Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

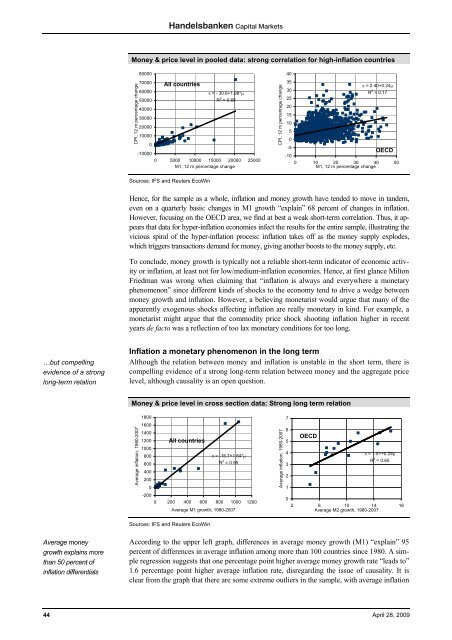

Money & price level in pooled data: strong correlation for high-inflation countries<br />

CPI, 12 m percentage change<br />

80000<br />

70000<br />

60000<br />

50000<br />

40000<br />

30000<br />

20000<br />

10000<br />

0<br />

-10000<br />

All countries<br />

π = - 30.6+1.88*μ<br />

R 2 = 0.68<br />

0 5000 10000 15000 20000 25000<br />

M1, 12 m percentage change<br />

CPI, 12 m percentage change<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

π = 2.40+0.24μ<br />

R 2 = 0.17<br />

OECD<br />

0 10 20 30 40 50<br />

M1, 12 m percentage change<br />

Sources: IFS and Reuters EcoWin<br />

Hence, for the sample as a whole, inflation and money growth have tended to move in tandem,<br />

even on a quarterly basis: changes in M1 growth “explain” 68 percent of changes in inflation.<br />

However, focusing on the OECD area, we find at best a weak short-term correlation. Thus, it appears<br />

that data for hyper-inflation economies infect the results for the entire sample, illustrating the<br />

vicious spiral of the hyper-inflation process: inflation takes off as the money supply explodes,<br />

which triggers transactions demand for money, giving another boosts to the money supply, etc.<br />

To conclude, money growth is typically not a reliable short-term indicator of economic activity<br />

or inflation, at least not for low/medium-inflation economies. Hence, at first glance Milton<br />

Friedman was wrong when claiming that “inflation is always and everywhere a monetary<br />

phenomenon” since different kinds of shocks to the economy tend to drive a wedge between<br />

money growth and inflation. However, a believing monetarist would argue that many of the<br />

apparently exogenous shocks affecting inflation are really monetary in kind. For example, a<br />

monetarist might argue that the commodity price shock shooting inflation higher in recent<br />

years de facto was a reflection of too lax monetary conditions for too long.<br />

…but compelling<br />

evidence of a strong<br />

long-term relation<br />

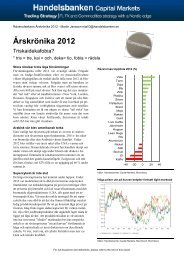

Inflation a monetary phenomenon in the long term<br />

Although the relation between money and inflation is unstable in the short term, there is<br />

compelling evidence of a strong long-term relation between money and the aggregate price<br />

level, although causality is an open question.<br />

Money & price level in cross section data: Strong long term relation<br />

Average inflation, 1980-2007<br />

1800<br />

1600<br />

1400<br />

1200 All countries<br />

1000<br />

800<br />

π = -15.7+1.64*μ<br />

600<br />

R 2 = 0.95<br />

400<br />

200<br />

0<br />

-200<br />

0 200 400 600 800 1000 1200<br />

Average M1 growth, 1980-2007<br />

Average inflation, 1980-2007<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

OECD<br />

π = 1.51+0.29μ<br />

R 2 = 0.65<br />

2 6 10 14 18<br />

Average M2 growth, 1980-2007<br />

Sources: IFS and Reuters EcoWin<br />

Average money<br />

growth explains more<br />

than 50 percent of<br />

inflation differentials<br />

According to the upper left graph, differences in average money growth (M1) “explain” 95<br />

percent of differences in average inflation among more than 100 countries since 1980. A simple<br />

regression suggests that one percentage point higher average money growth rate “leads to”<br />

1.6 percentage point higher average inflation rate, disregarding the issue of causality. It is<br />

clear from the graph that there are some extreme outliers in the sample, with average inflation<br />

44 April 28, 2009