Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

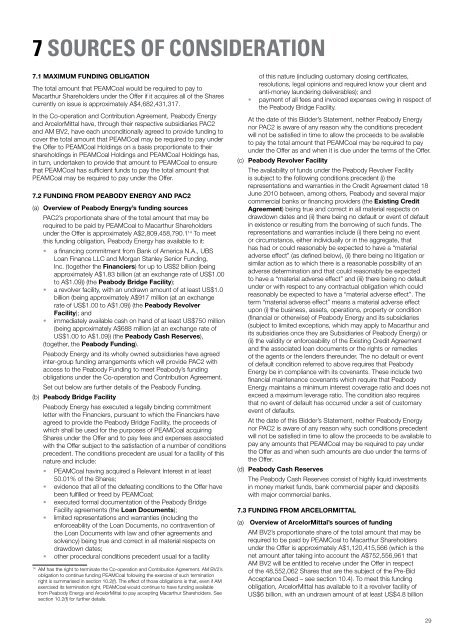

7 Sources of consideration<br />

7.1 Maximum funding obligation<br />

The total amount that PEAMCoal would be required to pay to<br />

Macarthur Shareholders under the Offer if it acquires all of the Shares<br />

currently on issue is approximately A$4,682,431,317.<br />

In the Co-operation and Contribution Agreement, <strong>Peabody</strong> <strong>Energy</strong><br />

and ArcelorMittal have, through their respective subsidiaries PAC2<br />

and AM BV2, have each unconditionally agreed to provide funding to<br />

cover the total amount that PEAMCoal may be required to pay under<br />

the Offer to PEAMCoal Holdings on a basis proportionate to their<br />

shareholdings in PEAMCoal Holdings and PEAMCoal Holdings has,<br />

in turn, undertaken to provide that amount to PEAMCoal to ensure<br />

that PEAMCoal has sufficient funds to pay the total amount that<br />

PEAMCoal may be required to pay under the Offer.<br />

7.2 Funding from <strong>Peabody</strong> <strong>Energy</strong> and PAC2<br />

(a) Overview of <strong>Peabody</strong> <strong>Energy</strong>’s funding sources<br />

PAC2’s proportionate share of the total amount that may be<br />

required to be paid by PEAMCoal to Macarthur Shareholders<br />

under the Offer is approximately A$2,809,458,790.1 14 To meet<br />

this funding obligation, <strong>Peabody</strong> <strong>Energy</strong> has available to it:<br />

• a financing commitment from Bank of America N.A., UBS<br />

Loan Finance LLC and Morgan Stanley Senior Funding,<br />

Inc. (together the Financiers) for up to US$2 billion (being<br />

approximately A$1.83 billion (at an exchange rate of US$1.00<br />

to A$1.09)) (the <strong>Peabody</strong> Bridge Facility);<br />

• a revolver facility, with an undrawn amount of at least US$1.0<br />

billion (being approximately A$917 million (at an exchange<br />

rate of US$1.00 to A$1.09)) (the <strong>Peabody</strong> Revolver<br />

Facility); and<br />

• immediately available cash on hand of at least US$750 million<br />

(being approximately A$688 million (at an exchange rate of<br />

US$1.00 to A$1.09)) (the <strong>Peabody</strong> Cash Reserves),<br />

(together, the <strong>Peabody</strong> Funding).<br />

<strong>Peabody</strong> <strong>Energy</strong> and its wholly owned subsidiaries have agreed<br />

inter-group funding arrangements which will provide PAC2 with<br />

access to the <strong>Peabody</strong> Funding to meet <strong>Peabody</strong>’s funding<br />

obligations under the Co-operation and Contribution Agreement.<br />

Set out below are further details of the <strong>Peabody</strong> Funding.<br />

(b) <strong>Peabody</strong> Bridge Facility<br />

<strong>Peabody</strong> <strong>Energy</strong> has executed a legally binding commitment<br />

letter with the Financiers, pursuant to which the Financiers have<br />

agreed to provide the <strong>Peabody</strong> Bridge Facility, the proceeds of<br />

which shall be used for the purposes of PEAMCoal acquiring<br />

Shares under the Offer and to pay fees and expenses associated<br />

with the Offer subject to the satisfaction of a number of conditions<br />

precedent. The conditions precedent are usual for a facility of this<br />

nature and include:<br />

• PEAMCoal having acquired a Relevant Interest in at least<br />

50.01% of the Shares;<br />

• evidence that all of the defeating conditions to the Offer have<br />

been fulfilled or freed by PEAMCoal;<br />

• executed formal documentation of the <strong>Peabody</strong> Bridge<br />

Facility agreements (the Loan Documents);<br />

• limited representations and warranties (including the<br />

enforceability of the Loan Documents, no contravention of<br />

the Loan Documents with law and other agreements and<br />

solvency) being true and correct in all material respects on<br />

drawdown dates;<br />

• other procedural conditions precedent usual for a facility<br />

14<br />

AM has the right to terminate the Co-operation and Contribution Agreement. AM BV2’s<br />

