Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

Download - Macro Research - Handelsbanken

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The ECB could<br />

adopt a policy of<br />

credit or quantitative<br />

easing<br />

EUR/USD to drift lower<br />

As financial markets are now performing better and better and the deleveraging process is<br />

becoming less disorderly, one of the causes of USD strength is abating (see, for instance,<br />

the BIS report on “the US dollar shortage in global banking”). All the same, we expect<br />

EUR/USD to drift lower on the back of further interest rate cuts in the eurozone (at least<br />

one more 25bp is due in May), while the ECB could still adopt a policy of credit or quantitative<br />

easing. The relationship between the US and the eurozone in the business cycle also<br />

suggests some downside pressure on the EUR.<br />

While the eurozone has an economy that has been less “unbalanced” than the US, it has its<br />

own set of problems that are expected to take a toll in coming years. Countries such as Spain<br />

and Greece (and Italy, and Ireland, and Portugal…) are facing a severe downturn and their<br />

budget deficits are rising sharply. Intra-eurozone sovereign spreads are wide and could widen<br />

further as bond supply increases, leading to increasing tensions within the eurozone. Several<br />

of these countries also face somewhat of a “cost crisis” due to ballooning labour costs relative<br />

to the eurozone average since the currency’s inception. The financial problems relating to<br />

Eastern Europe are also likely to remain a concern for the next year or two.<br />

We do not predict a strong growth rebound in either geography, so volatile macro data is<br />

bound to trigger sharp swings in the currency pair as optimism is replaced by pessimism<br />

and vice-versa. We nonetheless foresee the EUR/USD at 1.28, 1.25 and 1.20 in three, six<br />

and 12 months respectively. In two years time, we see EUR/USD at 1.20.<br />

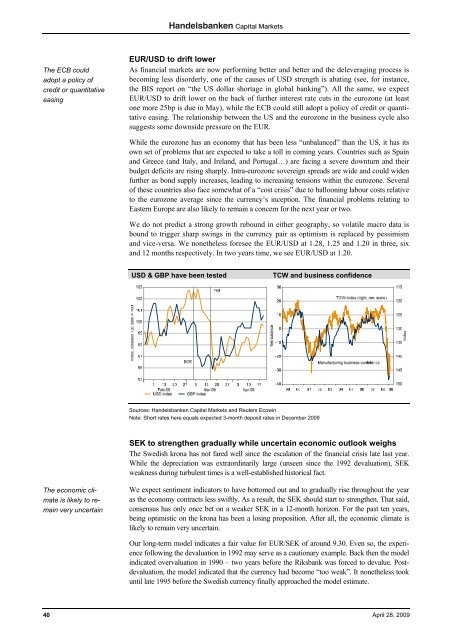

USD & GBP have been tested<br />

TCW and business confidence<br />

Sources: <strong>Handelsbanken</strong> Capital Markets and Reuters Ecowin<br />

Note: Short rates here equals expected 3-month deposit rates in December 2009<br />

SEK to strengthen gradually while uncertain economic outlook weighs<br />

The Swedish krona has not fared well since the escalation of the financial crisis late last year.<br />

While the depreciation was extraordinarily large (unseen since the 1992 devaluation), SEK<br />

weakness during turbulent times is a well-established historical fact.<br />

The economic climate<br />

is likely to remain<br />

very uncertain<br />

We expect sentiment indicators to have bottomed out and to gradually rise throughout the year<br />

as the economy contracts less swiftly. As a result, the SEK should start to strengthen. That said,<br />

consensus has only once bet on a weaker SEK in a 12-month horizon. For the past ten years,<br />

being optimistic on the krona has been a losing proposition. After all, the economic climate is<br />

likely to remain very uncertain.<br />

Our long-term model indicates a fair value for EUR/SEK of around 9.30. Even so, the experience<br />

following the devaluation in 1992 may serve as a cautionary example. Back then the model<br />

indicated overvaluation in 1990 – two years before the Riksbank was forced to devalue. Postdevaluation,<br />

the model indicated that the currency had become “too weak”. It nonetheless took<br />

until late 1995 before the Swedish currency finally approached the model estimate.<br />

40 April 28, 2009