Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In contrast, if you accept the Offer, and the Offer becomes unconditional, you will receive assured value for your investment and you will transfer<br />

to PEAMCoal all the potential risks and uncertainties inherent in Macarthur and its assets.<br />

The risks and uncertainties you will avoid by accepting the Offer include:<br />

(a) Operational and marketing risk: Unexpected operational and marketing issues, such as adverse weather events (including the recent<br />

floods in Queensland) and a reduction in global demand for low volatile pulverised coal injection coal (LV PCI), have historically affected<br />

Macarthur’s operations due to their lack of geographical and product diversification. There is a risk that further such issues could impact<br />

Macarthur’s operations and earnings in the future.<br />

(b) Coal price and foreign exchange volatility: Macarthur’s coal sales are generally priced in US dollars. Macarthur is therefore exposed to<br />

fluctuations in coal prices and foreign exchange rates. Although quarterly LV PCI contracts have recently been agreed at historically high<br />

prices, coal prices remain volatile and there is no assurance they will remain at high levels.<br />

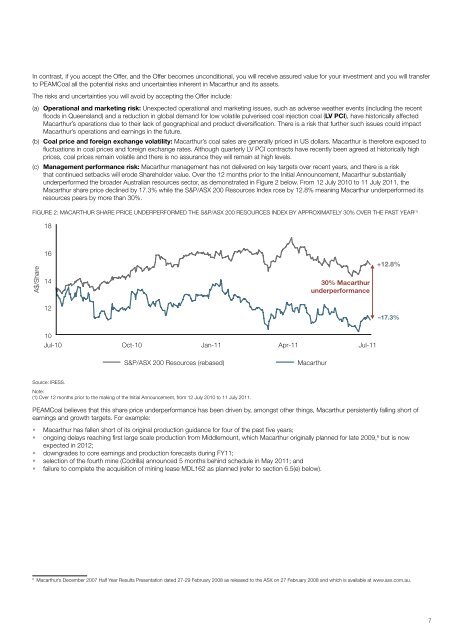

(c) Management performance risk: Macarthur management has not delivered on key targets over recent years, and there is a risk<br />

that continued setbacks will erode Shareholder value. Over the 12 months prior to the Initial Announcement, Macarthur substantially<br />

underperformed the broader Australian resources sector, as demonstrated in Figure 2 below. From 12 July 2010 to 11 July 2011, the<br />

Macarthur share price declined by 17.3% while the S&P/ASX 200 Resources Index rose by 12.8% meaning Macarthur underperformed its<br />

resources peers by more than 30%.<br />

Figure 2: Macarthur share price underperformed the S&P/ASX 200 Resources Index by approximately 30% over the past year (1)<br />

18<br />

16<br />

A$/Share<br />

14<br />

30% Macarthur<br />

underperformance<br />

+12.8%<br />

12<br />

–17.3%<br />

10<br />

Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

S&P/ASX 200 Resources (rebased)<br />

Macarthur<br />

Source: IRESS.<br />

Note:<br />

(1) Over 12 months prior to the making of the Initial Announcement, from 12 July 2010 to 11 July 2011.<br />

PEAMCoal believes that this share price underperformance has been driven by, amongst other things, Macarthur persistently falling short of<br />

earnings and growth targets. For example:<br />

• Macarthur has fallen short of its original production guidance for four of the past five years;<br />

• ongoing delays reaching first large scale production from Middlemount, which Macarthur originally planned for late 2009, 6 but is now<br />

expected in 2012;<br />

• downgrades to core earnings and production forecasts during FY11;<br />

• selection of the fourth mine (Codrilla) announced 5 months behind schedule in May 2011; and<br />

• failure to complete the acquisition of mining lease MDL162 as planned (refer to section 6.5(e) below).<br />

6<br />

Macarthur’s December 2007 Half Year Results Presentation dated 27-29 February 2008 as released to the ASX on 27 February 2008 and which is available at www.asx.com.au.<br />

7