Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

spiral taking hold. In the late 1990s, the Swedish output gap was closed from both sides as<br />

unemployment dropped on the back of an economic recovery, while the NAIRU increased<br />

due to hysteresis effects. Hence, while an increase in the NAIRU should mitigate the deflationary<br />

pressure, it will imply a huge loss of production capacity and economic resources.<br />

Risk of “Japanese<br />

situation” in eurozone<br />

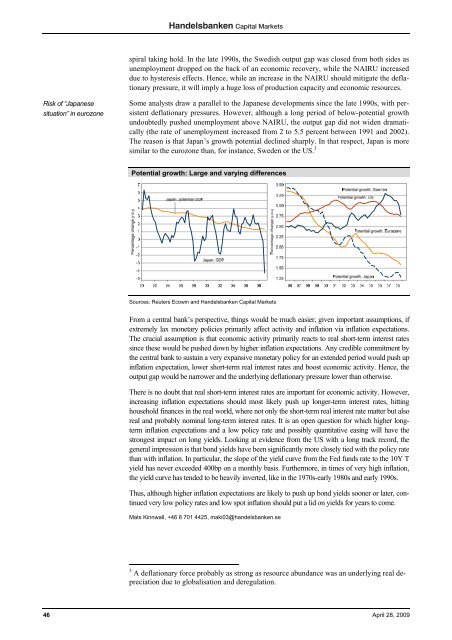

Some analysts draw a parallel to the Japanese developments since the late 1990s, with persistent<br />

deflationary pressures. However, although a long period of below-potential growth<br />

undoubtedly pushed unemployment above NAIRU, the output gap did not widen dramatically<br />

(the rate of unemployment increased from 2 to 5.5 percent between 1991 and 2002).<br />

The reason is that Japan’s growth potential declined sharply. In that respect, Japan is more<br />

similar to the eurozone than, for instance, Sweden or the US. 3<br />

Potential growth: Large and varying differences<br />

Sources: Reuters Ecowin and <strong>Handelsbanken</strong> Capital Markets<br />

From a central bank’s perspective, things would be much easier, given important assumptions, if<br />

extremely lax monetary policies primarily affect activity and inflation via inflation expectations.<br />

The crucial assumption is that economic activity primarily reacts to real short-term interest rates<br />

since these would be pushed down by higher inflation expectations. Any credible commitment by<br />

the central bank to sustain a very expansive monetary policy for an extended period would push up<br />

inflation expectation, lower short-term real interest rates and boost economic activity. Hence, the<br />

output gap would be narrower and the underlying deflationary pressure lower than otherwise.<br />

There is no doubt that real short-term interest rates are important for economic activity. However,<br />

increasing inflation expectations should most likely push up longer-term interest rates, hitting<br />

household finances in the real world, where not only the short-term real interest rate matter but also<br />

real and probably nominal long-term interest rates. It is an open question for which higher longterm<br />

inflation expectations and a low policy rate and possibly quantitative easing will have the<br />

strongest impact on long yields. Looking at evidence from the US with a long track record, the<br />

general impression is that bond yields have been significantly more closely tied with the policy rate<br />

than with inflation. In particular, the slope of the yield curve from the Fed funds rate to the 10Y T<br />

yield has never exceeded 400bp on a monthly basis. Furthermore, in times of very high inflation,<br />

the yield curve has tended to be heavily inverted, like in the 1970s-early 1980s and early 1990s.<br />

Thus, although higher inflation expectations are likely to push up bond yields sooner or later, continued<br />

very low policy rates and low spot inflation should put a lid on yields for years to come.<br />

Mats Kinnwall, +46 8 701 4425, maki03@handelsbanken.se<br />

3 A deflationary force probably as strong as resource abundance was an underlying real depreciation<br />

due to globalisation and deregulation.<br />

46 April 28, 2009