Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This is an important document and requires your immediate attention.<br />

If you are in any doubt about how to deal with this document, you should<br />

contact your broker, financial adviser or legal adviser immediately.<br />

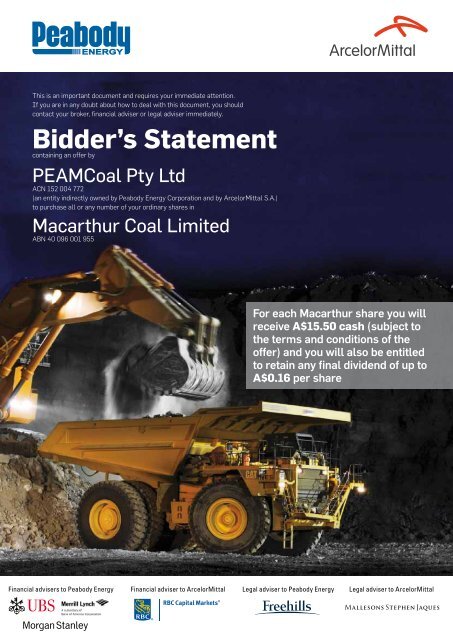

Bidder’s <strong>Statement</strong><br />

containing an offer by<br />

PEAMCoal Pty Ltd<br />

ACN 152 004 772<br />

(an entity indirectly owned by <strong>Peabody</strong> <strong>Energy</strong> Corporation and by ArcelorMittal S.A.)<br />

to purchase all or any number of your ordinary shares in<br />

Macarthur Coal Limited<br />

ABN 40 096 001 955<br />

For each Macarthur share you will<br />

receive A$15.50 cash (subject to<br />

the terms and conditions of the<br />

offer) and you will also be entitled<br />

to retain any final dividend of up to<br />

A$0.16 per share<br />

Financial advisers to <strong>Peabody</strong> <strong>Energy</strong> Financial adviser to ArcelorMittal Legal adviser to <strong>Peabody</strong> <strong>Energy</strong> Legal adviser to ArcelorMittal

important notices<br />

Nature of this document<br />

This document is a replacement Bidder’s <strong>Statement</strong> and is issued<br />

by PEAMCoal Pty Ltd ACN 152 004 772 under Part 6.5 of the<br />

Corporations Act (as amended by ASIC Class Order 00/344).<br />

This replacement Bidder’s <strong>Statement</strong> is dated 15 August 2011 and<br />

a copy of this replacement Bidder’s <strong>Statement</strong> was lodged with ASIC<br />

on 15 August 2011. This replacement Bidder’s <strong>Statement</strong> replaces<br />

the original Bidder’s <strong>Statement</strong> lodged with ASIC on 4 August 2011.<br />

References in this document to ‘the date of this Bidder’s <strong>Statement</strong>’<br />

(or similar) should be read as references to 4 August 2011.<br />

Neither ASIC nor its officers take any responsibility for the content<br />

of this Bidder’s <strong>Statement</strong>.<br />

No account of your personal circumstances<br />

In preparing this Bidder’s <strong>Statement</strong>, none of PEAMCoal, PEAMCoal<br />

Holdings, <strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal have taken into account<br />

the individual objectives, financial situation or needs of individual<br />

Macarthur Shareholders. Accordingly, before making a decision<br />

whether or not to accept the Offer, you may wish to consult with your<br />

financial or other professional adviser.<br />

Disclaimer as to forward looking statements<br />

Some of the statements appearing in this Bidder’s <strong>Statement</strong> may<br />

be in the nature of forward looking statements. You should be aware<br />

that such statements are either statements of current expectations<br />

or predictions and are subject to inherent risks and uncertainties.<br />

Those risks and uncertainties include factors and risks specific to the<br />

industry in which the members of the Macarthur Group, the members<br />

of the <strong>Peabody</strong> Group and the members of the ArcelorMittal Group<br />

operate as well as general economic conditions, prevailing exchange<br />

rates and interest rates and conditions in financial markets. Actual<br />

events or results may differ materially from the events or results<br />

expressed or implied in any forward looking statement. None of<br />

PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal,<br />

the officers or employees of PEAMCoal, PEAMCoal Holdings,<br />

<strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal, any persons named in this<br />

Bidder’s <strong>Statement</strong> with their consent or any person involved in the<br />

preparation of this Bidder’s <strong>Statement</strong>, makes any representation<br />

or warranty (express or implied) as to the accuracy or likelihood of<br />

fulfilment of any forward looking statement, or any events or results<br />

expressed or implied in any forward looking statement, except to the<br />

extent required by law. You are cautioned not to place undue reliance<br />

on any forward looking statement. The forward looking statements in<br />

this Bidder’s <strong>Statement</strong> reflect views held only as at the date of this<br />

Bidder’s <strong>Statement</strong>.<br />

Disclaimer as to Macarthur information<br />

The information on Macarthur, Macarthur’s securities and the<br />

Macarthur Group contained in this Bidder’s <strong>Statement</strong> has been<br />

prepared by PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> and<br />

ArcelorMittal using publicly available information.<br />

Information in this Bidder’s <strong>Statement</strong> concerning Macarthur,<br />

Macarthur’s securities and the Macarthur Group and the assets<br />

and liabilities, financial position and performance, profits and losses<br />

and prospects of the Macarthur Group has not been independently<br />

verified by PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> and<br />

ArcelorMittal. Accordingly, PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong><br />

<strong>Energy</strong> and ArcelorMittal do not, subject to the Corporations Act,

Key dates<br />

Date original Bidder’s <strong>Statement</strong> was lodged with ASIC 4 August 2011<br />

Date replacement Bidder’s <strong>Statement</strong> was lodged with ASIC 15 August 2011<br />

Date of Offer and Offer opens 18 August 2011<br />

Date Offer closes (unless extended or withdrawn) 7.00pm (Brisbane time) on 20 September 2011<br />

Key Contacts<br />

Share registrar for the Offer<br />

Link Market Services Limited<br />

PEAMCoal Offer Information Line*<br />

• 1800 992 039 (for callers within Australia)<br />

• +61 2 8280 7692 (for callers outside Australia)<br />

* Calls to these numbers may be recorded<br />

make any representation or warranty, express or implied, as to the<br />

accuracy or completeness of such information.<br />

Further information relating to Macarthur’s business may be included<br />

in Macarthur’s target’s statement which Macarthur must provide to<br />

Macarthur’s Shareholders in response to this Bidder’s <strong>Statement</strong>.<br />

Foreign jurisdictions<br />

The distribution of this Bidder’s <strong>Statement</strong> in jurisdictions outside<br />

Australia may be restricted by law, and persons who come into<br />

possession of it should seek advice on and observe any such<br />

restrictions. Any failure to comply with such restrictions may<br />

constitute a violation of applicable securities laws. This Bidder’s<br />

<strong>Statement</strong> does not constitute an offer in any jurisdiction in which, or<br />

to any person to whom, it would not be lawful to make such an offer.<br />

Responsibility statement<br />

The information in this Bidder’s <strong>Statement</strong> has been prepared by<br />

PEAMCoal and is the responsibility of PEAMCoal, except for the<br />

ArcelorMittal Information, which has been prepared by ArcelorMittal<br />

and the <strong>Peabody</strong> <strong>Energy</strong> Information which has been prepared<br />

by <strong>Peabody</strong> <strong>Energy</strong>. ArcelorMittal takes sole responsibility for the<br />

ArcelorMittal Information. <strong>Peabody</strong> <strong>Energy</strong> takes sole responsibility for<br />

the <strong>Peabody</strong> <strong>Energy</strong> Information.<br />

No director, officer, employee or adviser of PEAMCoal, PEAMCoal<br />

Holdings or of any member of the <strong>Peabody</strong> Group, assumes any<br />

responsibility for the ArcelorMittal Information. No director, officer,<br />

employee or adviser of any member of the ArcelorMittal Group<br />

assumes any responsibility for any information other than the<br />

ArcelorMittal Information.<br />

No director, officer, employee or adviser of PEAMCoal, PEAMCoal<br />

Holdings or any member of the ArcelorMittal Group, assumes any<br />

responsibility for the <strong>Peabody</strong> <strong>Energy</strong> Information. No director, officer,<br />

employee or adviser of any member of the <strong>Peabody</strong> Group (other<br />

than PEAMCoal) assumes any responsibility for any information other<br />

than the <strong>Peabody</strong> <strong>Energy</strong> Information.<br />

Privacy<br />

PEAMCoal has collected your information from the Macarthur<br />

Register for the purpose of making this Offer and, if accepted,<br />

administering your holding of Shares and your acceptance of<br />

the Offer. The type of information PEAMCoal has collected about<br />

you includes your name, contact details and information on your<br />

shareholding in Macarthur. Without this information, PEAMCoal would<br />

be hindered in its ability to carry out the Offer. The Corporations<br />

Act requires the name and address of shareholders to be held in a<br />

public register. Your information may be disclosed on a confidential<br />

basis to PEAMCoal’s Related Bodies Corporate and external service<br />

providers, and may be required to be disclosed to regulators such as<br />

ASIC. The registered address of PEAMCoal is Level 13, BOQ Centre,<br />

259 Queen Street, Brisbane, Queensland 4000.<br />

Defined terms<br />

A number of defined terms are used in this Bidder’s <strong>Statement</strong>.<br />

