Flexible Design of Airport System Using Real Options Analysis - MIT

Flexible Design of Airport System Using Real Options Analysis - MIT

Flexible Design of Airport System Using Real Options Analysis - MIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12/14/2007<br />

1.231 Planning and <strong>Design</strong> <strong>of</strong> <strong>Airport</strong> <strong>System</strong> Dai Ohama<br />

current design that government actually planned and that would construct the whole runway<br />

island, including a parallel taxiway and a south edge. This design does not include<br />

flexibility.<br />

Case B refers to the design that constructs the whole runway island in the same way as<br />

Case A. But this design recognizes future uncertainty which is demand <strong>of</strong> passengers,<br />

while Case A considers deterministic projection <strong>of</strong> the demand <strong>of</strong> passengers.<br />

Case C refers to the design that constructs only runway area without parallel taxiway<br />

and south edge <strong>of</strong> the runway at the initial construction, and expands the parallel taxiway<br />

and south edge after 10 years operation if the demand exceeds the capacity <strong>of</strong> the airport for<br />

two consecutive years.<br />

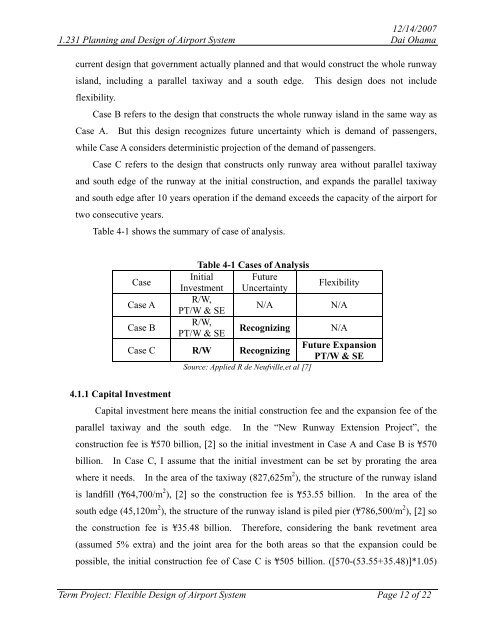

Table 4-1 shows the summary <strong>of</strong> case <strong>of</strong> analysis.<br />

Table 4-1 Cases <strong>of</strong> <strong>Analysis</strong><br />

Case<br />

Initial Future<br />

Investment Uncertainty<br />

Flexibility<br />

Case A<br />

R/W,<br />

PT/W & SE<br />

N/A<br />

N/A<br />

Case B<br />

R/W,<br />

PT/W & SE<br />

Recognizing N/A<br />

Case C R/W Recognizing<br />

Future Expansion<br />

PT/W & SE<br />

Source: Applied R de Neufville,et al [7]<br />

4.1.1 Capital Investment<br />

Capital investment here means the initial construction fee and the expansion fee <strong>of</strong> the<br />

parallel taxiway and the south edge. In the “New Runway Extension Project”, the<br />

construction fee is ¥570 billion, [2] so the initial investment in Case A and Case B is ¥570<br />

billion. In Case C, I assume that the initial investment can be set by prorating the area<br />

where it needs. In the area <strong>of</strong> the taxiway (827,625m 2 ), the structure <strong>of</strong> the runway island<br />

is landfill (¥64,700/m 2 ), [2] so the construction fee is ¥53.55 billion. In the area <strong>of</strong> the<br />

south edge (45,120m 2 ), the structure <strong>of</strong> the runway island is piled pier (¥786,500/m 2 ), [2] so<br />

the construction fee is ¥35.48 billion. Therefore, considering the bank revetment area<br />

(assumed 5% extra) and the joint area for the both areas so that the expansion could be<br />

possible, the initial construction fee <strong>of</strong> Case C is ¥505 billion. ([570-(53.55+35.48)]*1.05)<br />

Term Project: <strong>Flexible</strong> <strong>Design</strong> <strong>of</strong> <strong>Airport</strong> <strong>System</strong> Page 12 <strong>of</strong> 22