Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1.4 You will still receive value for any final dividend declared<br />

Macarthur Shareholders will be entitled to retain any final dividend declared by Macarthur in respect of the financial year ended 30 June 2011,<br />

up to an amount equal to A$0.16 per Share, in respect of the Shares of which they are the registered holder as at the record date for the<br />

dividend, without there being any reduction in the consideration payable under the Offer. 8<br />

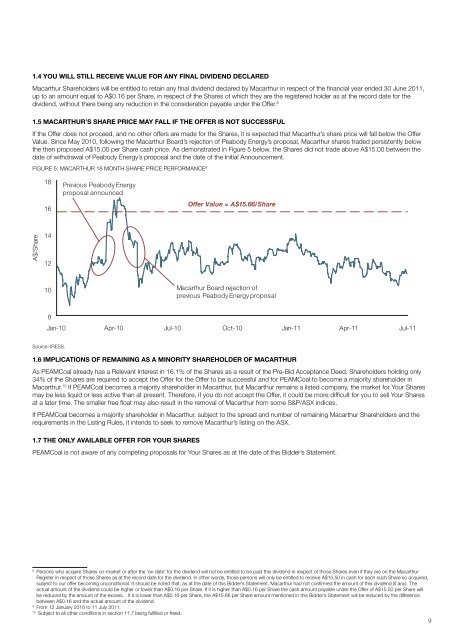

1.5 Macarthur’s share price may fall if the Offer is not successful<br />

If the Offer does not proceed, and no other offers are made for the Shares, it is expected that Macarthur’s share price will fall below the Offer<br />

Value. Since May 2010, following the Macarthur Board’s rejection of <strong>Peabody</strong> <strong>Energy</strong>’s proposal, Macarthur shares traded persistently below<br />

the then proposed A$15.00 per Share cash price. As demonstrated in Figure 5 below, the Shares did not trade above A$15.00 between the<br />

date of withdrawal of <strong>Peabody</strong> <strong>Energy</strong>’s proposal and the date of the Initial Announcement.<br />

Figure 5: Macarthur 18 month Share price performance 9<br />

18<br />

16<br />

Previous <strong>Peabody</strong> <strong>Energy</strong><br />

proposal announced<br />

Offer Value = A$15.66/Share<br />

A$/Share<br />

14<br />

12<br />

10<br />

Macarthur Board rejection of<br />

previous <strong>Peabody</strong> <strong>Energy</strong> proposal<br />

8<br />

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

Source: IRESS.<br />

1.6 Implications of remaining as a minority shareholder of Macarthur<br />

As PEAMCoal already has a Relevant Interest in 16.1% of the Shares as a result of the Pre-Bid Acceptance Deed, Shareholders holding only<br />

34% of the Shares are required to accept the Offer for the Offer to be successful and for PEAMCoal to become a majority shareholder in<br />

Macarthur. 10 If PEAMCoal becomes a majority shareholder in Macarthur, but Macarthur remains a listed company, the market for Your Shares<br />

may be less liquid or less active than at present. Therefore, if you do not accept the Offer, it could be more difficult for you to sell Your Shares<br />

at a later time. The smaller free float may also result in the removal of Macarthur from some S&P/ASX indices.<br />

If PEAMCoal becomes a majority shareholder in Macarthur, subject to the spread and number of remaining Macarthur Shareholders and the<br />

requirements in the Listing Rules, it intends to seek to remove Macarthur’s listing on the ASX.<br />

1.7 The only available offer for Your Shares<br />

PEAMCoal is not aware of any competing proposals for Your Shares as at the date of this Bidder’s <strong>Statement</strong>.<br />

8<br />

Persons who acquire Shares on-market or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those Shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the Offer of A$15.50 per Share will<br />

be reduced by the amount of the excess. . If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference<br />

between A$0.16 and the actual amount of the dividend.<br />

9<br />

From 12 January 2010 to 11 July 2011.<br />

10<br />

Subject to all other conditions in section 11.7 being fulfilled or freed.<br />

9