Unless the contrary intention appears, the context requires otherwise<br />

or capitalised words are defined in section 12 of this Bidder’s<br />

<strong>Statement</strong>, words and phrases in this Bidder’s <strong>Statement</strong> have the<br />

same meaning and interpretation as in the Corporations Act.<br />

Maps and diagrams<br />

Any diagrams and maps appearing in this Bidder’s <strong>Statement</strong><br />

are illustrative only and may not be drawn to scale. Unless stated<br />

otherwise, all data contained in charts, maps, graphs and tables is<br />

based on information available at the date of this Bidder’s <strong>Statement</strong>.<br />

1

Table of<br />

contents<br />

1 Why you should accept the Offer 5<br />

2 Summary of the Offer 10<br />

3 Information on PEAMCoal 11<br />

4 Information on <strong>Peabody</strong> <strong>Energy</strong> 13<br />

5 Information on ArcelorMittal 20<br />

6 Information on Macarthur 27<br />

7 Sources of consideration 29<br />

8 Intentions in relation to Macarthur 31<br />

9 Tax considerations 34<br />

10 Other material information 35<br />

11 The terms and conditions of the Offer 40<br />

12 Definitions and interpretation 47<br />

13 Approval of Bidder’s <strong>Statement</strong> 51<br />

2

letter to<br />

shareholders<br />

4 August 2011<br />

Dear Macarthur shareholders<br />

Offer to acquire your shares in Macarthur Coal Limited<br />

On behalf of <strong>Peabody</strong> <strong>Energy</strong> and ArcelorMittal, we are pleased to enclose an offer from PEAMCoal to acquire all of your shares in<br />

Macarthur Coal. PEAMCoal is indirectly owned 60% by <strong>Peabody</strong> <strong>Energy</strong> and 40% by ArcelorMittal.<br />

If you accept our offer, which we announced on 1 August 2011, you will receive A$15.50 in cash for each share in Macarthur that you hold,<br />

subject to our offer becoming unconditional.<br />

As a Macarthur shareholder, you will also be entitled to retain any final dividend declared by Macarthur for the financial year ended<br />

30 June 2011, up to A$0.16 per share for holdings as at the dividend record date, without there being any reduction in the cash payment<br />

under our offer. 1<br />

We believe that our offer, which represents a total cash value of A$15.66 per share, is compelling and represents outstanding value for your<br />

shares. It fully recognises Macarthur’s existing operations as well as its growth prospects and offers you certainty, liquidity and a significant<br />

premium. Quite simply, we believe it offers you greater value than Macarthur has to date been able to deliver.<br />

Macarthur shares have substantially underperformed other Australian resource stocks, despite rising coal prices and record demand. Our offer<br />

provides you with a substantial premium over Macarthur’s relevant trading ranges not only in its recent history, but over an extended time frame.<br />

In fact, over the 12 months before our proposed offer was announced, Macarthur’s share price declined by more than 17% while the S&P/ASX<br />

200 Resources Index rose by nearly 13%, meaning Macarthur underperformed its resources peers by approximately 30%.<br />

The total cash value of A$15.66 per share, represents a:<br />

• 41% premium to the closing price of the Macarthur shares prior to the Initial Announcement on 11 July 2011; 2<br />

• 45% premium to the 1 month volume weighted average price of the Macarthur shares up to and including 11 July 2011;<br />

• 38% premium to the 3 month volume weighted average price of the Macarthur shares up to and including 11 July 2011; and<br />

• 30% premium to the 12 month volume weighted average price of the Macarthur shares up to and including 11 July 2011.<br />

You should also know that, as at the date of this Bidder’s <strong>Statement</strong>, PEAMCoal has a relevant interest in approximately 16.1% of the<br />

Macarthur shares as ArcelorMittal has agreed to accept the offer in respect of its entire holding of Macarthur shares. For this offer to meet the<br />

50.01% minimum acceptance condition, PEAMCoal only requires an additional 34% of the shares in Macarthur.<br />

The cash value of the offer should be considered against the risks and uncertainties currently borne by you as a shareholder. If you do not<br />

accept the offer, and it becomes unconditional, you may become a minority shareholder in Macarthur. This may have several implications<br />

for you, including reduced liquidity in the shares and a reduced ability for you to sell your shares. Moreover, in the absence of our offer, it is<br />

expected that the shares will trade below the offer price and closer to the trading levels prior to our proposal announcement on 11 July 2011.<br />

Details of our offer, including its terms and conditions, are set out in this Bidder’s <strong>Statement</strong>. We encourage you to read this document in its<br />

entirety, together with the target’s statement, and then to accept the offer as soon as possible. In order to be valid, your acceptance must be<br />

received before 7.00pm (Brisbane time) on 20 September 2011, which, unless extended, will be the closing date of the offer.<br />

To accept the offer, please follow the instructions on the accompanying Acceptance Form. If you require additional assistance, please call the<br />

PEAMCoal Offer Information Line on 1800 992 039 (for callers within Australia) or +61 2 8280 7692 (for callers outside Australia).<br />

We appreciate your consideration of our offer and look forward to the prospect of delivering significant shareholder value to you.<br />

Gregory H. Boyce<br />

Chairman and Chief Executive Officer<br />

<strong>Peabody</strong> <strong>Energy</strong> Corporation<br />

Aditya Mittal<br />

Chief Financial Officer and Member of the Group Management Board<br />

ArcelorMittal S.A.<br />

1 <br />

Persons who acquire Macarthur shares on-market on or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those shares even if they are on<br />

Macarthur’s register of members in respect of those shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each<br />

such share so acquired, subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of<br />

this dividend (if any). The actual amount of the dividend could be higher or lower than A$0.16 per share. If it is higher than A$0.16 per share the cash amount payable under our offer<br />

of A$15.50 per share will be reduced by the amount of the excess. If it is lower than A$0.16 per share, the A$15.66 per share amount mentioned in this letter will be reduced by the<br />

difference between A$0.16 and the actual amount of the dividend.<br />

2 <br />

The date of 11 July 2011 was the date on which Macarthur first announced the proposed takeover approach from <strong>Peabody</strong> <strong>Energy</strong> and ArcelorMittal. This page contains references to<br />

trading data prepared by IRESS Market Technology Limited (ACN 060 313 359) who has not consented to the use of references to that trading data in this Bidder’s <strong>Statement</strong>. The above<br />

values are based on the Offer Value of A$15.66, a closing price of Macarthur shares on the ASX on 11 July 2011 of A$11.08, a 1 month volume weighted average price of A$10.82 and a<br />

3 month volume weighted average price of A$11.32, and 12 month volume weighted average price of A$12.02.<br />

3

1 Why you should accept the Offer<br />

1<br />

THE<br />

2<br />

ACCEPTING<br />

3<br />

THE<br />

4<br />

YOU<br />

5<br />

MACARTHUR’S<br />

6<br />

THERE<br />

7<br />

THERE<br />

OFFER REPRESENTS A<br />

SIGNIFICANT PREMIUM TO BOTH<br />

RECENT TRADING PRICES OF THE<br />

SHARES AND TRADING RANGES<br />

OVER AN EXTENDED TIME FRAME.<br />

THE OFFER PROVIDES<br />

FULL CASH CONSIDERATION AND<br />

CERTAIN VALUE FOR YOUR SHARES.<br />

OFFER IS SUBSTANTIALLY<br />

HIGHER THAN EQUITY ANALYSTS’<br />

VALUATIONS OF THE SHARES. 3<br />

WILL STILL HAVE THE<br />

OPPORTUNITY TO RECEIVE AND<br />

RETAIN additional VALUE<br />

FOR ANY FINAL FY11 DIVIDEND<br />

DECLARED UP TO AN AMOUNT<br />

EQUAL TO A$0.16 PER SHARE.<br />

SHARE PRICE<br />

MAY FALL IF THE OFFER IS<br />

UNSUCCESSFUL.<br />

ARE RISKS ASSOCIATED<br />

WITH REMAINING As a MINORITY<br />

INVESTOR IN MACARTHUR.<br />

ARE NO COMPETING<br />

PROPOSALS AVAILABLE FOR YOUR<br />

SHARES AT THIS TIME.<br />

3<br />

See section 1.3.<br />

5

1 Why you should accept the Offer<br />

1.1 The Offer represents a significant premium to recent trading prices<br />

The all cash consideration being offered by PEAMCoal is a compelling offer and represents a substantial premium to the levels at which the<br />

