASSOCIATES<br />

PREPARED FOR<br />

THE CITY OF TUSTIN<br />

THE TUSTIN COMMUNITY REDEVELOPMENT AGENCY<br />

300 CENTENNIAL WAY<br />

TUSTIN, CA 92780<br />

STRATEGIC GUIDE - SEPTEMBER 21, 2010

Table <strong>of</strong> Contents<br />

APPENDIX<br />

A.1 Glossary <strong>of</strong> Terms<br />

A.2 Development Thresholds<br />

A.3 Traffic and Circulation Testing<br />

A.4 Financial Feasibility Analysis for Key Opportunity Sites<br />

A.5 Implementation Strategies Exhibits<br />

A.6 Public Workshops<br />

A.6.1 Workshop #1 Materials<br />

A 6.2 Workshop #1 Public Comments<br />

A 6.3 Workshop #2 Materials<br />

A 6.4 Workshop #2 Public Comments<br />

A.7 Workshop Attendees<br />

A-1<br />

A-3<br />

A-8<br />

A-28<br />

A-48<br />

A-62<br />

A-72<br />

A-77<br />

A-95<br />

A-106<br />

Additional resource documents associated with <strong>the</strong> Town Center New Beginnings Project,<br />

(including copies <strong>of</strong> community workshop materials, presentations on alternative concept plans,<br />

and <strong>the</strong> Refined Market Analysis) are available on-line at <strong>the</strong> <strong>City</strong> <strong>of</strong> <strong>Tustin</strong> web site (<strong>tustin</strong>ca.org),<br />

under Redevelopment, What’s New, and <strong>the</strong> Town Center New Beginnings project.<br />

STRATEGIC GUIDE 09.21.2010<br />

THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A NEW BEGINNING<br />

v

APPENDIX

A.1 Glossary <strong>of</strong> Terms<br />

MAJOR IMPROVEMENTS<br />

Change <strong>of</strong> Use:<br />

Consolidate:<br />

Infill:<br />

Intensify:<br />

Streetscape:<br />

Changing <strong>the</strong> land use, intensification <strong>of</strong> development for a parcel <strong>of</strong> land,<br />

or consolidation <strong>of</strong> parcels.<br />

A combination <strong>of</strong> two or more parcels consolidated across existing lot<br />

lines to form a larger parcel for development. Larger parcels are easier to<br />

develop and <strong>of</strong>ten more efficient in layout than smaller parcels.<br />

The location <strong>of</strong> <strong>new</strong> development within an area with existing<br />

development. Infill can include renovations, <strong>new</strong> development,<br />

intensification <strong>of</strong> development, consolidation <strong>of</strong> development, and/or <strong>new</strong><br />

uses on a parcel that is located in a built area. Infill can meet short range to<br />

long term objectives for revitalization.<br />

Major improvements at a site that increases <strong>the</strong> scale and density <strong>of</strong><br />

development. Intensified development can include an increased number <strong>of</strong><br />

dwellings, increased building heights, replacement or alteration <strong>of</strong> single<br />

family buildings to accommodate multiple dwelling units, and/or a mix <strong>of</strong><br />

different uses.<br />

A combination <strong>of</strong> planting, amenities such as benches, pavement, and<br />

special visual treatments, which can occur on both sides <strong>of</strong> streets and<br />

within medians for <strong>the</strong> purposes <strong>of</strong> aes<strong>the</strong>tics and/or shade. Streetscape<br />

usually does not include <strong>the</strong> travel lanes <strong>of</strong> a street, but can include bicycle<br />

lanes, on-street parking, and crosswalks.<br />

MINOR IMPROVEMENTS<br />

Upgrade/Renovate: Upgrades are short- to mid-term objectives, whereas renovations are<br />

longer term. Upgrades improve existing building systems, structures<br />

and private landscaping to a higher standard for minor and moderate<br />

improvements. Renovations replace old materials with <strong>new</strong> ones, preferably<br />

with long lasting and environmental friendly materials (e.g. recycled and<br />

sustainable materials)<br />

USE DEFINITIONS<br />

Institutional:<br />

Mixed-Use:<br />

Public Use:<br />

A designation <strong>of</strong> land use for private uses such as churches and religious<br />

purposes, clinics, health facilities, hospitals, and non-pr<strong>of</strong>it activities.<br />

A site that contains buildings with two or more types <strong>of</strong> land uses (not<br />

counting parking), even if segregated in separate buildings.<br />

Any use operated by a governmental agency or school district that<br />

provides direct services to <strong>the</strong> public, such as governmental <strong>of</strong>fices, fire<br />

stations, police stations, schools, and libraries.<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-1<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

Neighborhood Retail Center:<br />

A Neighborhood Retail Center is typically anchored by a grocery store or<br />

a drug store. Some <strong>of</strong> <strong>the</strong> smaller neighborhood <strong>center</strong>s may not have<br />

an anchor tenant and are comprised <strong>of</strong> shops. Tenants could include a<br />

c<strong>of</strong>fee house, a nail salon, locally-owned businesses and restaurants. A<br />

neighborhood <strong>center</strong> generally ranges in size from 30,000 to 100,000<br />

square feet, surface parked, adjacent to a heavily traveled roadway, and<br />

located on three to ten acres. These <strong>center</strong>s serve populations ranging<br />

from 3,000 to 40,000 and provide convenience due to <strong>the</strong> proximity to <strong>the</strong>ir<br />

customer base.<br />

Anchor Store:<br />

A large store, such as a grocery store or department store, that is<br />

prominently located in a shopping <strong>center</strong> to attract customers who are <strong>the</strong>n<br />

expected to patronize <strong>the</strong> o<strong>the</strong>r shops in <strong>the</strong> <strong>center</strong>.<br />

Amenity Open Space:<br />

An open space that is privately owned and maintained as part <strong>of</strong> a<br />

development but is accessible to <strong>the</strong> public . Certain restrictions, such as<br />

public access times, rules, types <strong>of</strong> allowed activities, may apply.<br />

ABBREVIATIONS AND DEFINITIONS<br />

Gross Scheduled Income (GSI):<br />

The total rental and o<strong>the</strong>r income generated by a project before vacancy and operating<br />

expenses are deducted.<br />

Net Operating Income (NOI):<br />

The gross scheduled income generated by a project<br />

after deducting vacancy and operating expenses but before paying debt service.<br />

Area Median Income (AMI):<br />

The midpoint <strong>of</strong> income distribution within a specific geographic area, whereas, 50% <strong>of</strong><br />

households earn less than <strong>the</strong> median income and 50% earn more. The U.S. Department<br />

<strong>of</strong> Housing and Urban Development (HUD) calculates AMI levels for different communities<br />

annually, with adjustments for family size.<br />

Level <strong>of</strong> Service (LOS):<br />

The transportation LOS system uses <strong>the</strong> letters A through F, with A being best and F being<br />

worst. The Highway Capacity Manual and AASHTO Geometric Design <strong>of</strong> Highways and Streets<br />

(“Green Book”) list <strong>the</strong> following levels <strong>of</strong> service:<br />

LOS Traffic Flow<br />

A= Free flow<br />

B=Reasonably free flow<br />

C=Stable flow<br />

D=Approaching unstable flow<br />

E=Unstable flow<br />

F=Forced or breakdown flow<br />

LOS At-Grade Intersections (Average Vehicle<br />

Control Delay)<br />

Signalized Intersection Unsignalized Intersection<br />

A ≤10 sec ≤10 sec<br />

B 10-20 sec 10-15 sec<br />

C 20-35 sec 15-25 sec<br />

D 35-55 sec 25-35 sec<br />

E 55-80 sec 35-50 sec<br />

F ≥80 sec ≥50 sec<br />

A-2 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

A.2 Development Thresholds<br />

CENTER CITY POTENTIAL NEW DEVELOPMENT THRESHOLDS<br />

Existing Conditions vs. a Comparison <strong>of</strong> Alternatives<br />

Site Use Existing<br />

1<br />

2<br />

3<br />

4<br />

5<br />

Summary <strong>of</strong><br />

Opportunity<br />

Sites<br />

Summary <strong>of</strong><br />

O<strong>the</strong>r<br />

Locations in<br />

<strong>the</strong><br />

Neighborhood<br />

TOTAL<br />

Center <strong>City</strong><br />

Lot Size/Acres<br />

or Sq. Ft.<br />

DU/FAR<br />

Concept Plan<br />

Lot Size/Acres or<br />

Sq. Ft.<br />

Difference<br />

Residential Units 1 - - - 126 TBD 126<br />

Commercial Office (SF) 1 - - - 67,000 TBD 67,000<br />

Industrial Area (SF) 251,520 357,105 - - (251,500)<br />

Commercial Total (SF) 251,520 357,105 0.7 67,000 TBD<br />

Residential Units - - - 380 380<br />

Commercial Retail (SF) 119,373 399,969 - 160,000 473,529 40,600<br />

Commercial Hotel (SF) 16,321 32,290 - - - (16,300)<br />

Commercial Office (SF) 16,587 15,995 - 16,600 15,995 -<br />

Industrial Area (SF) 20,000 41,270 - - - (20,000)<br />

Commercial Total (SF) 172,281 489,524 0.4 176,600 489,524 24,300<br />

Commercial Retail (SF) 13,081 138,695 - 41,800 138,695 28,700<br />

Commercial Total (SF) 13,081 138,695 0.1 41,800 138,695 28,700<br />

Commercial Retail (SF) 19,201 83,922 - 19,200 83,922 -<br />

Commercial Total (SF) 19,201 83,922 0.2 19,200 83,922 -<br />

Commercial Retail (SF) 68,051 407,352 - 74,100 407,352 6,000<br />

Commercial Hotel (SF) 21,230 52,708 21,200 52,708 -<br />

Commercial Total (SF) 89,281 460,060 0.2 95,300 460,060 6,000<br />

Residential Units - 506 506<br />

Commercial Retail (SF) 219,706 295,100 75,300<br />

Commercial Office (SF) 16,587 83,600 67,000<br />

Commercial Hotel (SF) 37,551 21,200 (16,300)<br />

Industrial Area (SF) 271,520 - (271,500)<br />

Commercial Total (SF) 545,364 1,529,306 0.4 399,900 1,172,201 (145,500)<br />

Residential Units 763 1,113 - 350<br />

Commercial Retail (SF) 139,111 150,000 - 10,900<br />

Commercial Office (SF) 55,624 90,000 - 34,400<br />

Commercial Total (SF) 194,735 649,437 0.3 240,000 649,437 45,300<br />

Residential Units 763 1,619 856<br />

Commercial Retail (SF) 2 358,817 445,100 86,300<br />

Commercial Office (SF) 72,211 173,600 101,400<br />

Commercial Hotel (SF) 37,551 21,200 (16,400)<br />

Industrial Area (SF) 271,520 - (271,500)<br />

Commercial Total (SF) 740,099 2,178,743 0.3 639,900 1,821,638 (100,200)<br />

1 Originally Austin-Foust Associates, Inc. conducted traffic testing on two Concept Alternatives that proposed ei<strong>the</strong>r all residential development<br />

