Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Russia may bounce<br />

back as the global<br />

recovery gets under<br />

way<br />

To some extent, Russia is also a case of excessive leverage. However, most of this leverage<br />

can be found in the corporate sector rather than the economy as a whole. During the boom<br />

in commodities, many large Russian corporations took up large loans abroad to finance<br />

their expansions. As commodities eventually ran out of steam and fell sharply, cash flows<br />

were squeezed. There may be some defaults, or at least some restructuring of these loans,<br />

and perhaps some debt equity swaps. As troubling as this may be for some creditors, we<br />

still think that this process will be manageable, especially if the current positive tone in<br />

commodity markets continues. The authorities deserve credit for the way they have handled<br />

the situation so far. One might conclude that Russia has proved to be better with macro<br />

management than structural policy. Against this background, we think that the economy<br />

may bounce back as the global recovery gets under way. Russia also looks like an attractive<br />

inflation hedge when there is more concern about the aftermath of rate cuts and quantitative<br />

easing in the developed world. Barring a renewed reform drive, we expect Russia to fall<br />

short of long-term full convergence with the West.<br />

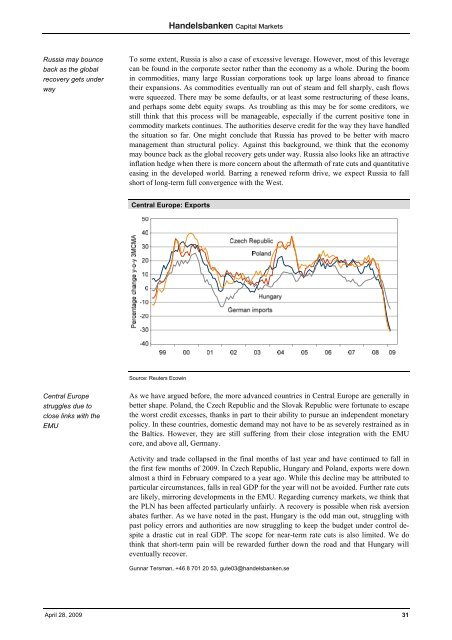

Central Europe: Exports<br />

Source: Reuters Ecowin<br />

Central Europe<br />

struggles due to<br />

close links with the<br />

EMU<br />

As we have argued before, the more advanced countries in Central Europe are generally in<br />

better shape. Poland, the Czech Republic and the Slovak Republic were fortunate to escape<br />

the worst credit excesses, thanks in part to their ability to pursue an independent monetary<br />

policy. In these countries, domestic demand may not have to be as severely restrained as in<br />

the Baltics. However, they are still suffering from their close integration with the EMU<br />

core, and above all, Germany.<br />

Activity and trade collapsed in the final months of last year and have continued to fall in<br />

the first few months of 2009. In Czech Republic, Hungary and Poland, exports were down<br />

almost a third in February compared to a year ago. While this decline may be attributed to<br />

particular circumstances, falls in real GDP for the year will not be avoided. Further rate cuts<br />

are likely, mirroring developments in the EMU. Regarding currency markets, we think that<br />

the PLN has been affected particularly unfairly. A recovery is possible when risk aversion<br />

abates further. As we have noted in the past, Hungary is the odd man out, struggling with<br />

past policy errors and authorities are now struggling to keep the budget under control despite<br />

a drastic cut in real GDP. The scope for near-term rate cuts is also limited. We do<br />

think that short-term pain will be rewarded further down the road and that Hungary will<br />

eventually recover.<br />

Gunnar Tersman, +46 8 701 20 53, gute03@handelsbanken.se<br />

April 28, 2009 31