Shares were trading prior to the Initial Announcement on 11 July 2011.<br />

The Offer Value of A$15.66 per Share (which comprises the Offer consideration of A$15.50 per Share plus an assumed final dividend from<br />

Macarthur for the financial year ended 30 June 2011 of A$0.16 per Share) represents a premium of:<br />

• 41% to A$11.08, the closing price of the Shares on the ASX on 11 July 2011 (being the date of the Initial Announcement);<br />

• 45% to A$10.82, the 1 month VWAP of the Shares on the ASX up to and including 11 July 2011;<br />

• 38% to A$11.32, the 3 month VWAP of the Shares on the ASX up to and including 11 July 2011;<br />

• 30% to A$12.02, the 12 month VWAP of the Shares on the ASX up to and including 11 July 2011; and<br />

• 36% to A$11.50, the per Share price at which Macarthur raised equity in August 2010. 4<br />

Figure 1: Offer premia relative to recent Macarthur trading prices<br />

16<br />

Offer Value = A$15.66/Share<br />

14<br />

12<br />

41% 45% 38%<br />

30% 36%<br />

A$/Share<br />

10<br />

8<br />

6<br />

11.08 10.82 11.32 12.02 11.50<br />

15.66<br />

A$15.50 Offer<br />

price + A$0.16<br />

dividend<br />

4<br />

2<br />

0<br />

Closing<br />

price 11<br />

July 2011 (1)<br />

1 month<br />

VWAP (2)<br />

3 month<br />

VWAP (3)<br />

12 month<br />

VWAP (4)<br />

August<br />

2010<br />

equity<br />

raising<br />

price<br />

Offer Value<br />

Source: IRESS. 5<br />

Notes:<br />

(1) Being the last trading day prior to the release of the Initial Announcement.<br />

(2) VWAP of Shares over 1 month prior to the release of the Initial Announcement (from 13 June 2011 to 11 July 2011).<br />

(3) VWAP of Shares over 3 months prior to the release of the Initial Announcement (from 12 April 2011 to 11 July 2011).<br />

(4) VWAP of Shares over 12 months prior to the release of the Initial Announcement (from 12 July 2010 to 11 July 2011).<br />

1.2 Full and certain cash consideratioN<br />

PEAMCoal believes that the Offer represents full and fair value for Your Shares.<br />

The certainty of receiving the Offer Value of A$15.66 cash per Share should be compared to the external and company specific risks and<br />

uncertainties which Macarthur may be subject to that could affect the trading price of the Shares.<br />

These risks and uncertainties include, but are not limited to:<br />

• coal price risk;<br />

• foreign exchange risk;<br />

• exploration, development and operational risk;<br />

• the uncertainties around the ability of Macarthur’s assets to generate anticipated cashflows and the related impact on dividends;<br />

• regulatory risk, including the introduction of the proposed minerals resource rent tax and the proposed carbon tax;<br />

• the uncertainties relating to the MDL 162 Litigation and the Monto Claims; and<br />

• equity market risk, including the uncertainty as to the prices at which Shares will trade in the absence of the Offer.<br />

4<br />

Noting the comments in footnote 1 of this Bidder’s <strong>Statement</strong>, the corresponding premia numbers based solely on the Offer consideration of A$15.50 per Share, are 40% to the closing<br />

price of the Shares on the ASX on 11 July 2011, 43% to the 1 month VWAP of the Shares on the ASX up to and including 11 July 2011, 37% to the 3 month VWAP of the Shares on<br />

the ASX up to and including 11 July 2011, 29% to the 12 month VWAP of the Shares on the ASX up to and including 11 July 2011 and 35% to A$11.50, the per Share price at which<br />

Macarthur raised equity in August 2010.<br />

5<br />

This section 1 contains various references to trading data prepared by IRESS Market Technology Limited (ACN 060 313 359) who has not consented to such use of references to that<br />

trading data.<br />

6

In contrast, if you accept the Offer, and the Offer becomes unconditional, you will receive assured value for your investment and you will transfer<br />

to PEAMCoal all the potential risks and uncertainties inherent in Macarthur and its assets.<br />

The risks and uncertainties you will avoid by accepting the Offer include:<br />

(a) Operational and marketing risk: Unexpected operational and marketing issues, such as adverse weather events (including the recent<br />

floods in Queensland) and a reduction in global demand for low volatile pulverised coal injection coal (LV PCI), have historically affected<br />

Macarthur’s operations due to their lack of geographical and product diversification. There is a risk that further such issues could impact<br />

Macarthur’s operations and earnings in the future.<br />

(b) Coal price and foreign exchange volatility: Macarthur’s coal sales are generally priced in US dollars. Macarthur is therefore exposed to<br />

fluctuations in coal prices and foreign exchange rates. Although quarterly LV PCI contracts have recently been agreed at historically high<br />

prices, coal prices remain volatile and there is no assurance they will remain at high levels.<br />

(c) Management performance risk: Macarthur management has not delivered on key targets over recent years, and there is a risk<br />

that continued setbacks will erode Shareholder value. Over the 12 months prior to the Initial Announcement, Macarthur substantially<br />

underperformed the broader Australian resources sector, as demonstrated in Figure 2 below. From 12 July 2010 to 11 July 2011, the<br />

Macarthur share price declined by 17.3% while the S&P/ASX 200 Resources Index rose by 12.8% meaning Macarthur underperformed its<br />

resources peers by more than 30%.<br />

Figure 2: Macarthur share price underperformed the S&P/ASX 200 Resources Index by approximately 30% over the past year (1)<br />

18<br />

16<br />

A$/Share<br />

14<br />

30% Macarthur<br />

underperformance<br />

+12.8%<br />

12<br />

–17.3%<br />

10<br />

Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

S&P/ASX 200 Resources (rebased)<br />

Macarthur<br />

Source: IRESS.<br />

Note:<br />

(1) Over 12 months prior to the making of the Initial Announcement, from 12 July 2010 to 11 July 2011.<br />

PEAMCoal believes that this share price underperformance has been driven by, amongst other things, Macarthur persistently falling short of<br />

earnings and growth targets. For example:<br />

• Macarthur has fallen short of its original production guidance for four of the past five years;<br />

• ongoing delays reaching first large scale production from Middlemount, which Macarthur originally planned for late 2009, 6 but is now<br />

expected in 2012;<br />

• downgrades to core earnings and production forecasts during FY11;<br />

• selection of the fourth mine (Codrilla) announced 5 months behind schedule in May 2011; and<br />

• failure to complete the acquisition of mining lease MDL162 as planned (refer to section 6.5(e) below).<br />

6<br />

Macarthur’s December 2007 Half Year Results Presentation dated 27-29 February 2008 as released to the ASX on 27 February 2008 and which is available at www.asx.com.au.<br />

7

As demonstrated in Figure 3, Macarthur management has continued to project production growth which has failed to materialise since 2006 –<br />

even after disregarding the impact of the severe weather on FY11 production.<br />

Figure 3: Macarthur saleable production since 2006<br />

Attributable production (Mt)<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

5.0<br />

2006 - 2010 CAGR = 0%<br />

3.6 3.5<br />

4.7<br />

5.0<br />

3.8<br />

0.0<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011<br />

Source: Macarthur ASX filings.<br />

(d) Development risk: While Macarthur has recently announced the selection of Codrilla as the fourth mine and has a portfolio of preproduction<br />

assets across Queensland, there are substantial uncertainties associated with greenfield mine development and there is no<br />

guarantee that Macarthur will be able to develop Codrilla, or any of the other projects, in the near future, if at all. If that development is<br />

delayed, Macarthur may face liabilities under its port and rail take-or-pay obligations.<br />

Furthermore, in August 2010, Macarthur announced its intention to acquire a controlling interest in MDL162, a pre-production project in the<br />

Bowen Basin, by providing a loan of approximately A$360 million which would be converted into equity in the company holding the licence.<br />

Macarthur has announced that it is now facing difficulty in converting this loan into equity. Accordingly, there is a risk that Macarthur will not<br />

be able to convert the loan into equity or receive full repayment of the loan. See section 6.5(e) for further details.<br />

