February 27, 2012 - IMM@BUCT

February 27, 2012 - IMM@BUCT

February 27, 2012 - IMM@BUCT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASTRAZENECA<br />

IN 2011, PHARMACEUTICAL companies<br />

got a glimpse of their not-too-distant future,<br />

and it isn’t a pretty sight. The level of<br />

annual product sales lost to generic competition<br />

has been rising since 2007, and it<br />

will peak in <strong>2012</strong>.<br />

To overcome the resulting slowdown<br />

in sales and earnings growth, major drug<br />

firms have been shifting their businesses<br />

and drastically cutting R&D programs<br />

and staffing. Their challenge is to make<br />

it through this period, replace lost sales<br />

with new products, and expand into new<br />

regional markets.<br />

The global market for pharmaceuticals<br />

is growing 3–6% annually, according to the<br />

market research firm IMS Health . But most<br />

of the growth is occurring in emerging markets<br />

and not the traditional Western ones<br />

where the big drug companies are based.<br />

Although demand in developed markets<br />

will show some incremental growth, it will<br />

be more than offset by the impact of patent<br />

expirations.<br />

BUSINESS<br />

PHARMA SEES THE<br />

START OF THE END<br />

Amid SLOWING GROWTH in 2011, drugmakers<br />

took steps to prepare for the year ahead<br />

ANN M. THAYER , C&EN HOUSTON<br />

WWW.CEN-ONLINE.ORG 28 FEBRUARY <strong>27</strong>, <strong>2012</strong><br />

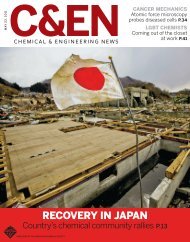

ON THE BUS<br />

AstraZeneca<br />

is counting on<br />

emerging markets,<br />

such as China, as<br />

patents expire in<br />

old ones.<br />

These dynamics were reflected in 2011<br />

sales and earnings results for the world’s<br />

major drug firms. Combined 2011 sales for<br />

the 11 companies C&EN tracks rose 3.2% to<br />

about $490 billion. In contrast, sales grew<br />

by double digits in 2010, although some of<br />

this was attributable to mergers.<br />

But combined figures obscure the fact<br />

that some firms got hit much harder than<br />

others by the patent expirations. Rather<br />

than tens of billions of dollars of lost sales<br />

spread around evenly, AstraZeneca , Eli<br />

Lilly & Co ., Pfizer , and Sanofi are bearing<br />

the brunt. They have lost, or will soon lose,<br />

patent protection on some of the industry’s<br />

biggest-selling products. In <strong>2012</strong>, patents<br />

will expire on drugs whose combined annual<br />

sales total more<br />

than $40 billion,<br />

according to IMS<br />

Health.<br />

Among the recent<br />

losses was U.S. patent<br />

protection in<br />

November 2011 on<br />

Pfizer’s cholesterol-lowering drug Lipitor.<br />

During peak years, Lipitor had annual sales<br />

exceeding $12 billion and accounted for<br />

about a quarter of Pfizer’s revenues. The<br />

full effects of the patent loss haven’t yet<br />

been seen, but in the fourth quarter alone<br />

Lipitor sales dropped 24%.<br />

Overall, Pfizer lost about $5 billion in<br />

revenues in 2011 from expiring patents.<br />

The company fought back by reaching its<br />

$4 billion cost-reduction target associated<br />

with the integration of Wyeth, purchased<br />

in late 2009, one year earlier than anticipated.<br />

Pfizer is also considering divesting<br />

its animal health and nutrition businesses,<br />

which would occur between July <strong>2012</strong> and<br />

July 2013 if it decides to move ahead.<br />

Pfizer reduced its sales forecast for <strong>2012</strong><br />

by about $2 billion. It now predicts that<br />

sales will be about 8% lower than in 2011<br />

because of patent expirations and the effects<br />

of currency exchange rates. Looking<br />

ahead, efforts to “fix the innovative core”<br />

will improve the company’s late-stage<br />

portfolio of compounds and lead to successful<br />

launches of novel products, Chief<br />

Executive Officer Ian Read told analysts in<br />

a recent conference call.<br />

BUT CITIGROUP stock analyst John T.<br />

Boris cautioned clients in a recent report<br />

that Pfizer executives may be too optimistic.<br />

“We expect Pfizer to see continued deterioration<br />

of its base business in the U.S.,<br />

with execution risk on the pipeline, and<br />

potential restructuring issues,” he said.<br />

Competition from branded and generic<br />

drug firms could also jeopardize Pfizer’s<br />

growing business in emerging markets<br />

such as China, Brazil, Russia, India, Turkey,<br />

and Mexico, Boris added.<br />

Like Pfizer, many big pharma firms are<br />

betting on emerging regions for growth.<br />

Over the next five years, total spending<br />

on medicines in these markets is expected<br />

Combined figures obscure the fact that<br />

some firms got hit much harder than<br />

others by the patent expirations.