(Alternative A) or all <strong>of</strong>fice development (Alternative B) on Opportunity Site #1. The recommended plan would permit ei<strong>the</strong>r mixed use, a<br />

combination <strong>of</strong> residential and <strong>of</strong>fice development, or all residential use (287 units). Pursuant to <strong>the</strong> <strong>City</strong>'s Housing Element, adopted June 16, 2009,<br />

<strong>the</strong> site may be required to have a minimum <strong>of</strong> 126 dwelling units in <strong>the</strong> event <strong>the</strong> <strong>City</strong> is not able to meet State-defined objectives. Factoring in a<br />

minimum <strong>of</strong> 126 dwelling units, a maximum <strong>of</strong> 67,000 square feet <strong>of</strong> Office Space can be built and still be within <strong>the</strong> traffic testing results conducted<br />

by Austin-Foust.<br />

2 Commercial Retail includes Service Commercial uses as well.<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-3<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

SOUTHERN GATEWAY POTENTIAL NEW DEVELOPMENT THRESHOLDS<br />

Existing Conditions vs. a Comparison <strong>of</strong> Alternatives<br />

Key Sites Use Existing<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

Summary <strong>of</strong><br />

Opportunity<br />

Sites<br />

Summary <strong>of</strong><br />

O<strong>the</strong>r<br />

Locations in<br />

<strong>the</strong><br />

Neighborhood<br />

TOTAL<br />

Sou<strong>the</strong>rn Gateway<br />

Lot Size/Acres or<br />

Sq. Ft.<br />

DU/FAR<br />

Concept Plan<br />

Lot Size/Acres<br />

or Sq. Ft.<br />

Difference<br />

Residential Units (DU) 13 1.43 9 175 3.49 162<br />

Commercial Retail (SF) 1 28,747 75,827 - - - (28,700)<br />

Commercial Total (SF) 28,747 75,827 0.4 - - (28,700)<br />

Residential Units (DU) - - - 23 - 23<br />

Commercial Retail (SF) 10,076 55,914 - 15,000 55,914 4,900<br />

Commercial Total (SF) 10,076 55,914 0.2 15,000 55,914 4,900<br />

Commercial Retail (SF) 26,726 112,514 - 23,600 - (3,100)<br />

Commercial Office (SF) - - - 23,600 112,514 23,600<br />

Commercial Total (SF) 26,726 112,514 0.2 47,200 112,514 20,500<br />

Commercial Retail (SF) 41,140 170,319 - 34,300 - (6,800)<br />

Commercial Office (SF) - - - 34,300 170,319 34,300<br />

Commercial Total (SF) 41,140 170,319 0.2 68,600 170,319 27,500<br />

Residential Units (DU) 164 7.20 23 186 7.20 22<br />

Public/Youth Center (SF) - - - 12,000 104,544 6,000<br />

Commercial Total (SF) - - - - - -<br />

Commercial Retail (SF) 4,528 21,780 - 36,100 103,136 31,600<br />

Public/Youth Center (SF) 6,008 23,086 - - - -<br />

Commercial Total (SF) 4,528 21,780 0.2 36,100 103,136 31,600<br />

Residential Units (DU) 177 384 207<br />

Commercial Retail (SF) 111,217 109,000 (2,100)<br />

Commercial Office (SF) - 57,900 57,900<br />

Public/Youth Center (SF) 6,008 12,000 6,000<br />

Commercial Total (SF) 111,217 436,354 0.3 166,900 441,883 55,800<br />

Residential Units (DU) 1,854 2,209 355<br />

Commercial Retail (SF) 106,194 130,000 - 23,800<br />

Commercial Office (SF) 75,000 215,000 - 140,000<br />

Commercial Total (SF) 181,194 820,703 0.2 345,000 762,433 163,800<br />

Residential Units (DU) 2,031 2,593 562<br />

Commercial Retail (SF) 2 217,411 239,000 21,600<br />

Commercial Office (SF) 75,000 272,900 197,900<br />

Public/Youth Center (SF) 6,008 12,000 6,000<br />

Commercial Total (SF) 292,411 1,257,057 0.2 511,900 1,204,316 219,500<br />

1 75,827 is <strong>the</strong> combined square footage <strong>of</strong> parcels: 402-371-35; 402-371-37; and 402-371-38. 28,747 square feet <strong>of</strong> existing is<br />

an estimate, based on a total <strong>of</strong> 32,263 sq. ft. less 3,516 sq. ft. Carl's Jr.<br />

2 Commercial Retail includes Service Commercial uses as well.<br />

A-4 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

WEST VILLAGE POTENTIAL NEW DEVELOPMENT THRESHOLDS<br />

Existing Conditions vs. a Comparison <strong>of</strong> Alternatives<br />

Key Sites Use Existing<br />

West Village<br />

Lot Size/Acres<br />

or Sq. Ft.<br />

DU/FAR<br />

Concept Plan<br />

Lot Size/Acres<br />

or Sq. Ft.<br />

Difference<br />

Residential Units (DU) - - - 210 210<br />

12 Commercial Retail (SF) 42,890 176,694 - 50,000 262,026 7,100<br />

Commercial Total (SF) 42,890 176,694 0.2 50,000 262,026 7,100<br />

13<br />

Commercial Retail (SF) 5,431 37,640 - 15,100 37,640 9,700<br />

Commercial Total (SF) 5,431 37,640 0.1 15,100 37,640 9,700<br />

14 Residential Units (DU) 44 1.71 26 24 0.95 (20)<br />

15 Residential Units (DU) 4 0.29 14 - - (4)<br />

Residential Units (DU) 1 164 18.35 9 240 18.35 76<br />

16 Commercial Retail (SF) - - - 6,000 24,000 6,000<br />

Commercial Total (SF) - - - 6,000 24,000 6,000<br />

17 Residential Units (DU) 1 188 18.43 10 276 18.43 88<br />

Summary <strong>of</strong><br />

Opportunity<br />

Sites<br />

Residential Units (DU) 400 751 351<br />

Commercial Retail (SF) 48,321 71,100 22,800<br />

Commercial Total (SF) 48,321 214,334 71,100 323,666 22,800<br />

Summary <strong>of</strong><br />

O<strong>the</strong>r Residential Units (DU) 2,396 2,396 0<br />

Locations in<br />

<strong>the</strong><br />

Commercial Retail (SF) 20,627 20,600 0<br />

Neighborhood Commercial Total (SF) 20,627 97,906 0.2 20,600 97,906 0<br />

Residential Units (DU) 2,796 3,147 351<br />

TOTAL Commercial Retail (SF) 2 68,948 91,700 22,800<br />

Commercial Total (SF) 68,948 312,240 0.2 91,700 421,572 22,800<br />

1 The number <strong>of</strong> units was calculated by multiplying (dwelling units/acre) x (75% <strong>of</strong> <strong>the</strong> total acreage), recognizing<br />

redevelopment will necessitate development <strong>of</strong> internal streets and parks on each site.<br />

2 Commercial Retail includes Service Commercial uses as well.<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-5<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