(e) Funding risk: Development of Macarthur’s projects pipeline will require significant investment in exploration, feasibility studies and mine<br />

construction. This expenditure may exceed Macarthur’s cash reserves and operating cashflows, and therefore Macarthur could be required to<br />

seek debt funding or raise equity from existing or new shareholders. Macarthur’s ability to secure this funding is not guaranteed, which could<br />

cause the deferral of development projects and any future funding arrangements could potentially dilute existing Macarthur Shareholders.<br />

(f) Regulatory risk: The introduction of the proposed minerals resource rent tax and the proposed carbon tax could have a negative effect on<br />

Macarthur’s future earnings and impact the value of the Shares. 7<br />

(g) Litigation risk: Macarthur and two of its subsidiaries, Monto Coal Pty Ltd and Monto Coal 2 Pty Ltd, have been served with a statement of<br />

claim in relation to proceedings commenced in the Supreme Court of Queensland in 2007 by three joint venture participants in the Monto Coal<br />

joint venture. The claim is for damages of not less than A$1.19 billion for breach of contract plus interest and expenses. Whilst Macarthur has<br />

stated that it believes the claims to be unfounded, there is a risk that the outcome of the litigation could be unfavourable to Macarthur.<br />

1.3 The Offer is substantially higher than equity analysts’ valuations of Macarthur<br />

The Offer Value of A$15.66 per Share is 30% higher than the median equity analyst net asset value of Macarthur of A$12.05 per Share.<br />

The median equity analyst valuation of A$12.05 per Share was calculated using the valuations of 15 brokers, and the value in those brokers’<br />

reports range between A$10.50 and A$16.01 per Share. These valuations were published in reports that were released between 11 May 2011 and<br />

26 July 2011. To PEAMCoal’s knowledge, these are the most recent analyst valuations published before the date of this Bidder’s <strong>Statement</strong>.<br />

Figure 4: Premium to median analyst valuation<br />

15.00<br />

30% premium<br />

12.00<br />

A$/Share<br />

9.00<br />

6.00<br />

12.05<br />

15.66<br />

3.00<br />

0.00<br />

Median Equity Analyst Valuation<br />

Offer Value<br />

7<br />

Macarthur has included an estimate of the impact of the proposed carbon tax on page 11 of its June 2011 quarterly report, a copy of which was released to the ASX on 25 July 2011<br />

and which is available at www.asx.com.au. PEAMCoal notes that such forward looking statements are the sole responsibility of Macarthur and PEAMCoal makes no comment on their<br />

accuracy or otherwise.<br />

8

1.4 You will still receive value for any final dividend declared<br />

Macarthur Shareholders will be entitled to retain any final dividend declared by Macarthur in respect of the financial year ended 30 June 2011,<br />

up to an amount equal to A$0.16 per Share, in respect of the Shares of which they are the registered holder as at the record date for the<br />

dividend, without there being any reduction in the consideration payable under the Offer. 8<br />

1.5 Macarthur’s share price may fall if the Offer is not successful<br />

If the Offer does not proceed, and no other offers are made for the Shares, it is expected that Macarthur’s share price will fall below the Offer<br />

Value. Since May 2010, following the Macarthur Board’s rejection of <strong>Peabody</strong> <strong>Energy</strong>’s proposal, Macarthur shares traded persistently below<br />

the then proposed A$15.00 per Share cash price. As demonstrated in Figure 5 below, the Shares did not trade above A$15.00 between the<br />

date of withdrawal of <strong>Peabody</strong> <strong>Energy</strong>’s proposal and the date of the Initial Announcement.<br />

Figure 5: Macarthur 18 month Share price performance 9<br />

18<br />

16<br />

Previous <strong>Peabody</strong> <strong>Energy</strong><br />

proposal announced<br />

Offer Value = A$15.66/Share<br />

A$/Share<br />

14<br />

12<br />

10<br />

Macarthur Board rejection of<br />

previous <strong>Peabody</strong> <strong>Energy</strong> proposal<br />

8<br />

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

Source: IRESS.<br />

1.6 Implications of remaining as a minority shareholder of Macarthur<br />

As PEAMCoal already has a Relevant Interest in 16.1% of the Shares as a result of the Pre-Bid Acceptance Deed, Shareholders holding only<br />

34% of the Shares are required to accept the Offer for the Offer to be successful and for PEAMCoal to become a majority shareholder in<br />

Macarthur. 10 If PEAMCoal becomes a majority shareholder in Macarthur, but Macarthur remains a listed company, the market for Your Shares<br />

may be less liquid or less active than at present. Therefore, if you do not accept the Offer, it could be more difficult for you to sell Your Shares<br />

at a later time. The smaller free float may also result in the removal of Macarthur from some S&P/ASX indices.<br />

If PEAMCoal becomes a majority shareholder in Macarthur, subject to the spread and number of remaining Macarthur Shareholders and the<br />

requirements in the Listing Rules, it intends to seek to remove Macarthur’s listing on the ASX.<br />

1.7 The only available offer for Your Shares<br />

PEAMCoal is not aware of any competing proposals for Your Shares as at the date of this Bidder’s <strong>Statement</strong>.<br />

8<br />

Persons who acquire Shares on-market or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those Shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the Offer of A$15.50 per Share will<br />

be reduced by the amount of the excess. . If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference<br />

between A$0.16 and the actual amount of the dividend.<br />

9<br />

From 12 January 2010 to 11 July 2011.<br />

10<br />

Subject to all other conditions in section 11.7 being fulfilled or freed.<br />

9

2 Summary of the Offer<br />

What PEAMCoal is<br />

offering to buy?<br />

Who is PEAMCoal?<br />

What you will receive if<br />

you accept the Offer?<br />

What is your entitlement<br />

to Macarthur’s FY11<br />

final dividend?<br />

When will you be paid?<br />

When does the Offer<br />

close?<br />

What are the conditions<br />

to the Offer?<br />

How do you accept the<br />

Offer?<br />

Where do you go for<br />

further information?<br />

Important notice<br />

PEAMCoal is offering to buy all of the Shares on the terms and conditions set out in this Bidder’s <strong>Statement</strong>.<br />

You may accept this Offer for all or any number of Your Shares.<br />

PEAMCoal is an entity that is indirectly owned 60% by <strong>Peabody</strong> <strong>Energy</strong> and 40% by ArcelorMittal.<br />

If you accept the Offer, subject to the conditions to the Offer being fulfilled or freed, you will receive A$15.50 cash<br />

for each of Your Shares accepted.<br />

In addition to the Offer price referred to above, you will also be entitled to retain any final dividend declared by<br />

Macarthur in respect of the financial year ended 30 June 2011, up to an amount equal to A$0.16 per Share,<br />

in respect of Shares of which you are the registered holder as at the record date for the dividend, without there<br />

being any reduction in the consideration payable under the Offer. 11<br />

Generally, PEAMCoal will pay the consideration due to you under the Offer on or before the earlier of:<br />

• one month after this Offer is accepted or one month after all of the conditions have been freed or fulfilled<br />

(whichever is the later); and<br />

• 21 days after the end of the Offer Period.<br />

Full details of when payments will be made are set out in section 11.6 of this Bidder’s <strong>Statement</strong>.<br />

The Offer closes at 7.00pm (Brisbane time) on 20 September 2011, unless it is extended or withdrawn<br />

under the Corporations Act.<br />

The Offer is subject to a number of conditions, including the following conditions:<br />

• PEAMCoal acquiring a Relevant Interest in excess of 50.01% of all Shares;<br />

• all required regulatory approvals being obtained;<br />

• no material adverse change occurring in relation to Macarthur;<br />

• no ‘prescribed occurrences’ occurring in relation to Macarthur; and<br />

• Macarthur not announcing a dividend, other than the Permitted FY11 Dividend or any Permitted Other<br />

Dividend.<br />

Full terms of the conditions of the Offer are set out in section 11.7 of this Bidder’s <strong>Statement</strong>.<br />

You may accept the Offer for all or any number of Your Shares.<br />

Issuer sponsored shareholders<br />

If Your Shares are held on Macarthur’s issuer sponsored subregister (such holdings will be evidenced by an<br />

‘I’ appearing next to your holder number on the enclosed Acceptance Form), to accept this Offer, you must<br />

complete and sign the Acceptance Form enclosed with this Bidder’s <strong>Statement</strong> and return it to the address<br />

indicated on the form so that it is received before the end of the Offer Period.<br />

CHESS sponsored shareholders<br />

If Your Shares are in a CHESS Holding (such holdings will be evidenced by an ‘X’ appearing next to your holder<br />

number on the enclosed Acceptance Form), you may accept the Offer by either:<br />

