Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

looning budget deficits imply higher taxes in the future, as does the pending demographic<br />

implosion. According to projections by the UN, the eurozone working age population will<br />

decline by around 0.2 percent per annum over the next ten years.<br />

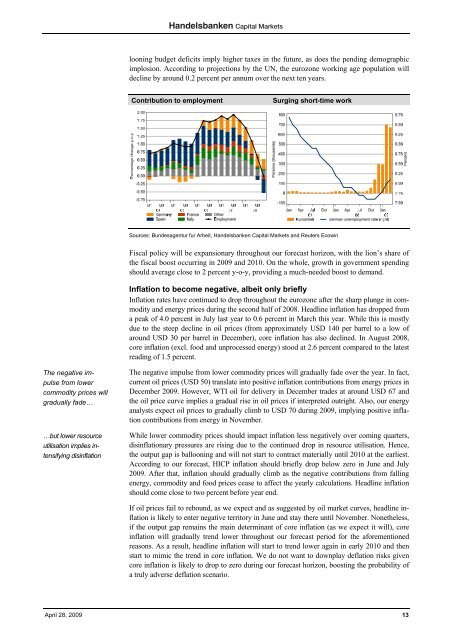

Contribution to employment<br />

Surging short-time work<br />

Sources: Bundesagentur fur Arbeit, <strong>Handelsbanken</strong> Capital Markets and Reuters Ecowin<br />

Fiscal policy will be expansionary throughout our forecast horizon, with the lion’s share of<br />

the fiscal boost occurring in 2009 and 2010. On the whole, growth in government spending<br />

should average close to 2 percent y-o-y, providing a much-needed boost to demand.<br />

Inflation to become negative, albeit only briefly<br />

Inflation rates have continued to drop throughout the eurozone after the sharp plunge in commodity<br />

and energy prices during the second half of 2008. Headline inflation has dropped from<br />

a peak of 4.0 percent in July last year to 0.6 percent in March this year. While this is mostly<br />

due to the steep decline in oil prices (from approximately USD 140 per barrel to a low of<br />

around USD 30 per barrel in December), core inflation has also declined. In August 2008,<br />

core inflation (excl. food and unprocessed energy) stood at 2.6 percent compared to the latest<br />

reading of 1.5 percent.<br />

The negative impulse<br />

from lower<br />

commodity prices will<br />

gradually fade…<br />

…but lower resource<br />

utilisation implies intensifying<br />

disinflation<br />

The negative impulse from lower commodity prices will gradually fade over the year. In fact,<br />

current oil prices (USD 50) translate into positive inflation contributions from energy prices in<br />

December 2009. However, WTI oil for delivery in December trades at around USD 67 and<br />

the oil price curve implies a gradual rise in oil prices if interpreted outright. Also, our energy<br />

analysts expect oil prices to gradually climb to USD 70 during 2009, implying positive inflation<br />

contributions from energy in November.<br />

While lower commodity prices should impact inflation less negatively over coming quarters,<br />

disinflationary pressures are rising due to the continued drop in resource utilisation. Hence,<br />

the output gap is ballooning and will not start to contract materially until 2010 at the earliest.<br />

According to our forecast, HICP inflation should briefly drop below zero in June and July<br />

2009. After that, inflation should gradually climb as the negative contributions from falling<br />

energy, commodity and food prices cease to affect the yearly calculations. Headline inflation<br />

should come close to two percent before year end.<br />

If oil prices fail to rebound, as we expect and as suggested by oil market curves, headline inflation<br />

is likely to enter negative territory in June and stay there until November. Nonetheless,<br />

if the output gap remains the main determinant of core inflation (as we expect it will), core<br />

inflation will gradually trend lower throughout our forecast period for the aforementioned<br />

reasons. As a result, headline inflation will start to trend lower again in early 2010 and then<br />

start to mimic the trend in core inflation. We do not want to downplay deflation risks given<br />

core inflation is likely to drop to zero during our forecast horizon, boosting the probability of<br />

a truly adverse deflation scenario.<br />

April 28, 2009 13