TOWN CENTER NEW BEGINNINGS CONCEPT ALTERNATIVES POTENTIAL NEW DEVELOPMENT THRESHOLDS<br />

Existing Conditions vs a Comparison <strong>of</strong> Alternatives<br />

Center <strong>City</strong><br />

Sou<strong>the</strong>rn<br />

Gateway<br />

West<br />

Village<br />

Neighborhood<br />

Key Opportunity Sites<br />

O<strong>the</strong>r Opportunities<br />

TOTAL<br />

Key Opportunity Sites<br />

O<strong>the</strong>r Opportunities<br />

TOTAL<br />

Key Opportunity Sites<br />

O<strong>the</strong>r Opportunities<br />

TOTAL<br />

TOTAL<br />

Key Opportunity Sites<br />

O<strong>the</strong>r Opportunities<br />

Use<br />

Existing<br />

Conditions<br />

Alternative A<br />

Changes Over<br />

Existing (+/-)<br />

Alternative B<br />

Changes Over<br />

Existing (+/-)<br />

KMA<br />

Absorption-<br />

Low 2008-<br />

2030<br />

KMA<br />

Absorption-<br />

High 2008-<br />

2030<br />

Residential (DU) 0 506 506 376 376<br />

Commercial Retail (SF) 219,706 295,100 75,300 234,200 14,400<br />

Commercial Office (SF) 16,587 83,600 67,000 755,000 738,400<br />

Commercial Hotel (SF) 37,551 21,200 (16,300) 0 (37,500)<br />

Industrial (SF) 271,520 0 (271,500) 0 (271,500)<br />

Residential (DU) 763 1,113 350 1,238 475<br />

Commercial Retail (SF) 139,111 150,000 10,900 155,000 15,900<br />

Commercial Office (SF) 55,624 90,000 34,400 105,000 49,400<br />

Residential (DU) 763 1,619 856 1,614 851<br />

Commercial Retail (SF) 358,817 445,100 86,300 389,200 30,400<br />

Commercial Office (SF) 72,211 173,600 101,400 860,000 787,800<br />

Commercial Hotel (SF) 37,551 21,200 (16,400) 0 (37,600)<br />

Industrial (SF) 271,520 0 (271,500) 0 (271,500)<br />

Commercial Total (SF) 740,099 639,900 (100,200) 1,249,200 509,100<br />

Residential (DU) (Alt A) 127 378 251<br />

Residential (DU) (Alt B) 177 384 207<br />

Commercial Retail (SF) 111,217 79,700 (31,400) 109,000 (2,100)<br />

Commercial Office (SF) 0 23,600 23,600 57,900 57,900<br />

Public/Youth Center (SF) 6,008 11,700 5,700 12,000 6,000<br />

Residential (DU) (Alt A) 1,904 2,170 266 2,259 355<br />

Residential (DU) (Alt B) 1,854 2,120 266 2,209 355<br />

Commercial Retail (SF) 106,194 125,000 18,800 130,000 23,800<br />

Commercial Office (SF) 75,000 200,000 125,000 215,000 140,000<br />

Residential (DU) (Alt B) 2,031 2,548 517 2,637 606<br />

Residential (DU) (Alt B) 2,031 2,504 473 2,593 562<br />

Commercial Retail (SF) 217,411 204,700 (12,700) 239,000 21,600<br />

Commercial Office (SF) 75,000 223,600 148,600 272,900 197,900<br />

Public/Youth Center (SF) 6,008 11,700 5,700 12,000 6,000<br />

Commercial Total (SF) 298,419 440,000 135,900 523,900 219,500<br />

Residential (DU) 400 524 124 751 351<br />

Commercial Retail (SF) 48,321 56,000 7,700 71,100 22,800<br />

Residential (DU) 2,396 2,396 0 2,396 0<br />

Commercial Retail (SF) 20,627 20,600 0 20,600 0<br />

Residential (DU) 2,796 2,920 124 3,147 351<br />

Commercial Retail (SF) 68,948 76,600 7,700 91,700 22,800<br />

Commercial Total (SF) 68,948 76,600 7,700 91,700 22,800<br />

Residential (DU) (Alt A) 527 1,408 881 1,127 600<br />

Residential (DU) (Alt B) 577 1,030 453 1,511 934<br />

Commercial Retail (SF) 379,244 430,800 51,600 414,300 35,056<br />

Commercial Office (SF) 16,587 107,200 90,600 812,900 796,313<br />

Commercial Hotel (SF) 37,551 21,200 (16,400) 0 (37,551)<br />

Public/Youth Center (SF) 6,008 11,700 5,700 12,000 5,992<br />

Industrial (SF) 271,520 0 (271,500) 0 (271,520)<br />

Commercial Total (SF) 704,902 559,200 (145,700) 1,227,200 522,298<br />

Residential (DU) (Alt A) 5,063 5,679 616 5,893 830<br />

Residential (DU) (Alt B) 5,013 5,629 616 5,843 830<br />

Commercial Retail (SF) 265,932 295,600 29,700 305,600 39,700<br />

Commercial Office (SF) 130,624 290,000 159,400 320,000 189,400<br />

Commercial Total (SF) 396,556 585,600 189,000 625,600 229,000<br />

Residential (DU) (Alt A) 5,590 7,087 1,497 7,398 1,808<br />

Residential (DU) (Alt B) 5,590 7,043 1,453 7,354 1,764<br />

761 1,141<br />

Commercial Retail (SF) 1 645,176 726,400 81,200 719,900 74,700 26,400 66,000<br />

Commercial Office (SF) 147,211 397,200 250,000 1,132,900 985,700 352,000 704,000<br />

Commercial Hotel (SF) 37,551 21,200 (16,300) 0 (37,500)<br />

Public/Youth Center (SF) 6,008 11,700 5,700 12,000 6,000<br />

Industrial (SF) 271,520 0 (271,500) 0 (271,500)<br />

Commercial Total (SF) 1,101,458 1,144,800 43,300 1,852,800 751,300<br />

1 Commercial Retail includes Service Commercial uses as well.<br />

A-6 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

OPPORTUNITY SITES - COMPARISON OF DEVELOPMENT ASSUMPTIONS<br />

FPA Neighborhood Concept<br />

Plans<br />

<strong>City</strong> Chart <strong>of</strong> Development<br />

Thresholds<br />

Protypical Testing (FPA) and<br />

Financial Feasibility Analysis<br />

(KMA)<br />

Center <strong>City</strong> - Opportunity Site 3<br />

Alternative A<br />

Comm. Retail (sf) No change/ Upgrade Existing 41,800 41,800<br />

FAR 0.3 0.3<br />

Residential<br />

DU/ac<br />

Alternative B<br />

Comm. Retail (sf) 25,000 20,000<br />

Comm. Office (sf) 45,000 40,000<br />

Total Commercial Office/ Retail (sf) 98,400 70,000 60,000<br />

FAR 0.8* 0.5 0.4<br />

Residential (DU)<br />

DU/ac<br />

Sou<strong>the</strong>rn Gateway - Opportunity Site 9<br />

Alternative A<br />

Comm. Retail (sf) No change/ Upgrade Existing 41,100 41,000<br />

FAR 0.2 0.2<br />

Residential<br />

DU/ac<br />

Alternative B<br />

Comm. Retail (sf) 34,300 34,000<br />

Comm. Office (sf) 34,300 34,000<br />

Total Commercial Office/ Retail (sf) 68,500 68,600 68,000<br />

FAR 0.4 0.4 0.4<br />

Residential (DU)<br />

DU/ac<br />

West Village - Opportunity Site 12<br />

Alternative A<br />

Comm. Retail (sf) No change/ Upgrade Existing 42,900 42,900<br />

FAR 0.2 0.2<br />

Residential<br />

DU/ac<br />

Alternative B<br />

Comm. Retail (sf) 30,000 50,000 41,000<br />

Comm. Office (sf)<br />

Total Commercial Office/ Retail (sf) 30,000 50,000 41,000<br />

FAR 0.3 0.2 0.2<br />

Residential (DU) 168 210 40<br />

DU/ac 37 TBD 7<br />

Note: Different site size FPA vs. <strong>City</strong><br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-7<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

A.3 Traffic and Circulation Testing<br />

This report presents a preliminary traffic evaluation <strong>of</strong> potential <strong>new</strong> development in three<br />

neighborhood study areas in <strong>the</strong> <strong>City</strong> <strong>of</strong> <strong>Tustin</strong> referred to as Center <strong>City</strong>, Sou<strong>the</strong>rn Gateway and<br />

West Village (see Figures 1 through 3). The traffic evaluation includes a preliminary qualitative<br />

analysis <strong>of</strong> <strong>the</strong> implications <strong>of</strong> two land use alternatives (Alternatives A and B) with changes<br />

in roadway circulation in select neighborhood areas and <strong>the</strong> potential impacts under existing<br />

conditions. The three defined neighborhood areas are evaluated separately. It should be noted<br />

that while <strong>the</strong>re are two land use alternatives in each neighborhood area <strong>of</strong> <strong>the</strong> <strong>Tustin</strong> Town Center,<br />

a number <strong>of</strong> combinations <strong>of</strong> alternatives both land use and circulation (i.e., Neighborhood Plan)<br />

could actually be paired that would affect <strong>the</strong> final development plan.<br />

ANALYSIS SCOPE<br />

The land use and trip generation for each neighborhood area will first be summarized along<br />

with information on any changes in circulation associated with <strong>the</strong> land use alternatives for each<br />

neighborhood. Next, available existing count data (average daily traffic (ADT) volumes and<br />

peak hour intersection capacity utilization (ICU) values) taken from various sources for <strong>the</strong> key<br />

roadways and intersections evaluated will be presented. Lastly, <strong>the</strong> potential traffic impacts will<br />

be discussed on <strong>the</strong> circulation system under existing conditions with potential hot spots/critical<br />

locations identified that would require fur<strong>the</strong>r and more detailed analysis at a later date.<br />

Hot spot locations can be identified in three ways in this report. First, hot spot locations are those<br />

locations that are likely impacted due to <strong>the</strong> project as defined by significance criteria and carried<br />

out in a quantitative analysis. Second, in addition to a more detailed analysis at a later date that<br />

would involve <strong>the</strong> use <strong>of</strong> <strong>the</strong> ICU methodology to determine project impact, certain areas will<br />

require a special traffic operations analysis. Those areas are designated as “Traffic Operations<br />

Hot Spots” and are locations where <strong>the</strong> standard ICU procedure does not fully depict <strong>the</strong> actual<br />

traffic characteristics. It should be noted that <strong>the</strong> ICU method <strong>of</strong> calculating <strong>the</strong> volume-tocapacity<br />

ratio <strong>of</strong> an intersection assumes isolated intersections and does not reflect any queuing<br />

<strong>of</strong> vehicles that may occur between intersections <strong>of</strong> close proximity. An example <strong>of</strong> this close<br />

proximity effect occurs on Newport Avenue and Red Hill Avenue at <strong>the</strong> I-5 interchange and <strong>the</strong><br />

adjacent intersections. Because <strong>of</strong> <strong>the</strong> closely spaced intersections, actual traffic conditions tend<br />

to be somewhat congested during peak periods even though <strong>the</strong> ICU values indicate adequate<br />

levels <strong>of</strong> service. Locations considered “hot spots” can also be sections <strong>of</strong> roadway where closely<br />

spaced intersections or side friction caused by numerous driveways degrade <strong>the</strong> performance<br />