• completing and signing the enclosed Acceptance Form and returning it to the address indicated on the form<br />

so that it is received before the end of the Offer Period; or<br />

• instructing your Controlling Participant (for example, your broker) to accept the Offer on your behalf before<br />

the end of the Offer Period.<br />

Participants<br />

If you are a Participant, acceptance of this Offer must be initiated in accordance with Rule 14.14 of the ASX<br />

Settlement Operating Rules before the end of the Offer Period.<br />

Full details on how to accept the Offer are set out in section 11.3 of this Bidder’s <strong>Statement</strong>.<br />

For queries on how to accept the Offer, see the enclosed Acceptance Form. If you have any other queries in<br />

relation to the Offer, please contact the PEAMCoal Offer Information Line on 1800 992 039 (for callers within<br />

Australia) or +61 2 8280 7692 (for callers outside Australia).<br />

Please note that calls to the above numbers may be recorded. Inquiries in relation to the Offer will not be<br />

received on any other telephone numbers of PEAMCoal or its advisers.<br />

The information in this section 2 is a summary only of the Offer and is qualified by the detailed information set<br />

out elsewhere in this Bidder’s <strong>Statement</strong>.<br />

You should read the entire Bidder’s <strong>Statement</strong> and the target’s statement that Macarthur will shortly be sending<br />

to you, before deciding whether to accept the Offer.<br />

11<br />

Persons who acquire Shares on-market on or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the offer of A$15.50 per Share will be<br />

reduced by the amount of the excess. If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference between<br />

A$0.16 and the actual amount of the dividend.<br />

10

3 Information on PEAMCoal<br />

3.1 Overview of PEAMCoal<br />

<strong>Peabody</strong> <strong>Energy</strong> indirectly owns 60% of PEAMCoal and ArcelorMittal<br />

indirectly owns 40% of PEAMCoal. The diagram in section 3.3<br />

illustrates the ownership structure of PEAMCoal.<br />

PEAMCoal’s sole purpose is to acquire Shares pursuant to the Offer.<br />

As at the date of this Bidder’s <strong>Statement</strong>, PEAMCoal was not carrying<br />

on business and had no assets or liabilities (other than pursuant to<br />

the Offer). PEAMCoal’s funding arrangements in relation to the Offer<br />

are set out in section 10.2(c).<br />

3.2 Directors<br />

As at the date of this Bidder’s <strong>Statement</strong>, the PEAMCoal<br />

Directors are:<br />

• Richard A. Navarre;<br />

• Eric Ford; and<br />

• Julian D. Thornton.<br />

Each of these individuals was appointed by <strong>Peabody</strong> <strong>Energy</strong>.<br />

Following the end of the Offer Period and pursuant to the terms of<br />

the Shareholders’ Deed, ArcelorMittal will be entitled to appoint two<br />

individuals as PEAMCoal Directors. For that purpose, ArcelorMittal<br />

has nominated the following individuals to be PEAMCoal Directors:<br />

• Peter Kukielski; and<br />

• Carole Whittall.<br />

Brief profiles of the existing and proposed PEAMCoal Directors are<br />

set out below.<br />

Richard A. Navarre<br />

Rick Navarre was named<br />

President and Chief Commercial<br />

Officer for <strong>Peabody</strong> in January<br />

2008. He has executive<br />

responsibility for global sales<br />

and trading, business<br />

development, international<br />

growth initiatives and business<br />

performance. He also is a<br />

frequent speaker on energy,<br />

industry and company trends<br />

and topics.<br />

With more than 25 years<br />

of financial and business<br />

experience, Rick served as<br />

<strong>Peabody</strong>’s Chief Financial<br />

Officer from 1999 through<br />

2008. He joined the<br />

company in 1993 and has held a series of financial and commercial<br />

positions, including executive responsibility for departments as<br />

diverse as Sales, Marketing, Trading and Transportation, Legal,<br />

Information Technology, Materials Management, Post-Mining<br />

Reclamation, Resource Management, and Investor Relations and<br />

Corporate Communications.<br />

Rick is a member of the Hall of Fame of the College of Business<br />

at Southern Illinois University Carbondale, a member of the<br />

Board of Advisors of the College of Business and Administration<br />

and the School of Accountancy of Southern Illinois University<br />

Carbondale; and a member of the Board of Directors of the Regional<br />

Chamber and Growth Association of St. Louis. He is a Director<br />

of the United Way of Greater St. Louis, Treasurer of the Missouri<br />

Historical Society, a member of Financial Executives International<br />

and the Civic Entrepreneurs Organization, a Fellow of the Foreign<br />

Policy Association and a former chairman of the Bituminous Coal<br />

Operators’ Association.<br />

Eric Ford<br />

Eric Ford is Executive Vice<br />

President and Chief Operating<br />

Officer of <strong>Peabody</strong> <strong>Energy</strong>. In<br />

his current role, he is<br />

responsible for all of the<br />

company’s global mining<br />

operations, along with areas of<br />

safety, operations, planning,<br />

and project development.<br />

Eric joined <strong>Peabody</strong> in<br />

January 2007 as Executive<br />

Vice President and Chief<br />

Operating Officer. Prior to<br />

joining <strong>Peabody</strong> <strong>Energy</strong>, he<br />

served six years with Anglo<br />

Coal Australia Pty Ltd. as Chief<br />

Executive Officer.<br />

Eric was Deputy Chairman and<br />

a member of the Executive Committee of the Coal Industry Advisory<br />

Board of the International <strong>Energy</strong> Agency and Vice Chairman and<br />

Director of the Minerals Council of Australia. He holds a Master of<br />

Management Sciences from Imperial College in London, England as<br />

well as a Bachelor of Science degree in Mining Engineering from the<br />

University of the Witwatersrand in Johannesburg, South Africa.<br />

Julian D. Thornton<br />

Julian Thornton is the Group<br />

Executive & Managing Director<br />

of <strong>Peabody</strong>’s Australian<br />

operations, being appointed in<br />

May 2008. Julian joined<br />

<strong>Peabody</strong> in March 2007 as<br />

Chief Operating Officer for the<br />

New South Wales operations<br />

and was then appointed to the<br />

newly created position of Chief<br />

Operating Officer for Australia in<br />

November 2007.<br />

Prior to joining <strong>Peabody</strong>, Julian<br />

was Chief Operating Officer for<br />

RPG Industries in the Czech<br />

Republic with responsibility<br />

for the operational aspects<br />

of the coal mines and coking<br />

operations of the company which were situated in the Eastern part<br />

of the country. Prior to that Julian worked for Anglo American’s<br />

Coal Division and performed a number of roles including a variety<br />

of operational roles on mines in South Africa and Colombia as well<br />

as joint venture management of operations in South America and<br />

project work.<br />

Julian holds a Bachelor of Science Degree and Doctorate in<br />

mining engineering from the University of Wales and a Higher<br />

Postgraduate Diploma in Computer Science from the University of<br />

the Witwatersrand in South Africa. Julian’s leadership roles currently<br />

include directorships of the New South Wales Minerals Council,<br />

Queensland Resources Council and the Australian Coal Association.<br />

11

Peter Kukielski<br />

Peter Kukielski is a member of<br />

the Group Management Board<br />

of ArcelorMittal and Chief<br />

Executive Mining. As part of this<br />

role, he has responsibility for<br />

ArcelorMittal’s mining business<br />

and for driving its development.<br />

Prior to joining ArcelorMittal,<br />

Peter was Executive<br />

Vice President and<br />

Chief Operating Officer at<br />

Teck Cominco Limited.<br />

Before that, he was<br />

Chief Operating Officer<br />

of Falconbridge Limited.<br />

He also has held senior<br />

engineering and project<br />

management positions with BHP Billiton and Fluor Corporation.<br />

Peter holds a Bachelor of Science degree in civil engineering from<br />

the University of Rhode Island and a Master of Science degree in<br />

civil engineering from Stanford University.<br />

Carole Whittall<br />

Carole Whittall is Vice President<br />

and Head of Mining M&A at<br />

ArcelorMittal where she is<br />

responsible for business<br />

development and transaction<br />

execution in the mining sector.<br />

She was previously with Rio<br />

Tinto where she held various<br />

commercial and business<br />

development roles. Her prior<br />

career was with JP Morgan and<br />

Standard Corporate and<br />

Merchant Bank (South Africa) in<br />

mergers and acquisitions and<br />

corporate finance.<br />

Carole holds a Bachelor of<br />

Science (Honours) degree in<br />

geology and geochemistry from the University of Cape Town and a<br />

Master of Business Administration from London Business School.<br />

3.3 Current Ownership structure and shareholder arrangements<br />

The following diagram shows PEAMCoal’s current ownership structure.<br />

<strong>Peabody</strong> <strong>Energy</strong> Corporation<br />

(<strong>Peabody</strong> <strong>Energy</strong>)<br />

ArcelorMittal S.A.<br />

(ArcelorMittal)<br />

100% (indirectly) 100% (indirectly)<br />

<strong>Peabody</strong> Acquisition Co. No. 2 Pty Ltd<br />

(PAC2)<br />

ArcelorMittal Mining Australasia B.V.<br />

(AM BV2)<br />

60% 40%<br />

PEAMCoal Holdings Pty Ltd<br />

(PEAMCoal Holdings)<br />

100%<br />

PEAMCoal Pty Ltd<br />

(PEAMCoal)<br />

Takeover Bid<br />

Macarthur Coal Ltd<br />

(Macarthur)<br />

12

4 Information on <strong>Peabody</strong> <strong>Energy</strong><br />

4.1 Overview of <strong>Peabody</strong> <strong>Energy</strong><br />

<strong>Peabody</strong> <strong>Energy</strong> is the world’s largest private sector coal company,<br />

with majority interests in 28 coal mining operations in the U.S. and<br />

Australia. In 2010, it produced 218.4 million Tons of coal and sold<br />

245.9 million Tons of coal.<br />

<strong>Peabody</strong> <strong>Energy</strong>, a public company existing under the laws of the<br />

