Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

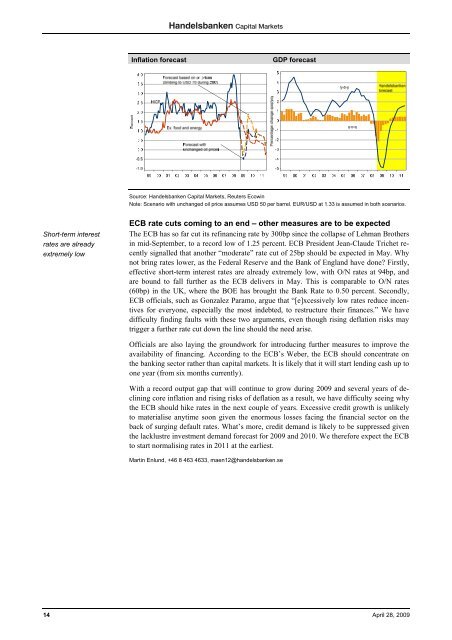

Inflation forecast<br />

GDP forecast<br />

Source: <strong>Handelsbanken</strong> Capital Markets, Reuters Ecowin<br />

Note: Scenario with unchanged oil price assumes USD 50 per barrel. EUR/USD at 1.33 is assumed in both scenarios.<br />

Short-term interest<br />

rates are already<br />

extremely low<br />

ECB rate cuts coming to an end – other measures are to be expected<br />

The ECB has so far cut its refinancing rate by 300bp since the collapse of Lehman Brothers<br />

in mid-September, to a record low of 1.25 percent. ECB President Jean-Claude Trichet recently<br />

signalled that another “moderate” rate cut of 25bp should be expected in May. Why<br />

not bring rates lower, as the Federal Reserve and the Bank of England have done? Firstly,<br />

effective short-term interest rates are already extremely low, with O/N rates at 94bp, and<br />

are bound to fall further as the ECB delivers in May. This is comparable to O/N rates<br />

(60bp) in the UK, where the BOE has brought the Bank Rate to 0.50 percent. Secondly,<br />

ECB officials, such as Gonzalez Paramo, argue that “[e]xcessively low rates reduce incentives<br />

for everyone, especially the most indebted, to restructure their finances.” We have<br />

difficulty finding faults with these two arguments, even though rising deflation risks may<br />

trigger a further rate cut down the line should the need arise.<br />

Officials are also laying the groundwork for introducing further measures to improve the<br />

availability of financing. According to the ECB’s Weber, the ECB should concentrate on<br />

the banking sector rather than capital markets. It is likely that it will start lending cash up to<br />

one year (from six months currently).<br />

With a record output gap that will continue to grow during 2009 and several years of declining<br />

core inflation and rising risks of deflation as a result, we have difficulty seeing why<br />

the ECB should hike rates in the next couple of years. Excessive credit growth is unlikely<br />

to materialise anytime soon given the enormous losses facing the financial sector on the<br />

back of surging default rates. What’s more, credit demand is likely to be suppressed given<br />

the lacklustre investment demand forecast for 2009 and 2010. We therefore expect the ECB<br />

to start normalising rates in 2011 at the earliest.<br />

Martin Enlund, +46 8 463 4633, maen12@handelsbanken.se<br />

14 April 28, 2009