<strong>of</strong> <strong>the</strong> roadway compared to its <strong>the</strong>oretical carrying capacity (referred to as Operations Hot<br />

Spot). Third, “hot spots” can be intersections or sections <strong>of</strong> roadway that cannot be improved<br />

to <strong>the</strong>ir full standard because <strong>of</strong> limited space due to right-<strong>of</strong>-way or o<strong>the</strong>r physical constraints<br />

(referred to as Space Constrained Hot Spot). Space constrained hot spots can reach a V/C <strong>of</strong><br />

1.00 (ra<strong>the</strong>r than a threshold <strong>of</strong> .90) in recognition <strong>of</strong> <strong>the</strong> limitations involved in making physical<br />

improvements.<br />

In <strong>the</strong> future with a more detailed study, a set <strong>of</strong> performance criteria will be utilized to identify<br />

future level <strong>of</strong> service deficiencies on <strong>the</strong> study area circulation system and also to define impacts<br />

and peak hour ICU values <strong>of</strong> significance. Traffic LOS is designated “A” through “F” with LOS<br />

“A” representing free flow conditions and LOS “F” representing severe traffic congestion. The<br />

intersection criteria involve <strong>the</strong> use <strong>of</strong> peak hour ICU values. The ICU ranges that correspond to<br />

LOS “A” through “F” are presented in Table 1. By practice, <strong>the</strong> ICU methodology assumes that<br />

intersections are signalized. LOS “D” (ICU not to exceed .90) is <strong>the</strong> performance standard for <strong>the</strong><br />

intersections in <strong>the</strong> <strong>City</strong> <strong>of</strong> <strong>Tustin</strong>.<br />

A-8 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

Table 1<br />

LEVEL OF SERVICE DESCRIPTIONS – SIGNALIZED INTERSECTIONS<br />

Levels <strong>of</strong> service (LOS) for signalized intersections are defined in terms <strong>of</strong> ei<strong>the</strong>r average control delay<br />

that is measured in seconds (HCM methodology) or intersection capacity utilization (ICU) values as follows:<br />

Average<br />

LOS Description Delay (sec) 1 ICU 2<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

LOS “A” describes operations with low control delay, up to 10 seconds per<br />

vehicle. This LOS occurs when progression is extremely favorable and<br />

most vehicles arrive during <strong>the</strong> green phase. Many vehicles do not stop at<br />

all. Short cycle lengths may tend to contribute to low delay values.<br />

LOS “B” describes operations with control delay greater than 10 and up to<br />

20 seconds per vehicle. This level generally occurs with good progression,<br />

short cycle lengths, or both. More vehicles stop than <strong>the</strong> LOS “A,” causing<br />

higher levels <strong>of</strong> delay.<br />

LOS “C” describes operations with control delay greater than 20 and up to<br />

35 seconds per vehicle. These higher delays may result from only fair<br />

progression, longer cycle lengths, or both. Individual cycle failures may<br />

begin to appear at this level. Cycle failure occurs when a given green phase<br />

does not serve queued vehicles, and overflows occur. The number <strong>of</strong><br />

vehicles stopping is significant at this level, though many still pass through<br />

<strong>the</strong> intersection without stopping.<br />

LOS “D” describes operations with control delay greater than 35 and up to<br />

55 seconds per vehicle. At LOS “D,” <strong>the</strong> influence <strong>of</strong> congestion becomes<br />

more noticeable. Longer delays may result from some combination <strong>of</strong><br />

unfavorable progression, long cycle lengths, and high V/C ratios. Many<br />

vehicles stop, and <strong>the</strong> proportion <strong>of</strong> vehicles not stopping declines.<br />

Individual cycle failures are noticeable.<br />

LOS “E” describes operations with control delay greater than 55 and up to<br />

80 seconds per vehicle. These high delay values generally indicate poor<br />

progression, long cycle lengths, and high V/C ratios. Individual cycle<br />

failures are frequent.<br />

LOS “F” describes operations with control delay in excess <strong>of</strong> 80 seconds<br />

per vehicle. This level, considered unacceptable to most drivers, <strong>of</strong>ten<br />

occurs with oversaturation, that is, when arrival flow rates exceed <strong>the</strong><br />

capacity <strong>of</strong> lane groups. It may also occur at high V/C ratios with many<br />

individual cycle failures. Poor progression and long cycle lengths may also<br />

contribute significantly to high delay levels.<br />

10.0 .60<br />

10.1 – 20.0 .61 - .70<br />

20.1 – 35.0 .71 - .80<br />

35.1 – 55.0 .81 - .90<br />

55.1 – 80.0 .91 – 1.00<br />

> 80.0 > 1.00<br />

1 Source: Highway Capacity Manual 2000 (HCM 2000), Transportation Research Board, National Research Council.<br />

2 Source: Orange County Congestion Management Program (CMP).<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-9<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

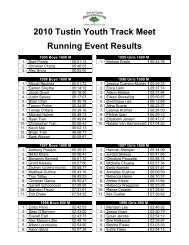

LAND USE AND TRIP GENERATION<br />

The land uses and trip generation for each neighborhood area and alternatives illustrated in<br />

Figures 4 through 9 are summarized in Tables 2 through 4. The highest Alternative A increase<br />

over existing, by approximately 35%, occurs in Center <strong>City</strong> whereas Sou<strong>the</strong>rn Gateway and<br />

West Village proposed land use changes increase around 20% and 5%, respectively. The trips<br />

generated by <strong>the</strong> land uses assumed in Alternative A for any neighborhood area indicate that<br />

it is less intense than Alternative B by as much as 15% on a daily basis as in <strong>the</strong> case in Center<br />

<strong>City</strong>. Alternative B can be intense by as much as 51% compared to existing and 29% and 15% in<br />

Sou<strong>the</strong>rn Gateway and West Village, respectively. There are three neighborhood areas (Center<br />

<strong>City</strong>, Sou<strong>the</strong>rn Gateway, and West Village) each with two circulation plans that are referred to in this<br />

report as Neighborhood Plans (Alternatives A and B) and two land use alternatives (Alternatives<br />

A and B). The traffic evaluation carried out here for worse-case evaluation purposes uses <strong>the</strong> land<br />

use alternative with <strong>the</strong> highest trip generation (Alternative B) for each Neighborhood Plan under<br />

existing conditions in each <strong>of</strong> <strong>the</strong> Neighborhood Areas. However, it is likely <strong>the</strong> final development<br />

plan for <strong>Tustin</strong> Town Center will be a combination <strong>of</strong> circulation (such as Neighborhood Plan) and<br />

land use alternatives for each Neighborhood Area presented in Figures 4 through 9 and Tables<br />

2 through 4.<br />

EXISTING CONDITIONS<br />

Figure 10 presents <strong>the</strong> circulation system within <strong>the</strong> study area. The existing ADT volumes<br />

are illustrated in Figure 11 and <strong>the</strong> select key intersections evaluated are shown in Figure 12.<br />

Drivers are more likely to perceive traffic problem at intersections ra<strong>the</strong>r than roadway segments,<br />

<strong>the</strong>refore <strong>the</strong> performance <strong>of</strong> intersections using peak hour data is <strong>the</strong> main emphasis <strong>of</strong> <strong>the</strong><br />

evaluation given here. The ICU values for <strong>the</strong>se intersections are summarized in Table 5. As can<br />

be seen here, all intersections are operating better than <strong>the</strong> acceptable level <strong>of</strong> service “D” (ICU<br />

= .90) with LOS “C” or better (ICU = .80 or below). The worst performing intersection with a PM<br />

peak hour ICU <strong>of</strong> .71 under existing conditions is Pasadena Avenue at McFadden Avenue.<br />

Future conditions that are not analyzed here but could affect travel patterns include <strong>the</strong> extension<br />

<strong>of</strong> Newport Avenue from just south <strong>of</strong> Sycamore Avenue to Edinger Avenue which will particularly<br />

affect traffic on Newport Avenue in <strong>the</strong> Sou<strong>the</strong>rn Gateway. To what extent will be <strong>the</strong> subject <strong>of</strong><br />

fur<strong>the</strong>r study at a later date.<br />

A-10 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

CENTER CITY TRAFFIC EVALUATION<br />

For <strong>the</strong> Center <strong>City</strong> Neighborhood Area, a traffic evaluation was carried out for <strong>the</strong> two<br />

Neighborhood Plans (Alternatives A and B) on existing conditions assuming <strong>the</strong> vacation <strong>of</strong> El<br />

Camino Way south <strong>of</strong> El Camino Real. The intensity <strong>of</strong> land use Alternative A for Center <strong>City</strong><br />

is only 32% in <strong>the</strong> AM peak hour and Alternative B slightly more than doubles in <strong>the</strong> AM peak<br />

hour compared to existing. The doubling <strong>of</strong> trips will likely trigger significant impacts to <strong>the</strong><br />

intersections analyzed in this area even though <strong>the</strong>y are currently operating at most LOS “B.”<br />

Any land use combination selected will likely cause adverse traffic operation hot spots in <strong>the</strong><br />

area if <strong>the</strong> trip generation is higher than land use Alternative A. In addition, <strong>the</strong>re are operational<br />

issues that will need to be addressed by both land use alternatives which are discussed in <strong>the</strong><br />

next paragraph regarding operations hot spots.<br />

The potential operations hot spots that will occur in ei<strong>the</strong>r land use Alternative A or B in <strong>the</strong><br />

