Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

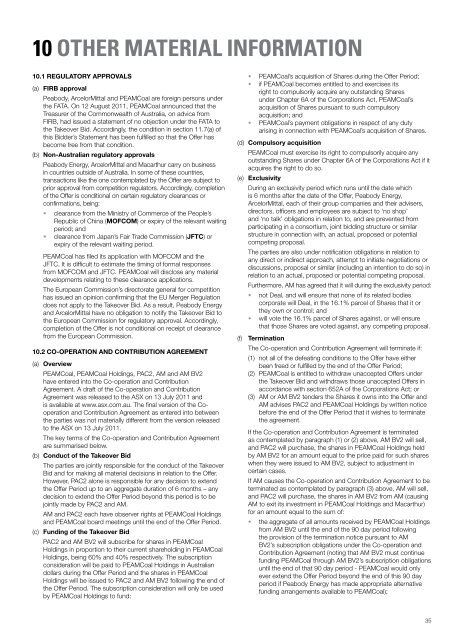

10 Other material information<br />

10.1 Regulatory approvals<br />

(a) FIRB approval<br />

<strong>Peabody</strong>, ArcelorMittal and PEAMCoal are foreign persons under<br />

the FATA. On 12 August 2011, PEAMCoal announced that the<br />

Treasurer of the Commonwealth of Australia, on advice from<br />

FIRB, had issued a statement of no objection under the FATA to<br />

the Takeover Bid. Accordingly, the condition in section 11.7(a) of<br />

this Bidder’s <strong>Statement</strong> has been fulfilled so that the Offer has<br />

become free from that condition.<br />

(b) Non-Australian regulatory approvals<br />

<strong>Peabody</strong> <strong>Energy</strong>, ArcelorMittal and Macarthur carry on business<br />

in countries outside of Australia. In some of these countries,<br />

transactions like the one contemplated by the Offer are subject to<br />

prior approval from competition regulators. Accordingly, completion<br />

of the Offer is conditional on certain regulatory clearances or<br />

confirmations, being:<br />

• clearance from the Ministry of Commerce of the People’s<br />

Republic of China (MOFCOM) or expiry of the relevant waiting<br />

period; and<br />

• clearance from Japan’s Fair Trade Commission (JFTC) or<br />

expiry of the relevant waiting period.<br />

PEAMCoal has filed its application with MOFCOM and the<br />

JFTC. It is difficult to estimate the timing of formal responses<br />

from MOFCOM and JFTC. PEAMCoal will disclose any material<br />

developments relating to these clearance applications.<br />

The European Commission’s directorate general for competition<br />

has issued an opinion confirming that the EU Merger Regulation<br />

does not apply to the Takeover Bid. As a result, <strong>Peabody</strong> <strong>Energy</strong><br />