United States and listed on the New York Stock Exchange, indirectly<br />

owns 60% of PEAMCoal Holdings.<br />

4.2 History, structure and ownership of<br />

<strong>Peabody</strong> <strong>Energy</strong><br />

(a) History<br />

<strong>Peabody</strong> <strong>Energy</strong> was incorporated in Delaware, U.S., in 2001 and<br />

its history in the coal mining business dates back to 1883. Over<br />

the past decade, <strong>Peabody</strong> <strong>Energy</strong> has continually adjusted its<br />

business to focus on the highest-growth regions in the U.S. and<br />

Asia-Pacific region. As part of this transformation, it has made<br />

strategic acquisitions and divestitures in Australia and the U.S.<br />

After re-entering the Australian market in 2002, <strong>Peabody</strong> <strong>Energy</strong><br />

expanded its presence there with acquisitions in 2004 and 2006.<br />

In 2007, <strong>Peabody</strong> <strong>Energy</strong> spun off portions of its former Eastern<br />

U.S. Mining segment through a dividend of all outstanding shares<br />

of Patriot Coal Corporation. It has also continued to expand its<br />

Trading and Brokerage operations and now has a global trading<br />

platform with offices in the U.S., Europe, Australia and Asia.<br />

(b) Structure<br />

<strong>Peabody</strong> <strong>Energy</strong> conducts it operations through a number<br />

of Subsidiaries, including <strong>Peabody</strong> <strong>Energy</strong> Australia Pty Ltd<br />

(<strong>Peabody</strong> <strong>Energy</strong> Australia) and joint ventures. <strong>Peabody</strong> <strong>Energy</strong><br />

Australia is currently the holding company for <strong>Peabody</strong> <strong>Energy</strong>’s<br />

Australian operations.<br />

(c) Ownership<br />

As at 2 August 2011, <strong>Peabody</strong> <strong>Energy</strong> understands that the<br />

following entities beneficially own more than 5% of <strong>Peabody</strong><br />

<strong>Energy</strong>’s issued share capital:<br />

Beneficial owner<br />

Percentage of issued<br />

share capital*<br />

Blackrock, Inc. 11.1%<br />

T. Rowe Price Associates 9.1%<br />

* Based on information filed with the SEC.<br />

4.3 Principal activities of <strong>Peabody</strong> <strong>Energy</strong><br />

<strong>Peabody</strong> <strong>Energy</strong> is actively pursuing growth plans in Australia with<br />

a view to being a long-term participant in the Australian coal industry.<br />

In addition to its mining operations, <strong>Peabody</strong> <strong>Energy</strong> markets, brokers<br />

and trades coal through its Trading and Brokerage segment.<br />

<strong>Peabody</strong> <strong>Energy</strong>’s other energy related commercial activities<br />

include participating in the development of mine-mouth coal-fueled<br />

generating plants and the development of Btu Conversion and clean<br />

coal technologies. <strong>Peabody</strong> <strong>Energy</strong>’s Btu Conversion projects are<br />

designed to expand the uses of coal through various technologies<br />

such as coal-to-liquids and coal gasification.<br />

<strong>Peabody</strong> <strong>Energy</strong> conducts business through four principal<br />

segments: Western U.S. Mining, Midwestern U.S. Mining, Australian<br />

Mining and Trading and Brokerage. The principal business of the<br />

Western and Midwestern U.S. Mining segments is the mining,<br />

preparation and sale of thermal coal, sold primarily to electric utilities.<br />

The Western U.S. Mining operations consist of <strong>Peabody</strong> <strong>Energy</strong>’s<br />

Powder River Basin, Southwest and Colorado operations. The<br />

Midwestern U.S. Mining operations consist of its Illinois and Indiana<br />

operations. The business of the Australian Mining Segment is the<br />

mining of various qualities of low-sulfur, high calorific value coal<br />

as well as thermal coal primarily sold to an international customer<br />

base with a portion sold to Australian steel producers and power<br />

generators. Metallurgical coal is produced primarily from five of<br />

<strong>Peabody</strong> <strong>Energy</strong>’s Australian mines.<br />

The Trading and Brokerage segment’s principal business is the<br />

brokering of coal sales of other producers, both as principal and<br />

agent, and the trading of coal, freight and freight-related contracts.<br />

It also provides transportation-related services in support of <strong>Peabody</strong><br />

<strong>Energy</strong>’s coal trading strategy, as well as hedging activities in support<br />

of its mining operations.<br />

A fifth segment, Corporate and Other, includes mining and<br />

export/transportation joint ventures, energy-related commercial<br />

activities, as well as the management of its coal reserve and real<br />

estate holdings.<br />

<strong>Peabody</strong> <strong>Energy</strong> continues to pursue Btu Conversion projects that<br />

expand the uses of coal through coal-to-liquids and coal-to-gas<br />

projects. <strong>Peabody</strong> <strong>Energy</strong>’s participation in generation development<br />

projects involves using its surface lands and coal reserves as the<br />

basis for mine-mouth plants. <strong>Peabody</strong> <strong>Energy</strong> is also advancing<br />

several initiatives associated with clean coal technologies, including<br />

carbon capture and storage.<br />

The maps below display <strong>Peabody</strong> <strong>Energy</strong> and <strong>Peabody</strong> <strong>Energy</strong><br />

Australia’s mine locations as of 31 December 2010. Also noted<br />

are the primary ports utilized in the U.S. and in Australia for its coal<br />

exports and its corporate headquarters.<br />

13

Map 1: U.S. mining Operations<br />

Map 2: Australian mining operations<br />

14

The table below presents information regarding each of <strong>Peabody</strong> <strong>Energy</strong>’s 28 mines, including mine location, type of mine, mining method, coal<br />

type, transportation method and Tons sold in 2010. The mines are sorted by Tons sold within each mining segment.<br />

Mine Location Mine Type Mining Method Coal Type<br />

Transport<br />

Method<br />

2010 Tons Sold<br />

(in millions)<br />

Western U.S. Mining<br />

North Antelope Rochelle Wright, WY S DL, T/S Thermal R 105.8<br />

Caballo Gillette, WY S D,T/S Thermal R 23.5<br />

Rawhide Gillette, WY S D, T/S Thermal R 11.3<br />

Twenty mile Oak Creek, CO U LW Thermal R, T 7.1<br />

Kayenta Kayenta, AZ S DL, T/S Thermal R 7.8<br />

El Segundo Grants, NM S T/S Thermal R 6.6<br />

Lee Ranch Grants, NM S DL, T/S Thermal R 1.7<br />

Midwestern U.S. Mining<br />

Somerville Central Oakland City, IN S DL, D, T/S Thermal R, T/R, T/B 3.3<br />

Viking - Corning Pit Cannelburg, IN S D, T/S Thermal T, T/R 3.2<br />

Gateway Coulterville, IL U CM Thermal T, R, R/B 3.0<br />

Willow Lake Equality, IL U CM Thermal T/B 2.9<br />

Bear Run Sullivan County, IN S DL, D, T/S Thermal T, R 2.8<br />

Francisco Underground Francisco, IN U CM Thermal R 2.7<br />

Cottage Grove Equality, IL S D, T/S Thermal T/B 2.1<br />

Somerville North (1) Oakland City, IN S D, T/S Thermal R, T/R, T/B 2.0<br />

Somerville South (1) Oakland City, IN S D, T/S Thermal R, T/R, T/B 1.7<br />

Air Quality Vincennes, IN U CM Thermal T, T/R, T/B 1.1<br />

Wildcat Hills Underground Eldorado, IL U CM Thermal T/B 0.7<br />

Wild Boar Lynville, IN S D, T/S Thermal T, R, R/B 0.1<br />

Other (2) – – – – – 4.1<br />

Australian Mining<br />

Wilpinjong* Wilpinjong, New South Wales S T/S Thermal R, EV 9.2<br />

North Wambo Underground (1) Warkworth, New South Wales U LW Thermal/Met** R, EV 3.6<br />

