Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Emerging economies have been badly affected by the collapse of exports to developed economies.<br />

On this front, we do not expect recoveries, since domestic demand growth will remain<br />

weak for a long time in large parts of the OECD due to the need for balance sheet restoration.<br />

Household savings<br />

rates relatively high<br />

in China<br />

Conditions for domestic demand growth are not so bad in economies that do not face big<br />

debt loads in the private or public sectors. Private sector investment is likely to slow since<br />

capacity utilisation shrinks in the cyclical downturn. To some extent, this will be offset by<br />

fiscal stimulus. Household savings rates are relatively high, particularly in China, so consumer<br />

demand might be easier to stimulate than in many western economies.<br />

Emerging economies are also in a catch-up phase, with strong productivity growth leading<br />

to rapid increases in real incomes. If we can no longer rely on US consumers, maybe we<br />

can hope that households in emerging economies will start filling the gap. Actually, car<br />

sales in China are currently higher than in the US. At the moment, this is not enough to offset<br />

major declines in car sales in western economies. In a few years, however, there is likely<br />

to be a major rebalancing of roles. China will become less driven by exports and more<br />

driven by domestic demand, and the opposite will be true for the US economy.<br />

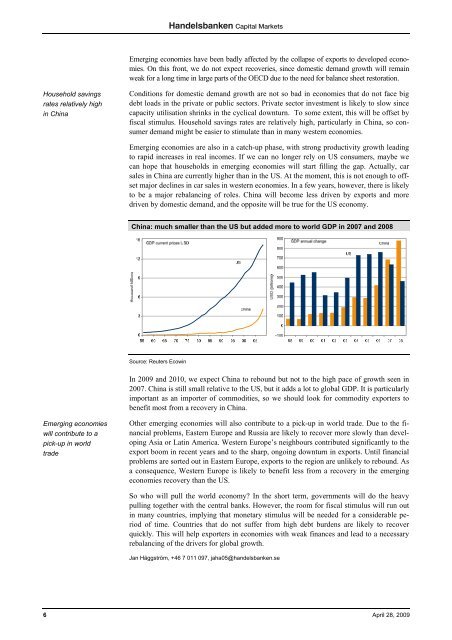

China: much smaller than the US but added more to world GDP in 2007 and 2008<br />

Source: Reuters Ecowin<br />

In 2009 and 2010, we expect China to rebound but not to the high pace of growth seen in<br />

2007. China is still small relative to the US, but it adds a lot to global GDP. It is particularly<br />

important as an importer of commodities, so we should look for commodity exporters to<br />

benefit most from a recovery in China.<br />

Emerging economies<br />

will contribute to a<br />

pick-up in world<br />

trade<br />

Other emerging economies will also contribute to a pick-up in world trade. Due to the financial<br />

problems, Eastern Europe and Russia are likely to recover more slowly than developing<br />

Asia or Latin America. Western Europe’s neighbours contributed significantly to the<br />

export boom in recent years and to the sharp, ongoing downturn in exports. Until financial<br />

problems are sorted out in Eastern Europe, exports to the region are unlikely to rebound. As<br />

a consequence, Western Europe is likely to benefit less from a recovery in the emerging<br />

economies recovery than the US.<br />

So who will pull the world economy? In the short term, governments will do the heavy<br />

pulling together with the central banks. However, the room for fiscal stimulus will run out<br />

in many countries, implying that monetary stimulus will be needed for a considerable period<br />

of time. Countries that do not suffer from high debt burdens are likely to recover<br />

quickly. This will help exporters in economies with weak finances and lead to a necessary<br />

rebalancing of the drivers for global growth.<br />

Jan Häggström, +46 7 011 097, jaha05@handelsbanken.se<br />

6 April 28, 2009