Country Economic Work for Malaysia - Islamic Development Bank

Country Economic Work for Malaysia - Islamic Development Bank

Country Economic Work for Malaysia - Islamic Development Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

that the Government’s <strong>Economic</strong> Trans<strong>for</strong>mation Program with an amount of MYR1.4 trillion<br />

($523 billion) has targeted (92% of total investment) by the private sector (out of total, 73% by<br />

the local private investors and 27% by the <strong>for</strong>eign investors).<br />

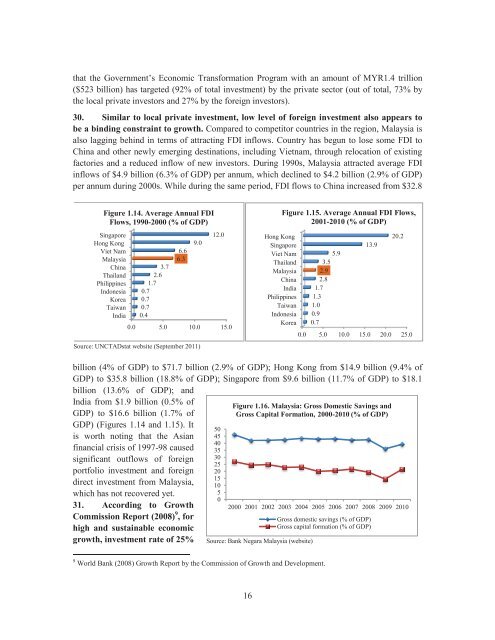

30. Similar to local private investment, low level of <strong>for</strong>eign investment also appears to<br />

be a binding constraint to growth. Compared to competitor countries in the region, <strong>Malaysia</strong> is<br />

also lagging behind in terms of attracting FDI inflows. <strong>Country</strong> has begun to lose some FDI to<br />

China and other newly emerging destinations, including Vietnam, through relocation of existing<br />

factories and a reduced inflow of new investors. During 1990s, <strong>Malaysia</strong> attracted average FDI<br />

inflows of $4.9 billion (6.3% of GDP) per annum, which declined to $4.2 billion (2.9% of GDP)<br />

per annum during 2000s. While during the same period, FDI flows to China increased from $32.8<br />

Figure 1.14. Average Annual FDI<br />

Flows, 1990-2000 (% of GDP)<br />

Singapore<br />

Hong Kong<br />

Viet Nam<br />

<strong>Malaysia</strong><br />

China<br />

Thailand<br />

Philippines<br />

Indonesia<br />

Korea<br />

Taiwan<br />

India<br />

3.7<br />

2.6<br />

1.7<br />

0.7<br />

0.7<br />

0.7<br />

0.4<br />

6.6<br />

6.3<br />

9.0<br />

0.0 5.0 10.0 15.0<br />

Source: UNCTADstat website (September 2011)<br />

12.0<br />

Hong Kong<br />

Singapore<br />

Viet Nam<br />

Thailand<br />

<strong>Malaysia</strong><br />

China<br />

India<br />

Philippines<br />

Taiwan<br />

Indonesia<br />

Korea<br />

Figure 1.15. Average Annual FDI Flows,<br />

2001-2010 (% of GDP)<br />

5.9<br />

3.5<br />

2.9<br />

2.8<br />

1.7<br />

1.3<br />

1.0<br />

0.9<br />

0.7<br />

13.9<br />

20.2<br />

0.0 5.0 10.0 15.0 20.0 25.0<br />

billion (4% of GDP) to $71.7 billion (2.9% of GDP); Hong Kong from $14.9 billion (9.4% of<br />

GDP) to $35.8 billion (18.8% of GDP); Singapore from $9.6 billion (11.7% of GDP) to $18.1<br />

billion (13.6% of GDP); and<br />

India from $1.9 billion (0.5% of<br />

GDP) to $16.6 billion (1.7% of<br />

GDP) (Figures 1.14 and 1.15). It<br />

is worth noting that the Asian<br />

financial crisis of 1997-98 caused<br />

significant outflows of <strong>for</strong>eign<br />

portfolio investment and <strong>for</strong>eign<br />

direct investment from <strong>Malaysia</strong>,<br />

which has not recovered yet.<br />

31. According to Growth<br />

Commission Report (2008) 9 , <strong>for</strong><br />

high and sustainable economic<br />

growth, investment rate of 25%<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Figure 1.16. <strong>Malaysia</strong>: Gross Domestic Savings and<br />

Gross Capital Formation, 2000-2010 (% of GDP)<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: <strong>Bank</strong> Negara <strong>Malaysia</strong> (website)<br />

Gross domestic savings (% of GDP)<br />

Gross capital <strong>for</strong>mation (% of GDP)<br />

9 World <strong>Bank</strong> (2008) Growth Report by the Commission of Growth and <strong>Development</strong>.<br />

16