February 27, 2012 - IMM@BUCT

February 27, 2012 - IMM@BUCT

February 27, 2012 - IMM@BUCT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BUSINESS<br />

CHEMICAL FIRMS<br />

SUSTAIN INVESTMENTS<br />

Expecting muted economic growth, chemical makers plan<br />

MODEST INCREASES in R&D and capital spending this year<br />

MARC S. REISCH , C&EN NORTHEAST NEWS BUREAU<br />

CABOT CORP.<br />

CHEMICAL COMPANIES plan to increase<br />

spending on research and equipment this<br />

year but at a slower pace than they did last<br />

year. Concerned over the sovereign debt<br />

crisis in Europe, a weak economic recovery<br />

in the U.S., and a slowdown in the pace of<br />

growth in Asia, many chemical executives<br />

are tempering their future-oriented spending<br />

plans, according to C&EN’s annual<br />

survey.<br />

Seventeen U.S.-based firms say they will<br />

boost spending on new plants and equipment<br />

by 14.1% this year to a combined<br />

$13.0 billion. The increase marks a more<br />

modest uptick in capital expenditures<br />

compared with last year’s hefty rise of<br />

31.2% to $11.4 billion.<br />

Nonetheless, this<br />

year will mark the<br />

third annual spending<br />

increase after<br />

2009, when investment<br />

sank during the<br />

Great Recession.<br />

Eight U.S.-based<br />

firms report they will<br />

lift their research<br />

spending by 3.0% in<br />

<strong>2012</strong> to a combined<br />

$4.4 billion. The<br />

increase follows an<br />

8.5% budget boost in<br />

2011 to $4.3 billion<br />

and points to the continued<br />

importance of<br />

R&D for the group.<br />

Even the recession<br />

did not interrupt the<br />

companies’ support<br />

for this important<br />

discovery activity.<br />

According to<br />

C&EN’s survey, the<br />

overall forecast for<br />

future-oriented<br />

spending continues<br />

to be bright. For the<br />

eight firms— Cabot ,<br />

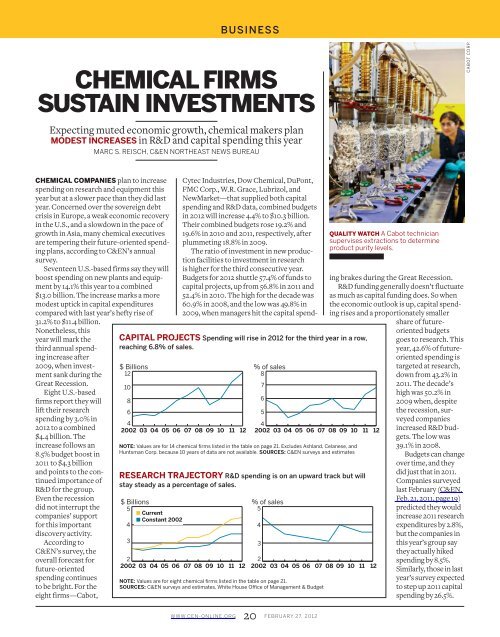

CAPITAL PROJECTS Spending will rise in <strong>2012</strong> for the third year in a row,<br />

reaching 6.8% of sales.<br />

$ Billions<br />

12<br />

10<br />

8<br />

6<br />

4<br />

4<br />

2002 03 04 05 06 07 08 09 10 11 12 2002 03 04 05 06 07 08 09 10 11 12<br />

NOTE: Values are for 14 chemical firms listed in the table on page 21. Excludes Ashland, Celanese, and<br />

Huntsman Corp. because 10 years of data are not available. SOURCES: C&EN surveys and estimates<br />

RESEARCH TRAJECTORY R&D spending is on an upward track but will<br />

stay steady as a percentage of sales.<br />

$ Billions<br />

5<br />

■ Current<br />

■ Constant 2002<br />

4<br />

3<br />

2<br />

2002 03 04 05 06 07 08 09 10 11 12<br />

% of sales<br />

8<br />

% of sales<br />

5<br />

2<br />

2002 03 04 05 06 07 08 09 10 11 12<br />

NOTE: Values are for eight chemical firms listed in the table on page 21.<br />

SOURCES: C&EN surveys and estimates, White House Office of Management & Budget<br />

WWW.CEN-ONLINE.ORG 20 FEBRUARY <strong>27</strong>, <strong>2012</strong><br />

4<br />

3<br />

7<br />

6<br />

5<br />

QUALITY WATCH A Cabot technician<br />

supervises extractions to determine<br />

product purity levels.<br />

Cytec Industries , Dow Chemical , DuPont ,<br />

FMC Corp., W.R. Grace , Lubrizol , and<br />

NewMarket —that supplied both capital<br />

spending and R&D data, combined budgets<br />

in <strong>2012</strong> will increase 4.4% to $10.3 billion.<br />

Their combined budgets rose 19.2% and<br />

19.6% in 2010 and 2011, respectively, after<br />

plummeting 18.8% in 2009.<br />

The ratio of investment in new production<br />

facilities to investment in research<br />

is higher for the third consecutive year.<br />

Budgets for <strong>2012</strong> shuttle 57.4% of funds to<br />

capital projects, up from 56.8% in 2011 and<br />

52.4% in 2010. The high for the decade was<br />

60.9% in 2008, and the low was 49.8% in<br />

2009, when managers hit the capital spending<br />

brakes during the Great Recession.<br />

R&D funding generally doesn’t fluctuate<br />

as much as capital funding does. So when<br />

the economic outlook is up, capital spending<br />

rises and a proportionately smaller<br />

share of futureoriented<br />

budgets<br />

goes to research. This<br />

year, 42.6% of futureoriented<br />

spending is<br />

targeted at research,<br />

down from 43.2% in<br />

2011. The decade’s<br />

high was 50.2% in<br />

2009 when, despite<br />

the recession, surveyed<br />

companies<br />

increased R&D budgets.<br />

The low was<br />

39.1% in 2008.<br />

Budgets can change<br />

over time, and they<br />

did just that in 2011.<br />

Companies surveyed<br />

last <strong>February</strong> (C&EN,<br />

Feb. 21, 2011, page 19)<br />

predicted they would<br />

increase 2011 research<br />

expenditures by 2.8%,<br />

but the companies in<br />

this year’s group say<br />

they actually hiked<br />

spending by 8.5%.<br />

Similarly, those in last<br />

year’s survey expected<br />

to step up 2011 capital<br />

spending by 26.5%.