Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

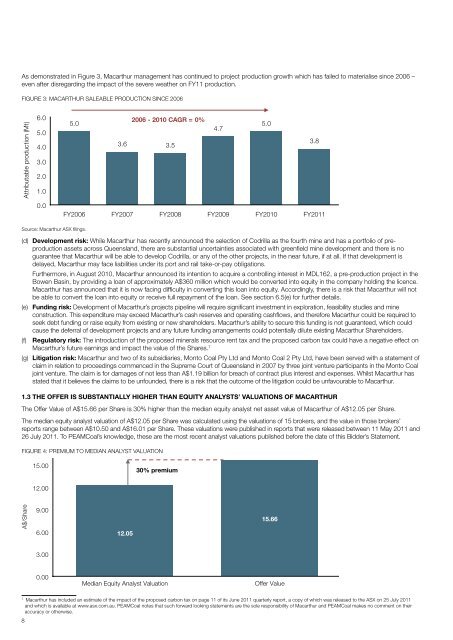

As demonstrated in Figure 3, Macarthur management has continued to project production growth which has failed to materialise since 2006 –<br />

even after disregarding the impact of the severe weather on FY11 production.<br />

Figure 3: Macarthur saleable production since 2006<br />

Attributable production (Mt)<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

5.0<br />

2006 - 2010 CAGR = 0%<br />

3.6 3.5<br />

4.7<br />

5.0<br />

3.8<br />

0.0<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011<br />

Source: Macarthur ASX filings.<br />

(d) Development risk: While Macarthur has recently announced the selection of Codrilla as the fourth mine and has a portfolio of preproduction<br />

assets across Queensland, there are substantial uncertainties associated with greenfield mine development and there is no<br />

guarantee that Macarthur will be able to develop Codrilla, or any of the other projects, in the near future, if at all. If that development is<br />

delayed, Macarthur may face liabilities under its port and rail take-or-pay obligations.<br />

Furthermore, in August 2010, Macarthur announced its intention to acquire a controlling interest in MDL162, a pre-production project in the<br />

Bowen Basin, by providing a loan of approximately A$360 million which would be converted into equity in the company holding the licence.<br />

Macarthur has announced that it is now facing difficulty in converting this loan into equity. Accordingly, there is a risk that Macarthur will not<br />

be able to convert the loan into equity or receive full repayment of the loan. See section 6.5(e) for further details.<br />

(e) Funding risk: Development of Macarthur’s projects pipeline will require significant investment in exploration, feasibility studies and mine<br />

construction. This expenditure may exceed Macarthur’s cash reserves and operating cashflows, and therefore Macarthur could be required to<br />

seek debt funding or raise equity from existing or new shareholders. Macarthur’s ability to secure this funding is not guaranteed, which could<br />

cause the deferral of development projects and any future funding arrangements could potentially dilute existing Macarthur Shareholders.<br />

(f) Regulatory risk: The introduction of the proposed minerals resource rent tax and the proposed carbon tax could have a negative effect on<br />

Macarthur’s future earnings and impact the value of the Shares. 7<br />

(g) Litigation risk: Macarthur and two of its subsidiaries, Monto Coal Pty Ltd and Monto Coal 2 Pty Ltd, have been served with a statement of<br />

claim in relation to proceedings commenced in the Supreme Court of Queensland in 2007 by three joint venture participants in the Monto Coal<br />

joint venture. The claim is for damages of not less than A$1.19 billion for breach of contract plus interest and expenses. Whilst Macarthur has<br />

stated that it believes the claims to be unfounded, there is a risk that the outcome of the litigation could be unfavourable to Macarthur.<br />

1.3 The Offer is substantially higher than equity analysts’ valuations of Macarthur<br />

The Offer Value of A$15.66 per Share is 30% higher than the median equity analyst net asset value of Macarthur of A$12.05 per Share.<br />

The median equity analyst valuation of A$12.05 per Share was calculated using the valuations of 15 brokers, and the value in those brokers’<br />

reports range between A$10.50 and A$16.01 per Share. These valuations were published in reports that were released between 11 May 2011 and<br />

26 July 2011. To PEAMCoal’s knowledge, these are the most recent analyst valuations published before the date of this Bidder’s <strong>Statement</strong>.<br />

Figure 4: Premium to median analyst valuation<br />

15.00<br />

30% premium<br />

12.00<br />

A$/Share<br />

9.00<br />

6.00<br />

12.05<br />

15.66<br />

3.00<br />

0.00<br />

Median Equity Analyst Valuation<br />

Offer Value<br />

7<br />

Macarthur has included an estimate of the impact of the proposed carbon tax on page 11 of its June 2011 quarterly report, a copy of which was released to the ASX on 25 July 2011<br />

and which is available at www.asx.com.au. PEAMCoal notes that such forward looking statements are the sole responsibility of Macarthur and PEAMCoal makes no comment on their<br />

accuracy or otherwise.<br />

8