Wambo Open-Cut (1) * Warkworth, New South Wales S T/S Thermal R, EV 3.0<br />

Burton* (3) Glenden, Queensland S T/S Thermal/Met** R, EV 2.6<br />

North Goonyella Glenden, Queensland U LW Met** R, EV 2.5<br />

Wilkie Creek Macalister, Queensland S T/S Thermal R, EV 1.7<br />

Metropolitan Helensburgh, New South Wales U LW Met** R, EV 1.7<br />

Millennium* Moranbah, Queensland S T/S Met** R, EV 1.6<br />

Eagle field* Glenden, Queensland S T/S Met** R, EV 1.1<br />

Legend:<br />

S Surface Mine R Rail<br />

U Underground Mine T Truck<br />

DL Dragline R/B Rail and Barge<br />

D Dozer/Casting T/B Truck and Barge<br />

T/S Truck and Shovel T/R Truck and Rail<br />

LW Longwall EV Export Vessel<br />

CM Continuous Miner<br />

Thermal Thermal/Steam<br />

* Mine is operated by a contract miner Met Metallurgical<br />

** Metallurgical coals range from pulverized coal injection (PCI) to high quality hard coking coal on the heat value scale.<br />

Notes:<br />

(1) Represents mines that have non-controlling ownership interests.<br />

(2) “Other” in Midwestern U.S. Mining primarily consists of purchased coal used to satisfy certain coal supply agreements and shipments made from operations closed during 2010.<br />

(3) The Burton Mine is a 95% proportionally owned and consolidated mine.<br />

15

4.4 Directors of <strong>Peabody</strong> <strong>Energy</strong><br />

Brief profiles of the directors of <strong>Peabody</strong> <strong>Energy</strong> at the date of this<br />

Bidder’s <strong>Statement</strong> are set out below.<br />

Gregory H. Boyce, Chairman and Chief Executive Officer<br />

Gregory H. Boyce was elected Chairman of the board of directors<br />

of <strong>Peabody</strong> <strong>Energy</strong> on 10 October 2007 and has been a director<br />

of the company since March 2005. He was named Chief Executive<br />

Officer Elect in March 2005, and assumed the position of Chief<br />

Executive Officer in January 2006. Mr. Boyce served as President<br />

from October 2003 to December 2007 and as Chief Operating<br />

Officer from October 2003 to December 2005. He previously served<br />

as Chief Executive — <strong>Energy</strong> of Rio Tinto plc from 2000 to 2003.<br />

Other prior positions include President and Chief Executive Officer<br />

of Kennecott <strong>Energy</strong> Company from 1994 to 1999 and President of<br />

Kennecott Minerals Company from 1993 to 1994. He has extensive<br />

engineering and operating experience with Kennecott and also<br />

served as Executive Assistant to the Vice Chairman of Standard<br />

Oil of Ohio from 1983 to 1984. Mr. Boyce serves on the board of<br />

directors of Marathon Oil Corporation. He is Chairman of the National<br />

Mining Association and a member of the World Coal Association, the<br />

National Coal Council and the Coal Industry Advisory Board of the<br />

International <strong>Energy</strong> Agency. He is a Board member of the Business<br />

Roundtable and the American Coalition for Clean Coal Electricity.<br />

He is a member of the Business Council; Civic Progress in St. Louis;<br />

the Board of Trustees of St. Louis Children’s Hospital; the Board<br />

of Trustees of Washington University in St. Louis; and the Advisory<br />

Council of the University of Arizona’s Department of Mining and<br />

Geological Engineering.<br />

William A. Coley, Independent Director<br />

Mr. Coley has been a director of <strong>Peabody</strong> <strong>Energy</strong> since March<br />

2004. From March 2005 to July 2009, Mr. Coley served as<br />

Chief Executive Officer and Director of British <strong>Energy</strong> Group plc,<br />

the U.K.’s largest electricity producer. He was previously a nonexecutive<br />

director of British <strong>Energy</strong>. Mr. Coley served as President<br />

of Duke Power, the U.S.-based global energy company, from 1997<br />

until his retirement in February 2003. During his 37-year career at<br />

Duke Power, Mr. Coley held various officer level positions in the<br />

engineering, operations and senior management areas, including Vice<br />

President, Operations (1984-1986), Vice President, Central Division<br />

(1986-1988), Senior Vice President, Power Delivery (1988-1990),<br />

Senior Vice President, Customer Operations (1990-1991), Executive<br />

Vice President, Customer Group (1991-1994) and President,<br />

Associated Enterprises Group (1994-1997). Mr. Coley was elected<br />

to the board of Duke Power in 1990 and was named President<br />

following Duke Power’s acquisition of Pan<strong>Energy</strong> in 1997. Mr. Coley<br />

earned his B.S. in electrical engineering from Georgia Institute of<br />

Technology and is a registered professional engineer. He is also a<br />

director of E.R. Jahna Enterprises. Mr. Coley previously served as a<br />

director of British <strong>Energy</strong> Group plc, CT Communications, Inc. and<br />

SouthTrust Bank.<br />

William E. James, Independent Director<br />

Mr. James has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2001.<br />

Since July 2000, Mr. James has been co-founder and Managing<br />

General Partner of RockPort Capital Partners LLC, a venture capital<br />

fund specializing in energy and power, advanced materials, process<br />

and prevention technologies, transportation and green building<br />

technologies. Prior to joining RockPort, Mr. James co-founded<br />

and served as Chairman and Chief Executive Officer of Citizens<br />

Power LLC, the nation’s first and a leading power marketer. He also<br />

co-founded the non-profit Citizens <strong>Energy</strong> Corporation and served as<br />

the Chairman and Chief Executive Officer of Citizens Corporation, its<br />

for-profit holding company, from 1987 to 1996. Mr. James is also a<br />

director of Ener1, Inc.<br />

Robert B. Karn III, Independent Director<br />

Mr. Karn has been a director of <strong>Peabody</strong> <strong>Energy</strong> since January<br />

2003. Mr. Karn is a financial consultant and former managing<br />

partner in financial and economic consulting with Arthur Andersen<br />

LLP in St. Louis. Before retiring from Arthur Andersen in 1998,<br />

Mr. Karn served in a variety of accounting, audit and financial roles<br />

over a 33-year career, including Managing Partner in charge of<br />

the global coal mining practice from 1981 through 1998. He is a<br />

Certified Public Accountant and has served as a Panel Arbitrator<br />

with the American Arbitration Association. Mr. Karn is also a director<br />

of Natural Resource Partners L.P., a master limited partnership<br />

that is listed on the NYSE, Kennedy Capital Management, Inc.<br />

and numerous NYSE-listed closed-end mutual and exchange<br />

traded funds under the Guggenheim Financial Family of Funds. He<br />

previously served as a director of the Fiduciary/Claymore Dynamic<br />

Equity Fund.<br />

M. Frances Keeth, Independent Director<br />

Mrs. Keeth has been a director of <strong>Peabody</strong> <strong>Energy</strong> since March 2009.<br />