Center <strong>City</strong> Neighborhood are <strong>the</strong> I-5 interchange ramps and El Camino Real intersections<br />

along Newport Avenue and Red Hill Avenue. With a high level <strong>of</strong> service <strong>of</strong> LOS “B” at <strong>the</strong><br />

intersection El Camino Real and Newport Avenue <strong>the</strong>re are no capacity issues expected in <strong>the</strong><br />

neighborhood assuming LOS “D” as being acceptable. However, <strong>the</strong>re are potential operational<br />

issues at intersections that could occur during <strong>the</strong> peak hour. The movement most affected by<br />

project traffic is <strong>the</strong> left-turn at Newport Avenue and Red Hill Avenue going away from <strong>the</strong> I-5<br />

Freeway at <strong>the</strong> intersection with El Camino Real. Currently a challenge today due to <strong>the</strong> closely<br />

spaced intersections, <strong>the</strong> left- turn lane on Newport Avenue to El Camino Real currently cannot<br />

accommodate <strong>the</strong> existing left-turn volume <strong>of</strong> 247 vehicles in <strong>the</strong> PM peak hour with a pocket<br />

<strong>of</strong> approximately 125 feet. To properly store <strong>the</strong> left-turning vehicles without impeding through<br />

traffic, a pocket length <strong>of</strong> 250 feet is required to accommodate <strong>the</strong> volume which cannot be<br />

CITY CENTER NEIGHBORHOOD - EXISTING<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-11<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

CITY CENTER NEIGHBORHOOD - ALTERNATIVE A<br />

CITY CENTER NEIGHBORHOOD - ALTERNATIVE B<br />

A-12 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

Table 2<br />

TUSTIN TOWN CENTER – CENTER CITY LAND USE AND TRIP GENERATION SUMMARY<br />

AM Peak Hour<br />

PM Peak Hour<br />

Land Use Amount/Unit In Out Total In Out Total ADT<br />

Trip Rates<br />

1. Residential (ITE 8th 220) DU .10 .41 .51 .40 .22 .62 6.65<br />

2. Retail (ITE 8th 820) TSF .61 .39 1.00 1.83 1.90 3.73 42.94<br />

3. Office (ITE 8th 710) TSF 1.36 .19 1.55 .25 1.24 1.49 11.01<br />

4. Motel (ITE 8th 320) Room .16 .29 .45 .25 .22 .47 5.63<br />

6. Industrial (ITE 8th 110) TSF .81 .11 .92 .12 .85 .97 6.97<br />

Existing<br />

1. Residential (ITE 8th 220) 763 DU 76 313 389 305 168 473 5,074<br />

2. Retail (ITE 8th 820) 358.82 TSF 219 140 359 657 682 1,339 15,408<br />

3. Office (ITE 8th 710) 72.21 TSF 98 14 112 18 90 108 795<br />

4. Motel (ITE 8th 320) 230 Room 37 67 104 58 51 109 1,295<br />

6. Industrial (ITE 8th 110) 271.52 TSF 220 30 250 33 231 264 1,892<br />

TOTAL 650 564 1,214 1,071 1,222 2,293 24,464<br />

Alternative A<br />

1. Residential (ITE 8th 220) 1,780 DU 178 730 908 712 392 1,104 11,837<br />

2. Retail (ITE 8th 820) 445.1 TSF 272 174 446 815 846 1,661 19,113<br />

3. Office (ITE 8th 710) 106.6 TSF 145 20 165 27 132 159 1,174<br />

4. Motel (ITE 8th 320) 177 Room 28 51 79 44 39 83 997<br />

TOTAL 623 975 1,598 1,598 1,409 3,007 33,121<br />

Changes over existing -27 411 384 527 187 714 8,657<br />

% changes over existing -4.2% 72.9% 31.6% 49.2% 15.3% 31.1% 35.4%<br />

Alternative B<br />

1. Residential (ITE 8th 220) 1,614 DU 161 662 823 646 355 1,001 10,733<br />

2. Retail (ITE 8th 820) 389.2 TSF 237 152 389 712 739 1,451 16,712<br />

3. Office (ITE 8th 710) 860 TSF 1,170 163 1,333 215 1,066 1,281 9,469<br />

TOTAL 1,568 977 2,545 1,573 2,160 3,733 36,914<br />

Changes over existing 918 413 1,331 502 938 1,440 12,450<br />

% changes over existing 141.2% 73.2% 109.6% 46.9% 76.8% 62.8% 50.9%<br />

Abbreviations:<br />

ADT – average daily trips<br />

DU – dwelling unit<br />

ITE – Institute <strong>of</strong> Transportation Engineers Trip Generation Manual – Eighth Edition (2008)<br />

achieved because <strong>of</strong> <strong>the</strong> close proximity to <strong>the</strong> I-5 northbound on-ramp. The same movement<br />

on Red Hill Avenue at El Camino Real presents more <strong>of</strong> a challenge even with two left-turn lanes<br />

because <strong>of</strong> <strong>the</strong> signals at <strong>the</strong> I-5 northbound ramp intersection that are approximately 130 feet<br />

away. Although no data is available to make a definite determination, <strong>the</strong> <strong>of</strong>fice in Alternative<br />

B will likely create a hot spot at El Camino Real/Sixth Street intersection with a potential need<br />

to improve/provide northbound left on El Camino Real and eastbound right on Sixth Street.<br />

Should <strong>of</strong>fice be desirable <strong>the</strong> intensity <strong>of</strong> o<strong>the</strong>r land uses in <strong>the</strong> area would need to be reduced<br />

accordingly so that overall trip generation is less than Alternative A.<br />

A proposed vacation <strong>of</strong> El Camino Way is identified under Neighborhood Plan Alternatives A and<br />

B. The vacation would not be an issue provided <strong>the</strong> current access is not completely eliminated<br />

and is relocated and o<strong>the</strong>r access driveways are built and/or modified.<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-13<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

SOUTHERN GATEWAY TRAFFIC EVALUATION<br />

In Sou<strong>the</strong>rn Gateway, On an average daily trip basis <strong>the</strong> intensity <strong>of</strong> land uses over existing<br />

for land use Alternative B increases by as much as 29% with more residential, retail and <strong>of</strong>fice<br />

uses and 20% for land use Alternative A with additional residential and <strong>of</strong>fice uses. The ADT<br />

generated by land use Alternatives A and B, 28,464 and 30,786, are not that different and would<br />

result in moderate increases in traffic <strong>the</strong>refore <strong>the</strong> focus <strong>of</strong> <strong>the</strong> evaluation here will be on <strong>the</strong><br />

circulation alternative (i.e., Neighborhood Plan Alternative A or B). Any land use combination<br />

selected will not likely cause adverse impacts provided <strong>the</strong> trip generation are not higher than<br />

land use Alternative B.<br />

With <strong>the</strong> absence <strong>of</strong> data, no definite determination can be made but it is likely that <strong>the</strong> change<br />

<strong>of</strong> retail to residential (even if mixed-use) in <strong>the</strong> nor<strong>the</strong>rnmost portion <strong>of</strong> Neighborhood Plan<br />

Alternative A will impact Newport Avenue at Mitchell Avenue intersection and Newport Avenue<br />

at <strong>the</strong> I-5 southbound <strong>of</strong>f-ramp intersection particularly during <strong>the</strong> PM peak hour which today has<br />

a high right-turning volume from <strong>the</strong> freeway ramp. Additional trips from both Center <strong>City</strong> and<br />

Sou<strong>the</strong>rn Gateway will be contributing to this ramp intersection.<br />

Neighborhood Plan Alternative A in <strong>the</strong> sou<strong>the</strong>rnmost portion <strong>of</strong> Sou<strong>the</strong>rn Gateway includes a<br />

proposal to ei<strong>the</strong>r cul-de-sac or partially close <strong>the</strong> sou<strong>the</strong>rn portion <strong>of</strong> Pasadena Avenue where<br />

it currently connects to <strong>the</strong> Sycamore Avenue ramp to <strong>the</strong> SR-55 Freeway, and <strong>the</strong> potential<br />

vacation <strong>of</strong> Bliss Lane and Altadena Drive west <strong>of</strong> Pasadena Avenue. The potential vacation <strong>of</strong><br />

Bliss Lane and western portion <strong>of</strong> Altadena Drive in <strong>the</strong> event that lot consolidation is possible<br />

will pose no significant traffic impacts as <strong>the</strong>se are local serving roadways. In addition, <strong>the</strong><br />

effect <strong>of</strong> potentially severing <strong>the</strong> connection <strong>of</strong> Pasadena Avenue to Sycamore Avenue would<br />

SOUTHERN GATEWAY NEIGHBORHOOD - EXISTING<br />

A-14 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

SOUTHERN GATEWAY NEIGHBORHOOD - ALTERNATIVE A<br />

SOUTHERN GATEWAY NEIGHBORHOOD - ALTERNATIVE B<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-15<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

add additional traffic at <strong>the</strong> intersections <strong>of</strong> Newport Avenue at Walnut Avenue and Walnut<br />

Avenue at McFadden Avenue but no capacity issues are expected since <strong>the</strong> current LOS at <strong>the</strong>se<br />

intersections is “A.” It is likely that with Alternative A and an increase <strong>of</strong> around 20% daily trips in<br />

<strong>the</strong> area due to <strong>the</strong> land use changes as well as closure <strong>of</strong> Pasadena Avenue to Sycamore Avenue<br />

that <strong>the</strong> intersection with <strong>the</strong> highest existing LOS (LOS “C”), Pasadena Avenue at McFadden<br />

Avenue, may experience higher LOS due to additional through traffic along McFadden Avenue.<br />

The addition <strong>of</strong> residential units and increase in traffic along Newport Avenue due to increased<br />

land use intensity and <strong>the</strong> closure <strong>of</strong> Pasadena Avenue may trigger <strong>the</strong> need for signals at <strong>the</strong><br />

current Myrtle Avenue/Newport Avenue intersection. However, Altadena Drive and Myrtle Drive<br />

within <strong>the</strong> Sou<strong>the</strong>rn Gateway are internal and narrow neighborhood streets that are expected to<br />

be slow speed and <strong>the</strong>refore would not be conducive to through traffic.<br />