and ArcelorMittal have no obligation to notify the Takeover Bid to<br />

the European Commission for regulatory approval. Accordingly,<br />

completion of the Offer is not conditional on receipt of clearance<br />

from the European Commission.<br />

10.2 Co-operation and Contribution Agreement<br />

(a) Overview<br />

PEAMCoal, PEAMCoal Holdings, PAC2, AM and AM BV2<br />

have entered into the Co-operation and Contribution<br />

Agreement. A draft of the Co-operation and Contribution<br />

Agreement was released to the ASX on 13 July 2011 and<br />

is available at www.asx.com.au. The final version of the Cooperation<br />

and Contribution Agreement as entered into between<br />

the parties was not materially different from the version released<br />

to the ASX on 13 July 2011.<br />

The key terms of the Co-operation and Contribution Agreement<br />

are summarised below.<br />

(b) Conduct of the Takeover Bid<br />

The parties are jointly responsible for the conduct of the Takeover<br />

Bid and for making all material decisions in relation to the Offer.<br />

However, PAC2 alone is responsible for any decision to extend<br />

the Offer Period up to an aggregate duration of 6 months – any<br />

decision to extend the Offer Period beyond this period is to be<br />

jointly made by PAC2 and AM.<br />

AM and PAC2 each have observer rights at PEAMCoal Holdings<br />

and PEAMCoal board meetings until the end of the Offer Period.<br />

(c) Funding of the Takeover Bid<br />

PAC2 and AM BV2 will subscribe for shares in PEAMCoal<br />

Holdings in proportion to their current shareholding in PEAMCoal<br />

Holdings, being 60% and 40% respectively. The subscription<br />

consideration will be paid to PEAMCoal Holdings in Australian<br />

dollars during the Offer Period and the shares in PEAMCoal<br />

Holdings will be issued to PAC2 and AM BV2 following the end of<br />

the Offer Period. The subscription consideration will only be used<br />

by PEAMCoal Holdings to fund:<br />

• PEAMCoal’s acquisition of Shares during the Offer Period;<br />

• if PEAMCoal becomes entitled to and exercises its<br />

right to compulsorily acquire any outstanding Shares<br />

under Chapter 6A of the Corporations Act, PEAMCoal’s<br />

acquisition of Shares pursuant to such compulsory<br />

acquisition; and<br />

• PEAMCoal’s payment obligations in respect of any duty<br />

arising in connection with PEAMCoal’s acquisition of Shares.<br />

(d) Compulsory acquisition<br />

PEAMCoal must exercise its right to compulsorily acquire any<br />

outstanding Shares under Chapter 6A of the Corporations Act if it<br />

acquires the right to do so.<br />

(e) Exclusivity<br />

During an exclusivity period which runs until the date which<br />

is 6 months after the date of the Offer, <strong>Peabody</strong> <strong>Energy</strong>,<br />

ArcelorMittal, each of their group companies and their advisers,<br />

directors, officers and employees are subject to ‘no shop’<br />

and ‘no talk’ obligations in relation to, and are prevented from<br />

participating in a consortium, joint bidding structure or similar<br />

structure in connection with, an actual, proposed or potential<br />

competing proposal.<br />

The parties are also under notification obligations in relation to<br />

any direct or indirect approach, attempt to initiate negotiations or<br />

discussions, proposal or similar (including an intention to do so) in<br />

relation to an actual, proposed or potential competing proposal.<br />

Furthermore, AM has agreed that it will during the exclusivity period:<br />

• not Deal, and will ensure that none of its related bodies<br />

corporate will Deal, in the 16.1% parcel of Shares that it or<br />

they own or control; and<br />

• will vote the 16.1% parcel of Shares against, or will ensure<br />

that those Shares are voted against, any competing proposal.<br />

(f) Termination<br />

The Co-operation and Contribution Agreement will terminate if:<br />

(1) not all of the defeating conditions to the Offer have either<br />

been freed or fulfilled by the end of the Offer Period;<br />

(2) PEAMCoal is entitled to withdraw unaccepted Offers under<br />

the Takeover Bid and withdraws those unaccepted Offers in<br />

accordance with section 652A of the Corporations Act; or<br />

(3) AM or AM BV2 tenders the Shares it owns into the Offer and<br />

AM advises PAC2 and PEAMCoal Holdings by written notice<br />

before the end of the Offer Period that it wishes to terminate<br />

the agreement.<br />

If the Co-operation and Contribution Agreement is terminated<br />

as contemplated by paragraph (1) or (2) above, AM BV2 will sell,<br />

and PAC2 will purchase, the shares in PEAMCoal Holdings held<br />

by AM BV2 for an amount equal to the price paid for such shares<br />

when they were issued to AM BV2, subject to adjustment in<br />

certain cases.<br />

If AM causes the Co-operation and Contribution Agreement to be<br />

terminated as contemplated by paragraph (3) above, AM will sell,<br />

and PAC2 will purchase, the shares in AM BV2 from AM (causing<br />

AM to exit its investment in PEAMCoal Holdings and Macarthur)<br />

for an amount equal to the sum of:<br />

• the aggregate of all amounts received by PEAMCoal Holdings<br />

from AM BV2 until the end of the 90 day period following<br />

the provision of the termination notice pursuant to AM<br />

BV2’s subscription obligations under the Co-operation and<br />

Contribution Agreement (noting that AM BV2 must continue<br />

funding PEAMCoal through AM BV2’s subscription obligations<br />

until the end of that 90 day period - PEAMCoal would only<br />

ever extend the Offer Period beyond the end of this 90 day<br />

period if <strong>Peabody</strong> <strong>Energy</strong> has made appropriate alternative<br />

funding arrangements available to PEAMCoal);<br />

35