Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

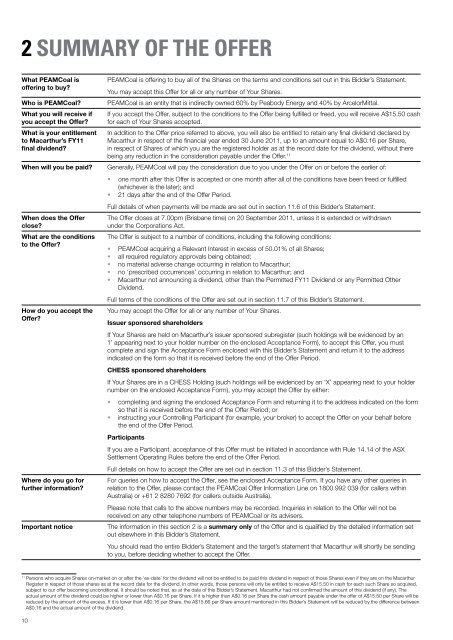

2 Summary of the Offer<br />

What PEAMCoal is<br />

offering to buy?<br />

Who is PEAMCoal?<br />

What you will receive if<br />

you accept the Offer?<br />

What is your entitlement<br />

to Macarthur’s FY11<br />

final dividend?<br />

When will you be paid?<br />

When does the Offer<br />

close?<br />

What are the conditions<br />

to the Offer?<br />

How do you accept the<br />

Offer?<br />

Where do you go for<br />

further information?<br />

Important notice<br />

PEAMCoal is offering to buy all of the Shares on the terms and conditions set out in this Bidder’s <strong>Statement</strong>.<br />

You may accept this Offer for all or any number of Your Shares.<br />

PEAMCoal is an entity that is indirectly owned 60% by <strong>Peabody</strong> <strong>Energy</strong> and 40% by ArcelorMittal.<br />

If you accept the Offer, subject to the conditions to the Offer being fulfilled or freed, you will receive A$15.50 cash<br />

for each of Your Shares accepted.<br />

In addition to the Offer price referred to above, you will also be entitled to retain any final dividend declared by<br />

Macarthur in respect of the financial year ended 30 June 2011, up to an amount equal to A$0.16 per Share,<br />

in respect of Shares of which you are the registered holder as at the record date for the dividend, without there<br />

being any reduction in the consideration payable under the Offer. 11<br />

Generally, PEAMCoal will pay the consideration due to you under the Offer on or before the earlier of:<br />

• one month after this Offer is accepted or one month after all of the conditions have been freed or fulfilled<br />

(whichever is the later); and<br />

• 21 days after the end of the Offer Period.<br />

Full details of when payments will be made are set out in section 11.6 of this Bidder’s <strong>Statement</strong>.<br />

The Offer closes at 7.00pm (Brisbane time) on 20 September 2011, unless it is extended or withdrawn<br />

under the Corporations Act.<br />

The Offer is subject to a number of conditions, including the following conditions:<br />

• PEAMCoal acquiring a Relevant Interest in excess of 50.01% of all Shares;<br />

• all required regulatory approvals being obtained;<br />

• no material adverse change occurring in relation to Macarthur;<br />

• no ‘prescribed occurrences’ occurring in relation to Macarthur; and<br />

• Macarthur not announcing a dividend, other than the Permitted FY11 Dividend or any Permitted Other<br />

Dividend.<br />

Full terms of the conditions of the Offer are set out in section 11.7 of this Bidder’s <strong>Statement</strong>.<br />

You may accept the Offer for all or any number of Your Shares.<br />

Issuer sponsored shareholders<br />

If Your Shares are held on Macarthur’s issuer sponsored subregister (such holdings will be evidenced by an<br />

‘I’ appearing next to your holder number on the enclosed Acceptance Form), to accept this Offer, you must<br />

complete and sign the Acceptance Form enclosed with this Bidder’s <strong>Statement</strong> and return it to the address<br />

indicated on the form so that it is received before the end of the Offer Period.<br />

CHESS sponsored shareholders<br />

If Your Shares are in a CHESS Holding (such holdings will be evidenced by an ‘X’ appearing next to your holder<br />

number on the enclosed Acceptance Form), you may accept the Offer by either:<br />

• completing and signing the enclosed Acceptance Form and returning it to the address indicated on the form<br />

so that it is received before the end of the Offer Period; or<br />

• instructing your Controlling Participant (for example, your broker) to accept the Offer on your behalf before<br />

the end of the Offer Period.<br />

Participants<br />

If you are a Participant, acceptance of this Offer must be initiated in accordance with Rule 14.14 of the ASX<br />

Settlement Operating Rules before the end of the Offer Period.<br />

Full details on how to accept the Offer are set out in section 11.3 of this Bidder’s <strong>Statement</strong>.<br />

For queries on how to accept the Offer, see the enclosed Acceptance Form. If you have any other queries in<br />

relation to the Offer, please contact the PEAMCoal Offer Information Line on 1800 992 039 (for callers within<br />

Australia) or +61 2 8280 7692 (for callers outside Australia).<br />

Please note that calls to the above numbers may be recorded. Inquiries in relation to the Offer will not be<br />

received on any other telephone numbers of PEAMCoal or its advisers.<br />

The information in this section 2 is a summary only of the Offer and is qualified by the detailed information set<br />

out elsewhere in this Bidder’s <strong>Statement</strong>.<br />

You should read the entire Bidder’s <strong>Statement</strong> and the target’s statement that Macarthur will shortly be sending<br />

to you, before deciding whether to accept the Offer.<br />

11<br />

Persons who acquire Shares on-market on or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the offer of A$15.50 per Share will be<br />

reduced by the amount of the excess. If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference between<br />

A$0.16 and the actual amount of the dividend.<br />

10