She was Executive Vice President of Royal Dutch Shell, plc, and Chief<br />

Executive Officer and President of Shell Chemicals Limited, a services<br />

company responsible for Royal Dutch Shell’s global petrochemical<br />

businesses, from January 2005 to December 2006. She served<br />

as Executive Vice President of Customer Fulfilment and Product<br />

Business Units for Shell Chemicals Limited from July 2001 to January<br />

2005 and was President and Chief Executive Officer of Shell Chemical<br />

LP, a U.S. petrochemical member of the Royal Dutch/Shell Group,<br />

from July 2001 to July 2006. Mrs. Keeth also serves as a director<br />

of Verizon Communications Inc. and Arrow Electronics Inc. She has<br />

been a member of the Advisory Board of the Bauer Business School,<br />

University of Houston, since 2002.<br />

Henry E. Lentz, Independent Director<br />

Mr. Lentz has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

February 1998. Mr. Lentz was a Managing Director of Lazard<br />

Frères & Co, an investment banking firm from June 2009 to<br />

May 2011. He was Managing Director of Barclays Capital, an<br />

investment banking firm and successor to Lehman Brothers Inc.,<br />

an investment banking firm, from September 2008 to June 2009.<br />

From January 2004 to September 2008 he was employed as<br />

an Advisory Director by Lehman Brothers. He joined Lehman<br />

Brothers Inc. in 1971 and became a Managing Director in 1976.<br />

He left the firm in 1988 to become Vice Chairman of Wasserstein<br />

Perella Group, Inc., an investment banking firm. In 1993, he<br />

returned to Lehman Brothers Inc. as a Managing Director and<br />

served as head of the firm’s worldwide energy practice. In 1996,<br />

he joined Lehman Brothers Inc.’s Merchant Banking Group as<br />

a Principal and in January 2003 became a consultant to the<br />

Merchant Banking Group. Mr. Lentz is also the non-executive<br />

Chairman of Rowan Companies, Inc. and a director of CARBO<br />

Ceramics, Inc.<br />

Robert A. Malone, Independent Director<br />

Mr. Malone has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2009.<br />

Mr. Malone was elected as President and Chief Executive Officer of<br />

the First National Bank of Sonora, Texas in October 2009. He is a<br />

retired Executive Vice President of BP plc and a retired Chairman of<br />

the Board and President of BP America Inc., at the time the largest<br />

producer of oil and natural gas and the second largest gasoline<br />

retailer in the United States. He served in that position from 2006<br />

to 2009. Mr. Malone previously served as Chief Executive Officer<br />

of BP Shipping Limited from 2002 to 2006, as Regional President<br />

Western United States, BP America Inc. from 2000 to 2002 and as<br />

President, Chief Executive Officer and Chief Operating Officer, Alyeska<br />

Pipeline Service Company from 1996 to 2000. He is also a director of<br />

Halliburton Company and the First National Bank of Sonora.<br />

16

William C. Rusnack, Independent Director<br />

Mr. Rusnack has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

January 2002. Mr. Rusnack is the former President and Chief<br />

Executive Officer of Premcor Inc., one of the largest independent oil<br />

refiners in the United States prior to its acquisition by Valero <strong>Energy</strong><br />

Corporation in 2005. He served as President, Chief Executive Officer<br />

and Director of Premcor from 1998 to February 2002. Prior to joining<br />

Premcor, Mr. Rusnack was President of ARCO Products Company,<br />

the refining and marketing division of Atlantic Richfield Company.<br />

During a 31-year career at ARCO, he was also President of ARCO<br />

Transportation Company and Vice President of Corporate Planning.<br />

He is also a director of Sempra <strong>Energy</strong>, Flowserve Corporation and<br />

Solutia Inc.<br />

John F. Turner, Independent Director<br />

Mr. Turner has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2005.<br />

Mr. Turner served as Assistant Secretary of State for the Bureau of<br />

Oceans and International Environmental and Scientific Affairs from<br />

November 2001 to July 2005. Mr. Turner was previously President<br />

and Chief Executive Officer of The Conservation Fund, a national<br />

non-profit organization dedicated to public-private partnerships to<br />

protect land and water resources. He was director of the U.S. Fish<br />

and Wildlife Service from 1989 to 1993. Mr. Turner also served in<br />

the Wyoming state legislature for 19 years and is a past president<br />

of the Wyoming State Senate. He serves as a consultant to The<br />

Conservation Fund. Mr. Turner also serves as Chairman of the<br />

University of Wyoming, Ruckelshaus Institute of Environment and<br />

Natural Resources. He is also a director of International Paper<br />

Company, American Electric Power Company, Inc. and Ashland, Inc.<br />

Sandra A. Van Trease, Independent Director<br />

Ms. Van Trease has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

January 2003. Ms. Van Trease is Group President, BJC HealthCare,<br />

a position she has held since September 2004. BJC HealthCare<br />

is one of the nation’s largest non-profit healthcare organizations,<br />

delivering services to residents in the greater St. Louis, southern<br />

Illinois and mid-Missouri regions. Prior to joining BJC HealthCare,<br />

Ms. Van Trease served as President and Chief Executive Officer<br />

of UNICARE, an operating affiliate of WellPoint Health Networks<br />

Inc., from 2002 to September 2004. Ms. Van Trease also served<br />

as President, Chief Financial Officer and Chief Operating Officer<br />

of RightCHOICE Managed Care, Inc. from 2000 to 2002 and as<br />

Executive Vice President, Chief Financial Officer and Chief Operating<br />

Officer from 1997 to 2000. Prior to joining RightCHOICE in 1994,<br />

she was a Senior Audit Manager with Price Waterhouse LLP.<br />

She is a Certified Public Accountant and Certified Management<br />

Accountant. Ms. Van Trease is also a director of Enterprise Financial<br />

Services Corporation.<br />

Alan H. Washkowitz, Independent Director<br />

Mr. Washkowitz has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

May 1998. Until July 2005, Mr. Washkowitz was a Managing<br />

Director of Lehman Brothers Inc. and part of the firm’s Merchant<br />

Banking Group, responsible for oversight of Lehman Brothers Inc.’s<br />

Merchant Banking Partners. He joined Kuhn Loeb & Co. in 1968<br />

and became a general partner of Lehman Brothers Inc. in 1978<br />

when it acquired Kuhn Loeb & Co. Prior to joining the Merchant<br />

Banking Group, he headed Lehman Brothers Inc.’s Financial<br />

Restructuring Group. Mr. Washkowitz is also a director of L-3<br />

Communications Corporation.<br />

4.5 Historical financial information on<br />

<strong>Peabody</strong> <strong>Energy</strong><br />

(a) Basis of presentation<br />

The historical financial information presented below is a summary<br />

only and the full financial accounts for <strong>Peabody</strong> <strong>Energy</strong> for the<br />

financial periods described below, which include the notes to<br />

the accounts, can be found in <strong>Peabody</strong> <strong>Energy</strong>’s annual report<br />

on Form 10-K for the year ended 31 December 2010 as filed<br />

with the SEC and the current report on Form 8-K that set forth<br />

financial results of <strong>Peabody</strong> <strong>Energy</strong> for the three and six months<br />

ended 30 June 2011 as furnished to the SEC.<br />

(b) Condensed consolidated balance sheets<br />

The condensed consolidated balance sheets of <strong>Peabody</strong> <strong>Energy</strong><br />

as at 31 December 2010 and 31 December 2009 presented<br />

below have been extracted from the consolidated financial<br />

statements in <strong>Peabody</strong> <strong>Energy</strong>’s annual report on Form 10-K for<br />

the year ended 31 December 2010. The condensed consolidated<br />

balance sheet as at 30 June 2011 has been extracted from the<br />

consolidated financial statements in <strong>Peabody</strong> <strong>Energy</strong>’s current<br />

report on Form 8-K that set forth financial results of <strong>Peabody</strong><br />

<strong>Energy</strong> for the three and six months ended 30 June 2011. These<br />

statements were prepared in accordance with U.S. generally<br />

accepted accounting principles (not AIFRS). The dollar amounts<br />

are presented in U.S. dollars. <strong>Peabody</strong> <strong>Energy</strong> will be filing its<br />

financial results with the SEC for the three and six months ended<br />

30 June 2011 on Form 10-Q on or before 10 August 2011.<br />

17

At 30 June 2011<br />

(US$ millions)<br />

(Unaudited)<br />

At 31 Dec 2010<br />

(US$ millions)<br />

(Audited)<br />

At 31 Dec 2009<br />

(US$ millions)<br />

(Audited)<br />

ASSETS<br />

Current assets<br />

Cash and cash equivalents 1,176.9 1,295.2 988.8<br />

Short-term investments 75.0 – –<br />

Accounts receivables, net 644.8 558.2 303.0<br />

Inventories 374.0 332.9 325.1<br />

Assets from coal trading activities, net 109.2 192.5 276.8<br />

Deferred income taxes 103.5 120.4 40.0<br />

Other current assets 627.0 459.0 255.3<br />

Total current assets 3,110.4 2,958.2 2,189.0<br />

Property, plant, equipment and mine development, net 7,584.0 7,426.1 7,261.5<br />

Investments and other assets 1,051.2 978.8 504.8<br />

Total assets 11,745.6 11,363.1 9,955.3<br />

LIABILITIES AND STOCKHOLDERS’ EQUITY<br />

Current liabilities<br />

Current maturities of long-term debt 43.8 43.2 14.1<br />

Liabilities from coal trading activities, net 106.1 181.7 110.6<br />

Accounts payable and accrued expenses 1,335.6 1,288.8 1,187.7<br />

Total current liabilities 1,485.5 1,513.7 1,312.4<br />

Long-term debt, less current maturities 2,468.2 2,706.8 2,738.2<br />