obligation to continue funding PEAMCoal following the exercise of such termination<br />

right is summarised in section 10.2(f). The effect of those obligations is that, even if AM<br />

exercised its termination right, PEAMCoal would continue to have funding available<br />

from <strong>Peabody</strong> <strong>Energy</strong> and ArcelorMittal to pay accepting Macarthur Shareholders. See<br />

section 10.2(f) for further details.<br />

of this nature (including customary closing certificates,<br />

resolutions, legal opinions and required know your client and<br />

anti-money laundering deliverables); and<br />

• payment of all fees and invoiced expenses owing in respect of<br />

the <strong>Peabody</strong> Bridge Facility.<br />

At the date of this Bidder’s <strong>Statement</strong>, neither <strong>Peabody</strong> <strong>Energy</strong><br />

nor PAC2 is aware of any reason why the conditions precedent<br />

will not be satisfied in time to allow the proceeds to be available<br />

to pay the total amount that PEAMCoal may be required to pay<br />

under the Offer as and when it is due under the terms of the Offer.<br />

(c) <strong>Peabody</strong> Revolver Facility<br />

The availability of funds under the <strong>Peabody</strong> Revolver Facility<br />

is subject to the following conditions precedent (i) the<br />

representations and warranties in the Credit Agreement dated 18<br />

June 2010 between, among others, <strong>Peabody</strong> and several major<br />

commercial banks or financing providers (the Existing Credit<br />

Agreement) being true and correct in all material respects on<br />

drawdown dates and (ii) there being no default or event of default<br />

in existence or resulting from the borrowing of such funds. The<br />

representations and warranties include (i) there being no event<br />

or circumstance, either individually or in the aggregate, that<br />

has had or could reasonably be expected to have a “material<br />

adverse effect” (as defined below), (ii) there being no litigation or<br />

similar action as to which there is a reasonable possibility of an<br />

adverse determination and that could reasonably be expected<br />

to have a “material adverse effect” and (iii) there being no default<br />

under or with respect to any contractual obligation which could<br />

reasonably be expected to have a “material adverse effect”. The<br />

term “material adverse effect” means a material adverse effect<br />

upon (i) the business, assets, operations, property or condition<br />

(financial or otherwise) of <strong>Peabody</strong> <strong>Energy</strong> and its subsidiaries<br />

(subject to limited exceptions, which may apply to Macarthur and<br />

its subsidiaries once they are Subsidiaries of <strong>Peabody</strong> <strong>Energy</strong>) or<br />

(ii) the validity or enforceability of the Existing Credit Agreement<br />

and the associated loan documents or the rights or remedies<br />

of the agents or the lenders thereunder. The no default or event<br />

of default condition referred to above requires that <strong>Peabody</strong><br />

<strong>Energy</strong> be in compliance with its covenants. These include two<br />

financial maintenance covenants which require that <strong>Peabody</strong><br />

<strong>Energy</strong> maintains a minimum interest coverage ratio and does not<br />

exceed a maximum leverage ratio. The condition also requires<br />

that no event of default has occurred under a set of customary<br />

event of defaults.<br />

At the date of this Bidder’s <strong>Statement</strong>, neither <strong>Peabody</strong> <strong>Energy</strong><br />

nor PAC2 is aware of any reason why such conditions precedent<br />

will not be satisfied in time to allow the proceeds to be available to<br />

pay any amounts that PEAMCoal may be required to pay under<br />

the Offer as and when such amounts are due under the terms of<br />

the Offer.<br />

(d) <strong>Peabody</strong> Cash Reserves<br />

The <strong>Peabody</strong> Cash Reserves consist of highly liquid investments<br />

in money market funds, bank commercial paper and deposits<br />

with major commercial banks.<br />

7.3 Funding from ArcelorMittal<br />

(a) Overview of ArcelorMittal’s sources of funding<br />

AM BV2’s proportionate share of the total amount that may be<br />

required to be paid by PEAMCoal to Macarthur Shareholders<br />

under the Offer is approximately A$1,120,415,566 (which is the<br />

net amount after taking into account the A$752,556,961 that<br />

AM BV2 will be entitled to receive under the Offer in respect<br />

of the 48,552,062 Shares that are the subject of the Pre-Bid<br />

Acceptance Deed – see section 10.4). To meet this funding<br />

obligation, ArcelorMittal has available to it a revolver facility of<br />

US$6 billion, with an undrawn amount of at least US$4.8 billion<br />

29