Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LATIN AMERICA<br />

Recovery ahead, but 2009 a tough year<br />

Q4 was a wake-up call, clearly showing that Latin America is not an island. However, less vulnerability has<br />

limited the effects from the global credit crunch and the region is now experiencing a cyclical downturn<br />

instead of a more structural, as in the US. Therefore, we expect a rapid recovery, although the first half of<br />

2009 will be tough.<br />

Stronger stock markets<br />

and FX while<br />

economy remains<br />

weak<br />

The incidents in recent months have been somewhat paradoxical. Strong global risk appetite,<br />

driven by signs of stabilising economies, especially in the US and China, has led to the<br />

strongest month for emerging stock markets in 15 years. Although there are many uncertainties<br />

ahead, the possibility of a worst case scenario being less likely has supported a recovery<br />

in commodity markets. This in turn has put a floor in commodity exporting areas<br />

such as Latin America. The tripling of IMF funds by the G20 has provided further comfort<br />

to investors in emerging markets, which has supported the return to emerging markets.<br />

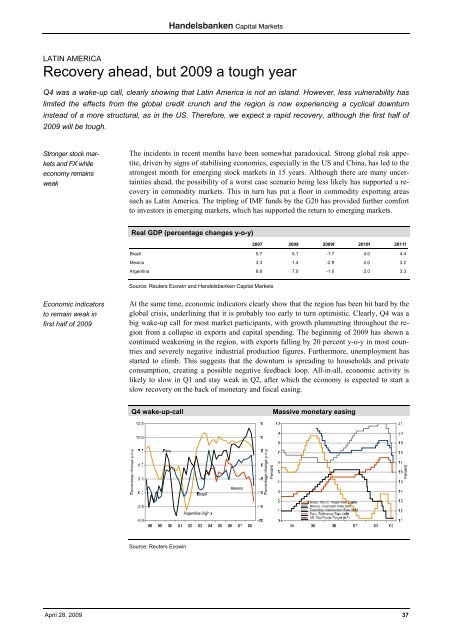

Real GDP (percentage changes y-o-y)<br />

2007 2008 2009f 2010f 2011f<br />

Brazil 5.7 5.1 -1.7 4.0 4.4<br />

Mexico 3.3 1.4 -2.9 2.0 3.2<br />

Argentina 8.6 7.0 -1.0 2.0 3.3<br />

Source: Reuters Ecowin and <strong>Handelsbanken</strong> Capital Markets<br />

Economic indicators<br />

to remain weak in<br />

first half of 2009<br />

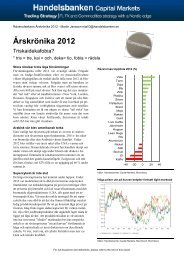

At the same time, economic indicators clearly show that the region has been hit hard by the<br />

global crisis, underlining that it is probably too early to turn optimistic. Clearly, Q4 was a<br />

big wake-up call for most market participants, with growth plummeting throughout the region<br />

from a collapse in exports and capital spending. The beginning of 2009 has shown a<br />

continued weakening in the region, with exports falling by 20 percent y-o-y in most countries<br />

and severely negative industrial production figures. Furthermore, unemployment has<br />

started to climb. This suggests that the downturn is spreading to households and private<br />

consumption, creating a possible negative feedback loop. All-in-all, economic activity is<br />

likely to slow in Q1 and stay weak in Q2, after which the economy is expected to start a<br />

slow recovery on the back of monetary and fiscal easing.<br />

Q4 wake-up-call<br />

Massive monetary easing<br />

Source: Reuters Ecowin<br />

April 28, 2009 37