Neighborhood Plan Alternative B includes a proposal to potentially add a <strong>new</strong> east-west<br />

street between Pasadena Avenue and Newport Avenue north <strong>of</strong> Altadena Drive and <strong>the</strong><br />

potential vacation <strong>of</strong> Altadena Drive, Bliss Lane, Pasadena Avenue south <strong>of</strong> Altadena Drive,<br />

and Myrtle Avenue south <strong>of</strong> <strong>the</strong> <strong>new</strong> street if lot consolidations occur. There are currently no<br />

capacity issues with <strong>the</strong> highest level <strong>of</strong> service <strong>of</strong> LOS “C” in <strong>the</strong> PM peak hour at Pasadena<br />

Avenue and McFadden Avenue intersection. The same concerns/issues that were discussed in<br />

Neighborhood Plan Alternative A apply for Alternative B. Instead <strong>of</strong> signals needed at Newport<br />

Avenue and Myrtle Avenue, which is vacated in Alternative B, <strong>the</strong> signals could be warranted at<br />

<strong>the</strong> <strong>new</strong> potential east-west road at Newport Avenue. However, a more direct connection such as<br />

provided by <strong>the</strong> <strong>new</strong> east-west road from Pasadena Avenue to Newport Avenue could potentially<br />

attract through traffic in <strong>the</strong> neighborhood especially by vehicles that are from to/from <strong>the</strong> SR-<br />

55 northbound ramps at Sycamore Avenue or sou<strong>the</strong>rn parts <strong>of</strong> <strong>Tustin</strong> if <strong>the</strong> sou<strong>the</strong>rn portion <strong>of</strong><br />

Pasadena Avenue was potentially closed or vacated.<br />

No significant traffic impacts are expected with <strong>the</strong> proposed location <strong>of</strong> <strong>the</strong> youth <strong>center</strong> in both<br />

Neighborhood Plan Alternatives A and B except for <strong>the</strong> possibility <strong>of</strong> a <strong>new</strong> signal which may be<br />

warranted at <strong>the</strong> <strong>new</strong> intersection <strong>of</strong> Newport Avenue at Myrtle Avenue (Alternative A) or <strong>the</strong><br />

<strong>new</strong> east-west road (Alternative B). In addition, if under ei<strong>the</strong>r alternative <strong>the</strong> proposed vacation<br />

<strong>of</strong> Pasadena Avenue to Sycamore Avenue is pursued by <strong>the</strong> <strong>City</strong>, <strong>the</strong> <strong>City</strong> will need to work with<br />

Caltrans to provide proper signage in order to inform drivers <strong>of</strong> <strong>the</strong> <strong>new</strong> route to/from <strong>the</strong> SR-55<br />

northbound ramps.<br />

A-16 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

Table 3<br />

TUSTIN TOWN CENTER – SOUTHERN GATEWAY LAND USE AND TRIP GENERATION SUMMARY<br />

AM Peak Hour<br />

PM Peak Hour<br />

Land Use Amount/Unit In Out Total In Out Total ADT<br />

Trip Rates<br />

1. Residential (ITE 8th 220) DU .10 .41 .51 .40 .22 .62 6.65<br />

2. Retail (ITE 8th 820) TSF .61 .39 1.00 1.83 1.90 3.73 42.94<br />

3. Office (ITE 8th 710) TSF 1.36 .19 1.55 .25 1.24 1.49 11.01<br />

5. Public/Youth Ctr (ITE 8th 495) TSF .99 .63 1.62 .54 .91 1.45 22.88<br />

Existing<br />

1. Residential (ITE 8th 220) 2,031 DU 203 833 1,036 812 447 1,259 13,506<br />

2. Retail (ITE 8th 820) 217.41 TSF 133 85 218 398 413 811 9,336<br />

3. Office (ITE 8th 710) 75 TSF 102 14 116 19 93 112 826<br />

5. Public/Youth Ctr (ITE 8th 495) 6.01 TSF 6 4 10 3 5 8 137<br />

TOTAL 444 936 1,380 1,232 958 2,190 23,805<br />

Alternative A<br />

1. Residential (ITE 8th 220) 2,548 DU 255 1,045 1,300 1,019 561 1,580 16,944<br />

2. Retail (ITE 8th 820) 204.7 TSF 125 80 205 375 389 764 8,790<br />

3. Office (ITE 8th 710) 223.6 TSF 304 42 346 56 277 333 2,462<br />

5. Public/Youth Ctr (ITE 8th 495) 11.7 TSF 12 7 19 6 11 17 268<br />

TOTAL 696 1,174 1,870 1,456 1,238 2,694 28,464<br />

Changes over existing 252 238 490 224 280 504 4,659<br />

% changes over existing 56.8% 25.4% 35.5% 18.2% 29.2% 23.0% 19.6%<br />

Alternative B<br />

1. Residential (ITE 8th 220) 2,593 DU 259 1,063 1,322 1,037 570 1,607 17,243<br />

2. Retail (ITE 8th 820) 239 TSF 146 93 239 437 454 891 10,263<br />

3. Office (ITE 8th 710) 272.9 TSF 371 52 423 68 338 406 3,005<br />

5. Public/Youth Ctr (ITE 8th 495) 12 TSF 12 8 20 6 11 17 275<br />

TOTAL 788 1,216 2,004 1,548 1,373 2,921 30,786<br />

Changes over existing 344 280 624 316 415 731 6,981<br />

% changes over existing 77.5% 29.9% 45.2% 25.6% 43.3% 33.4% 29.3%<br />

Abbreviations:<br />

ADT – average daily trips<br />

DU – dwelling unit<br />

ITE – Institute <strong>of</strong> Transportation Engineers Trip Generation Manual – Eighth Edition (2008)<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-17<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

WEST VILLAGE TRAFFIC EVALUATION<br />

A traffic evaluation was carried out for <strong>the</strong> two Neighborhood Plans (Alternatives A and B) on<br />

existing conditions for West Village. Neighborhood Plan Alternative A assumes <strong>the</strong> existing<br />

circulation system and Neighborhood Plan Alternative B includes a proposal to extend <strong>Tustin</strong><br />

Village Way through a current private street to a <strong>new</strong> east-west street between Williams Street and<br />

<strong>Tustin</strong> Village Way running parallel to Alliance Avenue. Similar to <strong>the</strong> o<strong>the</strong>r <strong>neighborhoods</strong>, <strong>the</strong>re<br />

are currently no capacity issues (i.e., intersection is not expected to be higher than <strong>the</strong> acceptable<br />

level <strong>of</strong> service <strong>of</strong> LOS “D”) with <strong>the</strong> highest level <strong>of</strong> service <strong>of</strong> LOS “B” at <strong>Tustin</strong> Village Way<br />

and McFadden Avenue intersection. Also out <strong>of</strong> <strong>the</strong> three <strong>neighborhoods</strong> proposed for changes,<br />

West Village has <strong>the</strong> least intense proposal with an increase in intensity <strong>of</strong> 15% in ADT assuming<br />

<strong>the</strong> higher trip generating land use Alternative B with slight increases <strong>of</strong> retail and residential<br />

compared to existing. The increase in ADT <strong>of</strong> 1,153 for Alternative A and 3,312 for Alternative B<br />

would add a low amount <strong>of</strong> traffic in <strong>the</strong> neighborhood area that could likely be accommodated<br />

by <strong>the</strong> existing circulation or Neighborhood Plan Alternative B circulation changes. Any land<br />

use/circulation combination not generating more trips than land use Alternative B will likely have<br />

no adverse impacts.<br />

No capacity issues are expected in both Neighborhood Plan alternatives, especially with <strong>the</strong><br />

addition <strong>of</strong> an east-west road parallel to Alliance Avenue. A likely benefit for <strong>the</strong> area under<br />

Neighborhood Plan Alternative B is less local traffic using Williams Street due to <strong>the</strong> <strong>new</strong> eastwest<br />

road that would provide a route to <strong>Tustin</strong> Village Way that runs parallel to Williams Street.<br />

WEST VILLAGE NEIGHBORHOOD - EXISTING<br />

A-18 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

WEST VILLAGE NEIGHBORHOOD - ALTERNATIVE A<br />

WEST VILLAGE NEIGHBORHOOD - ALTERNATIVE B<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-19<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

Never<strong>the</strong>less, a potential hot spot that may need to be improved would likely be at <strong>the</strong> intersection<br />

<strong>of</strong> <strong>Tustin</strong> Village Way and McFadden Avenue because <strong>of</strong> additional traffic that is expected from<br />

<strong>the</strong> proposed land uses <strong>of</strong> ei<strong>the</strong>r alternative as well as changes to Sou<strong>the</strong>rn Gateway and <strong>the</strong><br />

proximity to <strong>the</strong> SR-55 Bridge.<br />

CONCLUSIONS<br />

Table 4<br />

TUSTIN TOWN CENTER – WEST VILLAGE LAND USE AND TRIP GENERATION SUMMARY<br />

AM Peak Hour<br />

PM Peak Hour<br />

Land Use Amount/Unit In Out Total In Out Total ADT<br />

Trip Rates<br />

1. Residential (ITE 8th 220) DU .10 .41 .51 .40 .22 .62 6.65<br />

2. Retail (ITE 8th 820) TSF .61 .39 1.00 1.83 1.90 3.73 42.94<br />

Existing<br />

1. Residential (ITE 8th 220) 2,796 DU 280 1,146 1,426 1,118 615 1,733 18,593<br />

2. Retail (ITE 8th 820) 68.95 TSF 42 27 69 126 131 257 2,961<br />

TOTAL 322 1,173 1,495 1,244 746 1,990 21,554<br />

Alternative A<br />

1. Residential (ITE 8th 220) 2,920 DU 292 1,197 1,489 1,168 642 1,810 19,418<br />

2. Retail (ITE 8th 820) 76.6 TSF 47 30 77 140 146 286 3,289<br />

TOTAL 339 1,227 1,566 1,308 788 2,096 22,707<br />

Changes over existing 17 54 71 64 42 106 1,153<br />

% changes over existing 5.3% 4.6% 4.7% 5.1% 5.6% 5.3% 5.3%<br />

Alternative B<br />

1. Residential (ITE 8th 220) 3,147 DU 315 1,290 1,605 1,259 692 1,951 20,928<br />

2. Retail (ITE 8th 820) 91.7 TSF 56 36 92 168 174 342 3,938<br />

TOTAL 371 1,326 1,697 1,427 866 2,293 24,866<br />

Changes over existing 49 153 202 183 120 303 3,312<br />

% changes over existing 15.2% 13.0% 13.5% 14.7% 16.1% 15.2% 15.4%<br />

Abbreviations:<br />

ADT – average daily trips<br />

DU – dwelling unit<br />

ITE – Institute <strong>of</strong> Transportation Engineers Trip Generation Manual – Eighth Edition (2008)<br />

