Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ecame Vice President for Finance ten years later and in 2007<br />

became Chairman and Chief Executive Officer. Before this, Mr. Lafont<br />

had been working as the Group Chief Operating Officer. On becoming<br />

the Chief Executive Officer, he launched the “Excellence 2008”<br />

strategic plan, aimed at making Lafarge the best in its sector.<br />

In December 2008, he announced the acquisition of Orascom<br />

Cement, the leading cement player in the Middle East and the<br />

Mediterranean basin, therefore accelerating Lafarge’s development in<br />

emerging markets.<br />

Mr. Lafont is the co-chairman of the World Business Council for<br />

Sustainable Development’s Cement Sustainability Initiative, which<br />

brings together major cement companies from around the world. He<br />

also co-chairs the <strong>Energy</strong> Efficiency in Buildings initiative launched<br />

with United Technologies under the aegis of the World Business<br />

Council for Sustainable Development. He is a special adviser to the<br />

mayor of Chongqing, a Chinese city with 32 million inhabitants.<br />

Mr. Lafont is a member of the board of directors of Electrìté de<br />

France, the largest French electricity utility.<br />

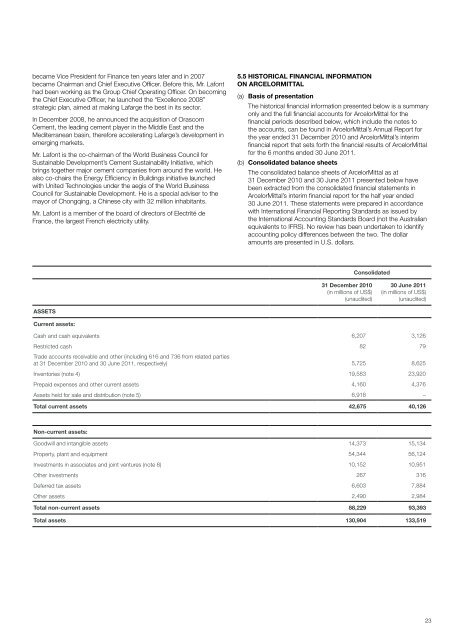

5.5 Historical financial information<br />

on ArcelorMittal<br />

(a) Basis of presentation<br />

The historical financial information presented below is a summary<br />

only and the full financial accounts for ArcelorMittal for the<br />

financial periods described below, which include the notes to<br />

the accounts, can be found in ArcelorMittal’s Annual Report for<br />

the year ended 31 December 2010 and ArcelorMittal’s interim<br />

financial report that sets forth the financial results of ArcelorMittal<br />

for the 6 months ended 30 June 2011.<br />

(b) Consolidated balance sheets<br />

The consolidated balance sheets of ArcelorMittal as at<br />

31 December 2010 and 30 June 2011 presented below have<br />

been extracted from the consolidated financial statements in<br />

ArcelorMittal’s interim financial report for the half year ended<br />

30 June 2011. These statements were prepared in accordance<br />

with International Financial Reporting Standards as issued by<br />

the International Accounting Standards Board (not the Australian<br />

equivalents to IFRS). No review has been undertaken to identify<br />

accounting policy differences between the two. The dollar<br />

amounts are presented in U.S. dollars.<br />

Consolidated<br />

31 December 2010<br />

(in millions of US$)<br />

(unaudited)<br />

30 June 2011<br />

(in millions of US$)<br />

(unaudited)<br />

ASSETS<br />

Current assets:<br />

Cash and cash equivalents 6,207 3,126<br />

Restricted cash 82 79<br />

Trade accounts receivable and other (including 616 and 736 from related parties<br />

at 31 December 2010 and 30 June 2011, respectively) 5,725 8,625<br />

Inventories (note 4) 19,583 23,920<br />

Prepaid expenses and other current assets 4,160 4,376<br />

Assets held for sale and distribution (note 5) 6,918 –<br />

Total current assets 42,675 40,126<br />

Non-current assets:<br />

Goodwill and intangible assets 14,373 15,134<br />

Property, plant and equipment 54,344 56,124<br />

Investments in associates and joint ventures (note 8) 10,152 10,951<br />

Other investments 267 316<br />

Deferred tax assets 6,603 7,884<br />

Other assets 2,490 2,984<br />

Total non-current assets 88,229 93,393<br />

Total assets 130,904 133,519<br />

23