Flexible Design of Airport System Using Real Options Analysis - MIT

Flexible Design of Airport System Using Real Options Analysis - MIT

Flexible Design of Airport System Using Real Options Analysis - MIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12/14/2007<br />

1.231 Planning and <strong>Design</strong> <strong>of</strong> <strong>Airport</strong> <strong>System</strong> Dai Ohama<br />

expiration date. An American option is exercised when the owners are allowed to exercise<br />

them on or before the expiration date. A European option is exercised only on the<br />

expiration date. [3]<br />

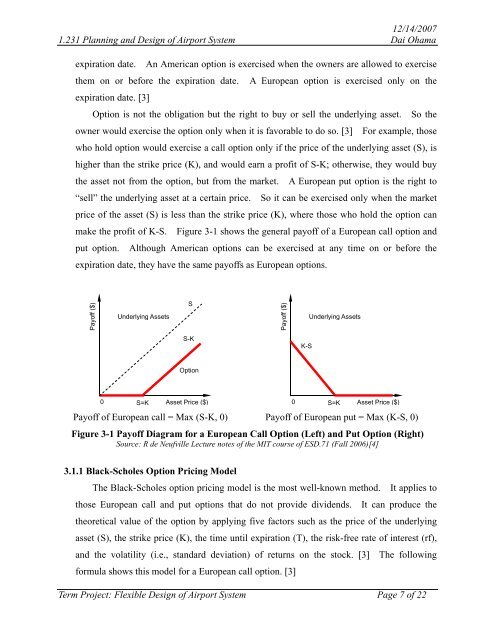

Option is not the obligation but the right to buy or sell the underlying asset. So the<br />

owner would exercise the option only when it is favorable to do so. [3] For example, those<br />

who hold option would exercise a call option only if the price <strong>of</strong> the underlying asset (S), is<br />

higher than the strike price (K), and would earn a pr<strong>of</strong>it <strong>of</strong> S-K; otherwise, they would buy<br />

the asset not from the option, but from the market. A European put option is the right to<br />

“sell” the underlying asset at a certain price. So it can be exercised only when the market<br />

price <strong>of</strong> the asset (S) is less than the strike price (K), where those who hold the option can<br />

make the pr<strong>of</strong>it <strong>of</strong> K-S. Figure 3-1 shows the general pay<strong>of</strong>f <strong>of</strong> a European call option and<br />

put option. Although American options can be exercised at any time on or before the<br />

expiration date, they have the same pay<strong>of</strong>fs as European options.<br />

Pay<strong>of</strong>f ($)<br />

Underlying Assets<br />

S<br />

Pay<strong>of</strong>f ($)<br />

Underlying Assets<br />

S-K<br />

K-S<br />

Option<br />

0<br />

S=K<br />

Asset Price ($)<br />

Pay<strong>of</strong>f <strong>of</strong> European call = Max (S-K, 0)<br />

0<br />

S=K<br />

Asset Price ($)<br />

Pay<strong>of</strong>f <strong>of</strong> European put = Max (K-S, 0)<br />

Figure 3-1 Pay<strong>of</strong>f Diagram for a European Call Option (Left) and Put Option (Right)<br />

Source: R de Neufville Lecture notes <strong>of</strong> the <strong>MIT</strong> course <strong>of</strong> ESD.71 (Fall 2006)[4]<br />

3.1.1 Black-Scholes Option Pricing Model<br />

The Black-Scholes option pricing model is the most well-known method. It applies to<br />

those European call and put options that do not provide dividends. It can produce the<br />

theoretical value <strong>of</strong> the option by applying five factors such as the price <strong>of</strong> the underlying<br />

asset (S), the strike price (K), the time until expiration (T), the risk-free rate <strong>of</strong> interest (rf),<br />

and the volatility (i.e., standard deviation) <strong>of</strong> returns on the stock. [3] The following<br />

formula shows this model for a European call option. [3]<br />

Term Project: <strong>Flexible</strong> <strong>Design</strong> <strong>of</strong> <strong>Airport</strong> <strong>System</strong> Page 7 <strong>of</strong> 22