With <strong>the</strong> exception <strong>of</strong> <strong>the</strong> highly intense land use Alternative B in Center <strong>City</strong>, any combination<br />

<strong>of</strong> <strong>the</strong> proposed <strong>Tustin</strong> Town Center land uses and circulation (i.e., Neighborhood Plans) are not<br />

expected to have any significant traffic impacts in <strong>the</strong> immediate surrounding area provided<br />

<strong>the</strong> resulting trip generation is not higher than presented in each Neighborhood Area (land use<br />

Alternative A in Center <strong>City</strong>, and land use Alternative B in Sou<strong>the</strong>rn Gateway and West Village).<br />

However, <strong>the</strong> following are potential hot spots mainly dealing with operational issues at certain<br />

intersections that would need to be monitored and addressed (i.e., lane or signal operation<br />

improvements, if possible) as each neighborhood plan is developed:<br />

A-20 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

Center <strong>City</strong><br />

Newport Avenue at El Camino Real, I-5 Northbound Ramps and I-5 Southbound Ramps – Physical<br />

constraints due to <strong>the</strong> close proximity <strong>of</strong> <strong>the</strong> I-5 northbound on-ramp would limit improvements<br />

needed to accommodate additional traffic on <strong>the</strong> northbound left turn on Newport Avenue (e.g.<br />

a second northbound left-turn on Newport Avenue at El Camino Real).<br />

Red Hill Avenue at El Camino Real, I-5 Northbound Ramps and I-5 Southbound Ramps – Physical<br />

constraints due to <strong>the</strong> close proximity <strong>of</strong> <strong>the</strong> I-5 northbound on-ramp intersection would limit<br />

improvements needed to accommodate additional traffic on Red Hill Avenue (e.g. longer pocket<br />

for <strong>the</strong> dual northbound left-turn lanes on Red Hill Avenue).<br />

El Camino Real and Sixth Street – Office use in Alternative B will likely cause a need to improve<br />

El Camino Real at Sixth Street (e.g. provide a separate northbound left-turn on El Camino Real<br />

or separate eastbound left-turn on Sixth Street or change signals at intersection to allow north/<br />

south and east/west split phase).<br />

Sou<strong>the</strong>rn Gateway<br />

Newport Avenue at Mitchell Avenue and I-5 Southbound Ramps – The change <strong>of</strong> retail to<br />

residential (even if mixed-use) in <strong>the</strong> nor<strong>the</strong>rnmost portion <strong>of</strong> Neighborhood Plan Alternative A<br />

will add traffic that has different a directionality in <strong>the</strong> peak hours. The I-5 southbound <strong>of</strong>f-ramp<br />

in particular will be affected in <strong>the</strong> PM peak hour, with homebound residential trips adding to an<br />

already high right-turning volume from <strong>the</strong> freeway ramp. Additional trips from both Center <strong>City</strong><br />

and Sou<strong>the</strong>rn Gateway will be contributing to this ramp intersection.<br />

McFadden Avenue at Pasadena Avenue, Myrtle Avenue, Newport Avenue – Additional traffic<br />

that is rerouted due to closure/vacation <strong>of</strong> Pasadena Avenue at Sycamore Avenue in both<br />

Neighborhood Plan alternatives could require lane/signal operation improvements or addition<br />

<strong>of</strong> signals in <strong>the</strong> case <strong>of</strong> Myrtle Avenue and McFadden Avenue intersection.<br />

Newport Avenue at Myrtle Avenue – This is likely to meet signal warrants due to closure <strong>of</strong> Pasadena<br />

Avenue at Sycamore Avenue, additional land uses and lot consolidation in Neighborhood Plan<br />

Alternative A.<br />

Newport Avenue at New East-West Road – This is likely to meet signal warrants due to <strong>the</strong><br />

closure <strong>of</strong> Pasadena Avenue at Sycamore Avenue, additional land uses and lot consolidation in<br />

Neighborhood Plan Alternative B.<br />

West Village<br />

<strong>Tustin</strong> Village Way and McFadden Avenue – This may need to be improved due to additional<br />

traffic from West Village and Sou<strong>the</strong>rn Gateway and close proximity to <strong>the</strong> SR-55 Bridge.<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-21<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

TUSTIN TOWN CENTER CIRCULATION SYSTEM<br />

EXISTING ADT VOLUMES<br />

A-22 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

INTERSECTION LOCATION MAP<br />

EXISTING INTERSECTION LOS SUMMARY<br />

AM Peak Hour PM Peak Hour Date or<br />

Intersection (N/S Rd at E/W Rd) ICU LOS ICU LOS Source<br />

1. El Camino Real & Newport .67 B .61 B 10/1/09<br />

2. Newport & I-5 NB Ramps .44 A .49 A IBC<br />

3. Newport & I-5 SB Ramps .48 A .62 B IBC<br />

4. Red Hill & El Camino Real .54 A .56 A 6/10/09<br />

5. Red Hill & I-5 NB Ramps .60 A .55 A 6/14, 6/15/05<br />

6. Red Hill & I-5 SB Ramps .62 B .59 A IBC<br />

7. Pasadena & McFadden .61 B .71 C 9/13,9/14/06<br />

8. Walnut & McFadden .41 A .38 A 2005<br />

9. Newport & McFadden .64 B .39 A 5/8/07<br />

10. Newport & Walnut .58 A .59 A 4/4/06<br />

11. Newport & Sycamore .48 A .46 A 1/24/07<br />

12. <strong>Tustin</strong> Village & McFadden .62 B .60 A 2005<br />

13. Williams & McFadden .51 A .54 A 2005<br />

14. Williams & Main .44 A .41 A 12/10, 12/9/09<br />

Level <strong>of</strong> service ranges: .00 - .60 A<br />

.61 - .70 B<br />

.71 - .80 C<br />

.81 - .90 D<br />

.91 – 1.00 E<br />

Above 1.00 F<br />

Abbreviations: IBC – Irvine Business Complex Vision Plan Traffic Study, 2009<br />

ICU – intersection capacity utilization<br />

LOS – level <strong>of</strong> service<br />

NB – northbound<br />

N/S Rd at E/W Rd – North/South Road at East/West Road<br />

SB – southbound<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-23<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

1. El Camino Real & Newport (10/1/09) 2. Newport & I-5 NB Ramps (IBC)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 1 1700 311 .18* 242 .14* NBL 1 1700 220 .13* 309 .18* <br />

NBT 2 3400 213 .09 349 .15 NBT 3 5100 1014 .20 1514 .30 <br />

NBR 0 0 100 157 NBR 0 0 0 0 <br />

<br />

SBL 1 1700 12 .01 45 .03 SBL 0 0 0 0 <br />

SBT 1 1700 86 .05* 161 .09* SBT 3 5100 1343 .26* 1002 .20* <br />

SBR 1 1700 241 .14 237 .14 SBR 1 1700 411 .24 434 .26 <br />

<br />

EBL 1 1700 156 .09* 247 .15* EBL 0 0 0 0 <br />

EBT 3 5100 598 .15 990 .23 EBT 0 0 0 0 <br />

EBR 0 0 181 198 EBR 0 0 0 0 <br />

<br />

WBL 1 1700 74 .04 143 .08 WBL 0 0 0 0 <br />

WBT 3 5100 1412 .28* 906 .18* WBT 0 0 0 0 <br />

WBR 0 0 18 28 WBR 0 0 0 0 <br />

<br />

Right Turn Adjustment SBR .02* Right Turn Adjustment SBR .06* <br />

Clearance Interval .05* .05* Clearance Interval .05* .05* <br />

<br />

TOTAL CAPACITY UTILIZATION .67 .61 TOTAL CAPACITY UTILIZATION .44 .49<br />

3. Newport & I-5 SB Ramps (IBC) 4. Red Hill & El Camino Real (6/10/09)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 0 0 0 0 NBL 2 3400 260 .08* 330 .10* <br />

NBT 3 5100 860 .17* 1191 .23* NBT 3 5100 632 .12 1223 .24 <br />

NBR 1 1700 63 .04 61 .04 NBR 1 1700 164 .10 288 .17 <br />

<br />

SBL 1 1700 176 .10* 223 .13* SBL 1 1700 15 .01 18 .01 <br />

SBT 3 5100 1094 .21 861 .17 SBT 3 5100 1066 .22* 734 .16* <br />

SBR 0 0 0 0 SBR 0 0 69 94 <br />

<br />

EBL 1.5 369 415 EBL 1 1700 37 .02 78 .05 <br />

EBT 0.5 3400 77 .13* 54 .14* EBT 1 1700 68 .04* 201 .12* <br />

EBR 1 1700 326 .19 531 .31 EBR 1 1700 145 .09 207 .12 <br />

<br />

WBL 1 1700 29 .02* 67 .04* WBL 1 1700 252 .15* 221 .13* <br />

WBT 0 0 0 0 WBT 1 1700 144 .09 279 .18 <br />

WBR 1 1700 110 .06 183 .11 WBR 0 0 14 29 <br />

<br />

Right Turn Adjustment EBR .01* EBR .03* Clearance Interval .05* .05* <br />

Clearance Interval .05* .05* <br />

TOTAL CAPACITY UTILIZATION .54 .56<br />

TOTAL CAPACITY UTILIZATION .48 .62<br />

26 <strong>Tustin</strong> Town Center 1180.001 2/10<br />

A-24 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

5. Red Hill & I-5 NB Ramps (6/14 & 6/15/05) 6. Red Hill & I-5 SB Ramps (IBC)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 1 1700 287 .17* 309 .18* NBL 0 0 0 0 <br />

NBT 3 5100 956 .19 1629 .32 NBT 3 5100 1055 .21* 1111 .22* <br />

NBR 0 0 0 0 NBR 1 1700 591 .35 441 .26 <br />

<br />

SBL 0 0 0 0 SBL 2 3400 403 .12* 298 .09* <br />

SBT 3 5100 1334 .26* 892 .17* SBT 3 5100 1201 .24 746 .15 <br />

SBR 1 1700 423 .25 259 .15 SBR 0 0 0 0 <br />

<br />

EBL 0 0 0 0 EBL 1 1700 226 .13* 386 .23* <br />

EBT 0 0 0 0 EBT 0 0 0 0 <br />

EBR 0 0 0 0 EBR 1 1700 457 .27 325 .19 <br />

<br />

WBL 1 1700 203 .12* 250 .15* WBL 0 0 0 0 <br />

WBT 1 1700 2 .00 15 .01 WBT 0 0 0 0 <br />

WBR 1 1700 239 .14 245 .14 WBR 0 0 0 0 <br />

<br />

Clearance Interval .05* .05* Right Turn Adjustment Multi .11* <br />

Clearance Interval .05* .05* <br />

TOTAL CAPACITY UTILIZATION .60 .55 <br />

TOTAL CAPACITY UTILIZATION .62 .59<br />

7. Pasadena & McFadden (9/13 & 9/14/06) 8. Walnut & McFadden (2005)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 1.5 296 {.09}* 254 {.09}* NBL 2 3400 340 .10* 430 .13* <br />

NBT 0.5 3400 20 .09 44 .09 NBT 0 0 0 0 <br />

NBR 1 1700 45 .03 51 .03 NBR 1 1700 10 .01 20 .01 <br />

<br />

SBL 1 1700 86 .05 41 .02 SBL 0 0 0 0 <br />

SBT 1 1700 92 .11* 44 .07* SBT 0 0 0 0 <br />

SBR 0 0 89 82 SBR 0 0 0 0 <br />

<br />

EBL 1 1700 34 .02* 105 .06 EBL 0 0 0 0 <br />

EBT 2 3400 541 .32 868 .46* EBT 2 3400 280 .16 430 .19* <br />

EBR 0 0 577 .34 697 EBR 0 0 300 .18 220 <br />

<br />

WBL 1 1700 50 .03 69 .04* WBL 1 1700 10 .01 10 .01* <br />

WBT 2 3400 1134 .34* 851 .27 WBT 2 3400 900 .26* 450 .13 <br />

WBR 0 0 23 65 WBR 0 0 0 0 <br />

<br />

Clearance Interval .05* .05* Clearance Interval .05* .05* <br />

<br />

TOTAL CAPACITY UTILIZATION .61 .71 TOTAL CAPACITY UTILIZATION .41 .38<br />

27 <strong>Tustin</strong> Town Center 1180.001 2/10<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-25<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

9. Newport & McFadden (5/8/07) 10. Newport & Walnut (4/4/06)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 1 1700 28 .02* 43 .03* NBL 1 1700 54 .03 73 .04 <br />

NBT 3 5100 527 .11 640 .13 NBT 3 5100 366 .09* 382 .08* <br />

NBR 0 0 11 15 NBR 0 0 100 49 <br />

<br />

SBL 1 1700 18 .01 38 .02 SBL 1 1700 451 .27* 338 .20* <br />

SBT 3 5100 795 .16* 669 .13* SBT 3 5100 346 .07 307 .07 <br />

SBR 1 1700 917 .54 416 .24 SBR 0 0 11 28 <br />

<br />

EBL 1.5 338 {.10}* 526 {.16}* EBL 1 1700 15 .01* 14 .01* <br />

EBT 0.5 3400 1 .10 9 .16 EBT 2 3400 258 .09 242 .09 <br />

EBR 1 1700 37 .02 33 .02 EBR 0 0 31 61 <br />

<br />

WBL 0 0 0 0 WBL 1 1700 99 .06 112 .07 <br />

WBT 1 1700 0 .01* 0 .02* WBT 2 3400 327 .16* 499 .25* <br />

WBR 0 0 19 28 WBR 0 0 220 353 <br />

<br />

Right Turn Adjustment SBR .30* Clearance Interval .05* .05* <br />

Clearance Interval .05* .05* <br />

TOTAL CAPACITY UTILIZATION .58 .59<br />

TOTAL CAPACITY UTILIZATION .64 .39<br />

11. Newport & Sycamore (1/24/07) 12. <strong>Tustin</strong> Village & McFadden (2005)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 1 1700 129 .08 41 .02 NBL 1.5 210 {.08}* 390 <br />

NBT 1 1700 95 .09* 63 .05* NBT 0.5 3400 50 .08 100 .14* <br />

NBR 0 0 59 26 NBR 1 1700 180 .11 280 .16 <br />

<br />

SBL 1 1700 213 .13* 235 .14* SBL 0.5 160 110 .06* <br />

SBT 1 1700 70 .04 139 .08 SBT 1.5 3400 120 .10* 30 .05 <br />

SBR 1 1700 103 .06 79 .05 SBR 0 60 60 <br />

<br />

EBL 1 1700 159 .09* 103 .06* EBL 1 1700 80 .05 70 .04 <br />

EBT 1 1700 65 .04 53 .05 EBT 2 3400 510 .23* 830 .31* <br />

EBR 0 0 11 24 EBR 0 0 280 210 <br />

<br />

WBL 0.5 27 54 WBL 2 3400 550 .16* 150 .04* <br />

WBT 1.5 3400 262 .12* 332 .16* WBT 2 3400 690 .23 800 .27 <br />

WBR 0 133 166 WBR 0 0 80 120 <br />

<br />

Clearance Interval .05* .05* Clearance Interval .05* .05* <br />

<br />

TOTAL CAPACITY UTILIZATION .48 .46 TOTAL CAPACITY UTILIZATION .62 .60<br />

28 <strong>Tustin</strong> Town Center 1180.001 2/10<br />

A-26 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS<br />

STRATEGIC GUIDE 09.21.2010

13. Williams & McFadden (2005) 14. Williams & Main (12/10 & 12/9/09)<br />

<br />

Existing Counts Existing Counts <br />

<br />

AM PK HOUR PM PK HOUR AM PK HOUR PM PK HOUR <br />

LANES CAPACITY VOL V/C VOL V/C LANES CAPACITY VOL V/C VOL V/C <br />

<br />

NBL 0 0 10 10 NBL 1 1700 164 .10* 148 .09* <br />

NBT 1 1700 10 .02* 10 .04* NBT 0 0 0 0 <br />

NBR 0 0 20 50 NBR 1 1700 231 .14 197 .12 <br />

<br />

SBL 1 1700 250 .15* 220 .13* SBL 0 0 0 0 <br />

SBT 1 1700 10 .06 10 .01 SBT 0 0 0 0 <br />

SBR 0 0 100 10 SBR 0 0 0 0 <br />

<br />

EBL 1 1700 30 .02* 40 .02* EBL 0 0 0 0 <br />

EBT 2 3400 510 .15 950 .28 EBT 1 1700 282 .17* 300 .18* <br />

EBR 0 0 10 10 EBR 1 1700 122 .07 152 .09 <br />

<br />

WBL 1 1700 30 .02 40 .02 WBL 1 1700 203 .12* 161 .09* <br />

WBT 2 3400 810 .27* 850 .30* WBT 1 1700 262 .15 256 .15 <br />

WBR 0 0 110 170 WBR 0 0 0 0 <br />

<br />

Clearance Interval .05* .05* Clearance Interval .05* .05* <br />

<br />

TOTAL CAPACITY UTILIZATION .51 .54 TOTAL CAPACITY UTILIZATION .44 .41<br />

29 <strong>Tustin</strong> Town Center 1180.001 2/10<br />

STRATEGIC GUIDE 09.21.2010 THE NEIGHBORHOODS OF TUSTIN TOWN CENTER<br />

A-27<br />

MARKET ANALYSIS AND NEIGHBORHOOD CONCEPT PLANS

A.4 Financial Feasibility Analysis for<br />

Key Opportunity Sites<br />

MEMORANDUM<br />

To:<br />

From:<br />

Frank Fuller, Principal<br />

Field Paoli Architects<br />

KEYSER MARSTON ASSOCIATES, INC.<br />

Date: June 1, 2010<br />

Subject:<br />

Neighborhoods <strong>of</strong> <strong>Tustin</strong> Town Center Financial Feasibility Analysis<br />

Keyser Marston Associates, Inc. (KMA) is pleased to present <strong>the</strong> following memorandum<br />

report summarizing <strong>the</strong> conclusions <strong>of</strong> <strong>the</strong> financial feasibility analysis for three (3) sites in<br />

<strong>the</strong> Neighborhoods <strong>of</strong> <strong>Tustin</strong> Town Center. It is KMA’s understanding that Field Paoli<br />

prepared two alternatives for a variation <strong>of</strong> sites within <strong>the</strong> Neighborhoods. KMA’s analysis<br />